(Bloomberg) — Value stocks are catching the eyes of investors seeking safe harbors as the crisis in Ukraine threatens to accelerate inflation and damp growth.

This will potentially bring “some violent rotation” among some asset classes and a shakeup within equities, according to Ronald Temple, co-head of multi-asset at Lazard Asset Management in New York.

“You can expect to see pressure on speculative growth stocks, companies whose cash flows are driven by expectations far into the future — where higher discount rates can have a major impact — versus companies that have higher current cash flow,” he said.

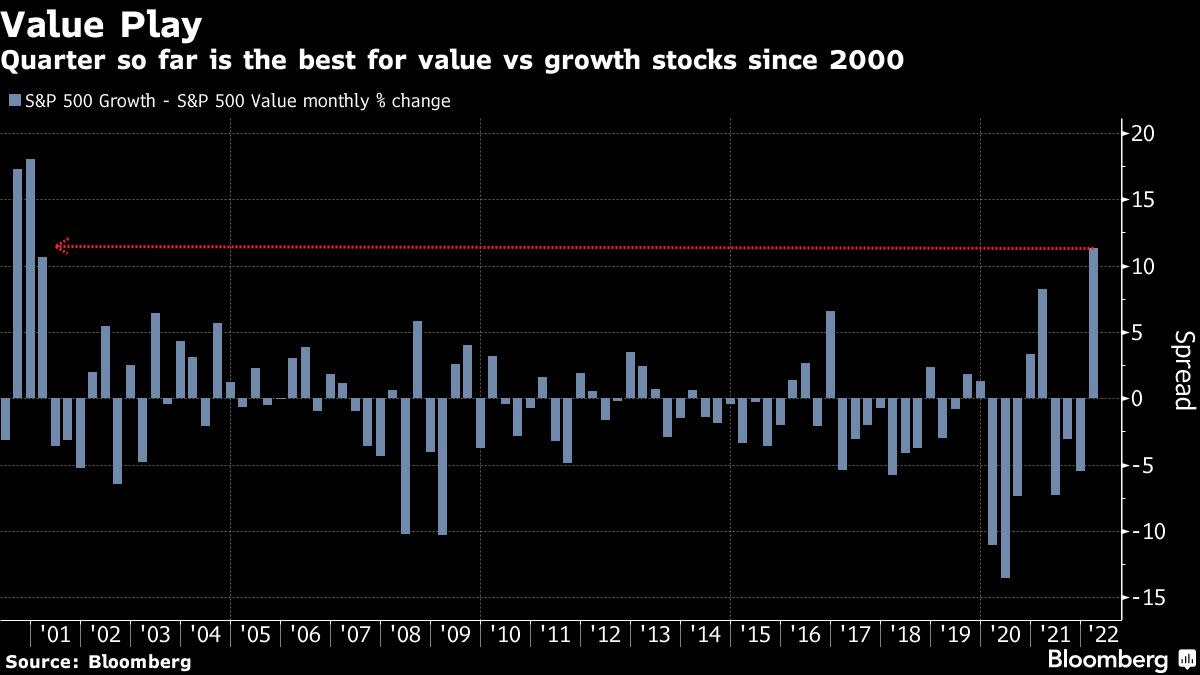

The rotation to value has been well underway since the start of the year, curtailing the pandemic-sparked boom in technology stocks. So far this quarter the outperformance of value over growth stocks has been the strongest in more than 20 years.

A key driver of the move to value stocks is the conviction among many investors that inflation has gained enough momentum to keep rising, convincing central bankers to move faster to unwind historic levels of stimulus.

While U.S. stocks rose Thursday in the face of Russia’s move on Ukraine, the Nasdaq Composite Index’s near 14% slump this year points to the hunt for havens and caution on growth stocks.

Russia’s attacks on Ukraine and the West’s subsequent imposition of sanctions has added fuel to those global price pressures, raising fears of supply shortages affecting a range of commodities from grains to natural gas.

This shift in favor of value comes as U.S. hedge funds have been slashing positions in technology stocks. They started 2022 more tilted toward cheaper shares than at any time in over a decade, according to Goldman Sachs Group Inc.

“Investors in my view would be well served to, A) emphasize value relative to growth, especially compared to the last 10 to 15 years. And B) within their growth allocation, to focus on quality,” Lazard’s Temple said.

©2022 Bloomberg L.P.