This sector outperforms when the Fed cuts rates, and now may be a good time to buy.

The market collectively held its breath Wednesday waiting for the Fed to announce its decision on a rate cut. While the Fed elected to keep rates unchanged this month in a 9-to-1 vote, chairman Jerome Powell opened the door to the possibility of a rate cut on the horizon in a press conference following the FOMC’s decision statement.

“Many participants now see the case for somewhat more accommodative policy has strengthened,” Powell said.

“This was probably the compromise decision – it wasn’t shocking and should offer some reassurance,” wrote Steve Rick, chief economist at CUNA Mutual Group, in a note. “The FOMC will still want to closely monitor the stress fractures from the bond market, middling housing and auto sales numbers, and an increasingly uncertain global economic landscape in the coming months.”

After the press conference, the market is now fully pricing in a quarter-point cut in the fed funds rate at the next monetary policy meeting in July, and are seeing a good chance of two more reductions by the end of the year. The central bank predicts one or two rate cuts in its economic predictions, however, not until 2020.

But if the Fed does begin lowering interest rates sooner rather than later, investors may want to look at one group of stocks that has historically outperformed after the Fed begins cutting.

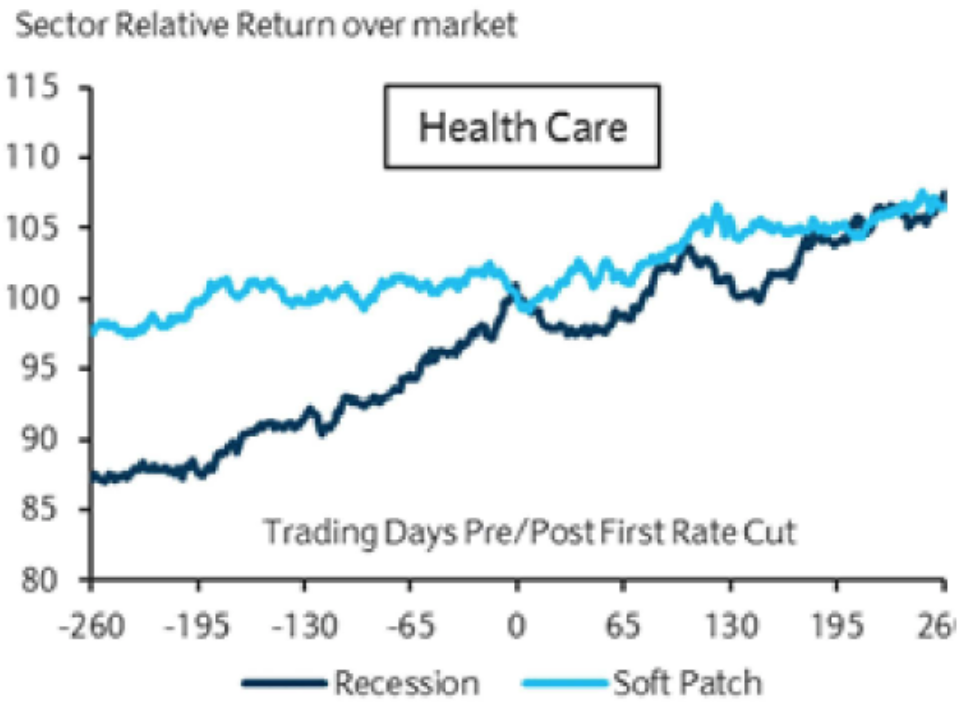

According to Barclays, healthcare stocks outperform the market by roughly 7% in the nine months following a rate cut. What’s more, this group is special relative to other groups given its consistency of performance following cuts.

Barclays’ analysis on the Fed’s rate cut cycles found that overall market performance and the performance of most sectors varies depending on why the central bank cuts rates. The firm identified two types of rate-cutting environments: recessions and economic “soft patches.”

In both rate-cutting scenarios, healthcare was the only sector that thrived.

Barclays’ head of U.S. equity strategy, Maneesh Deshpande, wrote in a note that this is “an intuitive result given that soft patches still represent a weak economic environment.” Healthcare stocks also tend to pay-out bigger dividends and have the benefit of posting consistent revenues. Such factors make healthcare stocks more attractive when rates fall during times of uneasiness.

Healthcare stocks struggled early this year, but have since begun to rebound. Shares of big names in healthcare like Merck (NYSE: MRK), Pfizer (NYSE: PFE), and UnitedHealth (NYSE: UNH) are all up over the last month.

As for those sectors that fare the worst when the Fed cuts rates, Barclays says that durables stand out due to the sector’s consistent underperformance. Historically, the sector has underperformed the market between 3% and 8% after interest rates are lowered. The durables sector includes goods such as autos, machinery, and homes, which are considerably impacted by economic cycles.

As things stand now, market expectations for a rate cut in July have risen to more than 80%, and investors are also pricing in further cuts in September and December.

If and when the Fed does cut rates, it may not be clear for a while if we’re in a “soft patch” environment or a recession. However, Barclays’ Deshpande says the current sector performance points to a “soft patch.”

“Using historical behavior of sectors and factors around prior rate cut cycles, we can attempt to determine whether the recent sector performances are indicating an anticipated soft patch or a recession,” Deshpande wrote. “In late 2018, Utilities (recession outperformer) and Non-Durables (recession outperformer) rallied while Tech (soft patch outperformer) fell, indicating a perception that an economic slowdown would morph into a full recession. Since that time, Tech railed back while Non-Durables and Utilities stalled.”