When it comes to oil stocks, most investors immediately think of the supermajors like Exxon Mobil Corp. (XOM) or Chevron Corp. (CVX). It makes sense considering they boast incredible brand recognition and remain two of the world’s biggest energy companies with individual market caps exceeding $230 billion.

But what most people fail to recognize is how oil stocks shouldn’t be grouped together simply because they all deal with the same commodity. These companies are categorized based on their primary operations, which are important for investors to recognize since some oil stocks are stronger in certain market environments. While most energy stocks rally when West Texas Intermediate (WTI) prices hover near year-to-date highs of $66 like they did this past spring, some of these stocks can outperform even when oil prices are low. That’s the kind of bulletproof investment every active investor should keep in the back of their minds when the energy sector does what it does best: become volatile.

Here are the three most common types of oil stocks — and how they perform in different energy environments…

No. 1: Oilfield Services Companies (Upstream)

Simply put, OFS companies are responsible for extracting oil from the ground. They’re also referred to as exploration and production (E&P) companies because they focus on exploring oil wells, producing the material, and later selling it to refiners.

Many OFS companies — the largest being Schlumberger NV (SLB) and Halliburton Co. (HAL) — offer a broad range of services that encompass the manufacturing and maintenance stage of equipment used in the oil extraction process. The services include…

- Seismic Testing: the process of searching for oil using blasts of sound. The sound waves map the geological structure beneath the surface and relay data about where oil reserves are located.

- Transport Services: moving land and water drilling rigs as necessary.

- Directional Services: the actual drilling of angled or horizontal holes used to extract oil.

OFS firms tend to be ripe areas for mergers and acquisitions when oil prices are low. For example, some of the decade’s biggest M&A deals happened when WTI neared eight-year lows throughout late 2014 and 2015. Halliburton and Schlumberger were at each other’s throats trying to purchase smaller companies, with the former making a bid for Baker Hughes (BHGE) in November 2014 that would eventually fail and the latter buying Cameron International in August 2015.

But as with the entire sector, OFS stocks rally in bullish price environments. Several have ranked among the best-performing energy stocks of the year, including Baker Hughes, which is up 14% since Dec. 31.

No. 2: Master Limited Partnerships (Midstream)

Master limited partnerships (MLPs) are companies that primarily own and operate midstream assets like utilities, pipeline operators, and underground storage facilities. These firms — which include Energy Transfer LP (ET) and Tallgrass Energy LP (TGE) — transport oil from the OFS or upstream firms to the refiners or downstream firms.

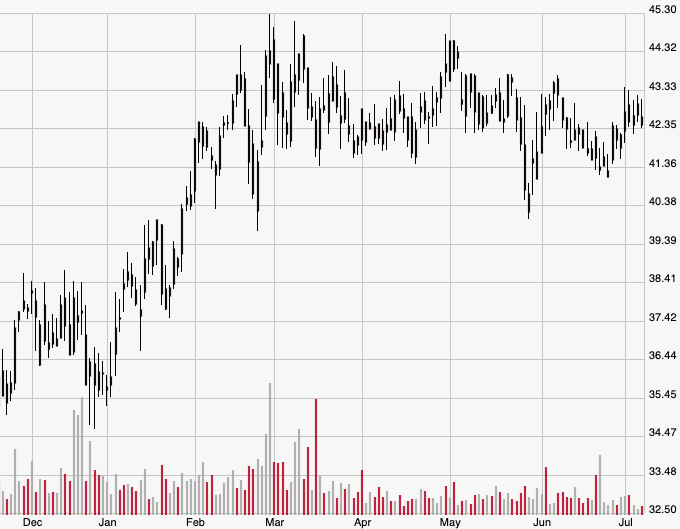

MLPs are different from other oil stocks, as they often enjoy very limited exposure to underlying oil prices. This is because they essentially serve as “middlemen” by connecting oil-producing areas with refineries, distributors, and retail centers. Investors recently witnessed this when WTI fell more than 23% from the April 23 peak of $66.30 to the June 12 low of $51.14. Over that same time, large MLPs like Cheniere Energy Partners LP (CQP) dropped only 0.8%.

These companies are also known for offering incredibly high dividend yield due to their tax benefits. To benefit from unique tax breaks and be considered an MLP, at least 90% of the firm’s income must come from natural resources like oil or natural gas. This in turn allows for a lower capital gains tax on earnings, which results in more cash that is then distributed to shareholders via dividends. Hess Midstream Partners LP (HESM), for instance, boasts a high 7.8% dividend yield, more than four times the S&P 500’s average yield.

No. 3: Refining Companies (Downstream)

Refining companies distill crude oil and turn it into petroleum products like diesel and gasoline. These firms — including giants like Exxon, Chevron, and BP Plc. (BP) — are crucial in that they refine oil into its consumable form.

As mentioned earlier, their importance is reflected in their size, as most of the largest oil refiners in the world are also the world’s largest energy companies. Exxon alone has a refining capacity of up to 5.5 million barrels a day, and its size allows it to rely heavily on the refining business during low oil price periods. That’s primarily because the refining area of an energy business tends to be the least profitable area when oil prices are higher, as high prices squeeze margins on refined products like gasoline that see lower prices due to excess supply. prices were lowered by excess supply.