(Bloomberg) — Banks are taking precedence for President Vladimir Putin as Russia devises a domestic response to sanctions rolled out by western governments over the invasion of Ukraine.

Russian state aid will initially focus on assisting lenders hit with penalties, according to two people who attended a closed meeting with Putin to address the impact of the conflict on big business.

First Deputy Prime Minister Andrey Belousov asked the gathered billionaires and corporate titans to keep working with sanctioned banks, said the people, who asked not to be identified because the meeting was private. The remarks came after the public part of the Thursday event, in which Putin warned that the west shouldn’t seek to push Russia out of the global economy.

The message underscores the urgency facing the government at home while the showdown in Ukraine intensifies. Retaining depositor confidence is crucial in a country where bouts of economic turmoil have in the past wiped out savings and prompted bank runs.

Belousov didn’t immediately respond to a request for comment.

The promise of aid came in the hours before the U.S. announced it would sanction many of Russia’s biggest lenders, including state-owned Sberbank PJSC and VTB Group, targeting nearly 80% of Russian banking assets. President Joe Biden said the measures “exceed anything that’s ever been done” and will hamper Russia’s ability to do business in foreign currency.

VTB was also hit with full blocking sanctions, while the U.K. announced an asset freeze against major Russian banks, including an immediate freeze against VTB.

Sberbank head Herman Gref and VTB chief Andrey Kostin attended the meeting in the Kremlin’s St. Catherine Hall, the same room where Putin convened his security council two days earlier in a staged event to weigh the invasion of Ukraine. Gazprom’s Alexey Miller and Igor Sechin, the head of Rosneft who was sanctioned Thursday by the U.S., were also in attendance.

Details of the U.S., EU and U.K. Sanctions Against Russia

The measures by western governments came as Russian forces push deeper into Ukraine in a three-pronged attack and move closer to the capital, Kyiv. The European Union also backed a broad sanctions package to limit Russia’s access to Europe’s financial sector and restricting key technologies.

But the penalties also included carve-outs for energy payments, a crucial source of revenue for Moscow, and held off from barring Russia from the Swift international banking network.

Despite isolated reports of Russians queuing to withdraw cash, calm has largely prevailed so far and markets stabilized on Friday. Sberbank shares rallied Friday 4.6% as of 3:00 p.m. in Moscow but are down by more than half this week. Shares in VTB were down 4.7% after falling 42% Thursday.

The U.S. sanctions do not come into force for a month, which could help explain the relative calm. In December 2014, plunging oil prices sent the ruble crashing and led to clients withdrawing 1.3 trillion rubles ($15 billion) in a single week from Sberbank.

Business as Usual?

Sberbank said its branches continue to function as usual and clients are not facing any restrictions, including on currency exchange. Before the sanctions were announced on Thursday, it published a statement that it later retracted about how a ban on foreign exchange operations would affect corporate customers.

VTB responded with a statement saying the “sanctions came as no surprise” and that it has several plans to counter the measures to minimize the impact on its clients. It also sold its stakes in Pochta Bank and Cyprus-based RCB Bank.

Even so, the central bank on Friday advised banks to postpone dividend payments and bonuses to managers to maintain financial stability. It also announced it loosened the short-term liquidity ratio for systemically important banks.

Many Russian lenders have scaled back their international ambitions since being hit sectoral sanctions since 2014, when Russia annexed Crimea from Ukraine. VTB maintains offices in London and Zug, Switzerland, as well as China, Angola and some post-Soviet states.

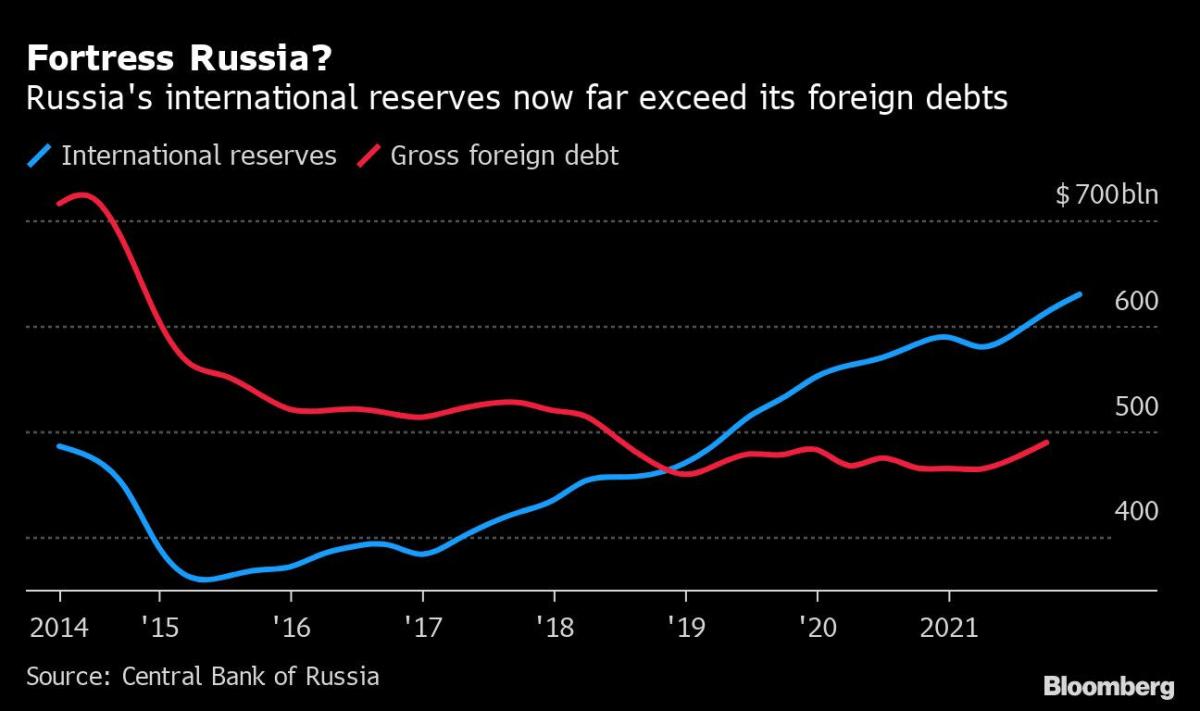

State-owned banks have been bracing for more sanctions as relations with the West deteriorated. Russia has built up its financial reserves to over $600 billion, developed a domestic payments system, Mir, and steadily reduced reliance on foreign currency.

The central bank said early Friday it would support sanctioned banks and noted that about 80% of the balances at the affected lenders are in rubles. It offered help with rubles and foreign currency.

A day earlier, the Bank of Russia announced it will intervene in the foreign exchange market for the first time in years, expand its Lombard list of securities accepted as collateral and provide additional liquidity to lenders in repo auctions.

“After 2014, Russia has been preparing for a dark day,” said Anton Tabakh, chief economist at Moscow-based credit assessor Expert RA. “The banking system is well capitalized, there are reserves and capabilities. The central bank is acting very reasonably.”

©2022 Bloomberg L.P.