These 4 stocks have been some of the best performers in environments when rates are falling.

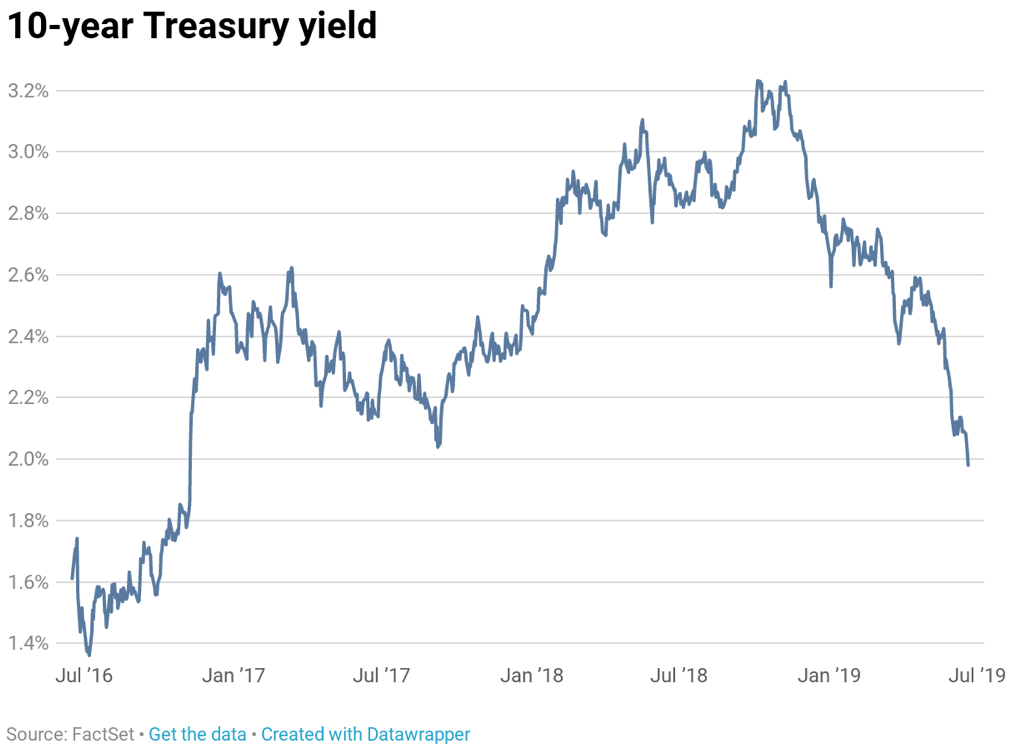

The yield on the 10-year Treasury note just fell below 2% for the first time since 2016, and the collapse in bond yields has helped spur the stock market to record highs this week.

On Thursday, the S&P 500 jumped 1% to close at 2,954.18, a new record high. The Dow climbed nearly 250 points to close at 26,753.17, and the Nasdaq gained 0.8% to end the day at 8,051.34.

The 10-year yield dropped briefly to 1.97% on Wednesday—breaching a key psychological level—but was up to 2% on Thursday as investors cheered the Fed’s dovish tone and hopes rose for an interest rate cut at the FOMC’s July meeting.

But as bond yields drop, there are some stocks that have historically been big winners in environments with declining rates.

According to analysis by CNBC, the Communications sector has historically been the top performing sector when the 10-year yield has broken below 2%, followed by Energy, Materials, and Consumer Discretionary.

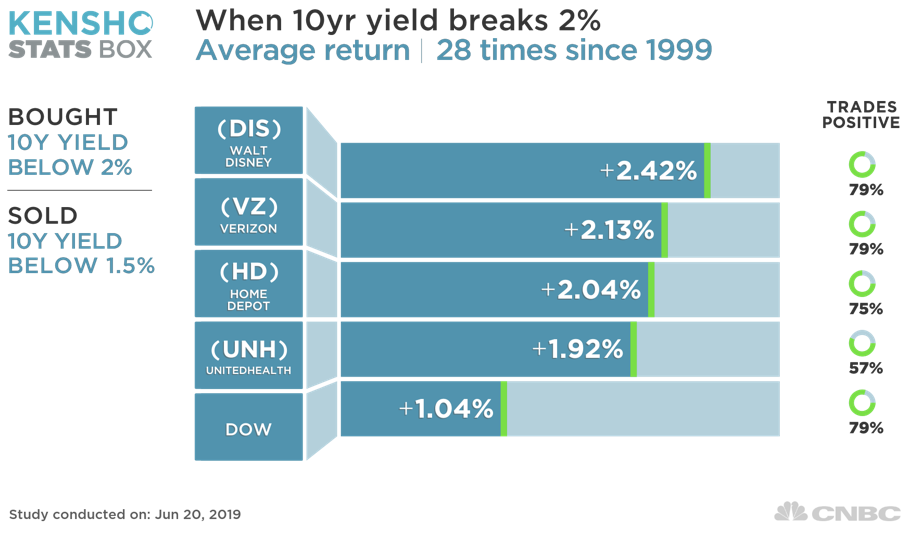

Their analysis also found that Disney (NYSE: DIS) has been the best performing Dow stock when rates decline. The house of mouse has historically risen 2.42% in such environments, while the Dow has only risen about 1%.

Other Dow stocks that have done well when rates have fallen below 2% include Verizon (NYSE: VZ), Home Depot (NYSE: HD), and UnitedHealth (NYSE: UNH).

Verizon boasts a dividend of 4.2% and while the stock has been beaten up a bit over the last month—it’s down just over -3% over the last month—it has historically been a safe bet in environments like the one we’re in now having returned an average of 2.13%.

When yields drop, mortgage rates also fall which means more homeowners refinancing, which is very good news for Home Depot. When mortgage payments are lower due to lower rates, homeowners often pour some of that money into home improvements and thus, traffic at DIY stores like Home Depot increase, which is good news for the stock.

Home Depot is the third best-performing Dow stock of the bunch, returning an average of 2.04%. And UnitedHealth is the fourth on the list, having returned an average of 1.92%.

Of the bunch, analysts are most bullish on UnitedHealth. Their average price target for the stock is $292.28, suggesting possible upside of roughly 18% over the next twelve months.