Shares of Goldman Sachs Group Inc. (GS) rallied during Tuesday’s session after the Wall Street titan released second-quarter earnings. The financials marked a modest year-over-year decline in profit, but that didn’t stop investors from pushing GS stock to its best close of 2019 so far.

Goldman’s fresh round of earnings are grounded in the bank’s swift change in strategy, which is defined by appealing to Main Street investors in a way that the bank has never done before. Although the new initiatives have so far sank the company’s profit, market participants are anxious to know whether or not investors in the financial sector will continue to reward Goldman against the currently lackluster results.

Here’s a closer look at the bank’s Q2 earnings — and how they illustrate a 150-year-old company in transition…

The News

Goldman reported revenue and earnings per share (EPS) that surpassed Wall Street expectations but declined from the same period last year. Earnings came in at $5.81 per share, surpassing analysts’ estimated $4.89 by 18.8% but declining 2.8% from $5.98 in Q2 2018. As for the top line, revenue fell 2% year-over-year to $9.46 billion but surpassed Wall Street’s expected $8.83 billion by 7.1%. The strongest area of the report was equities revenue, which climbed 6% from the year-ago quarter to $2.01 billion for the second highest quarterly performance since 2015. It also blew past the expected $1.80 billion by 11.7%.

CEO David Solomon, who took the reins from longtime leader Lloyd Blankfein back in October, remained optimistic about the firm’s performance despite looming bearish factors like the U.S.-China trade war and slowing global growth. He noted that the “global macro backdrop remains broadly constructive” amid imminent signs of a slowdown, while his firm’s business “performed well and remains solidly positioned for future growth.”

How Investors Reacted

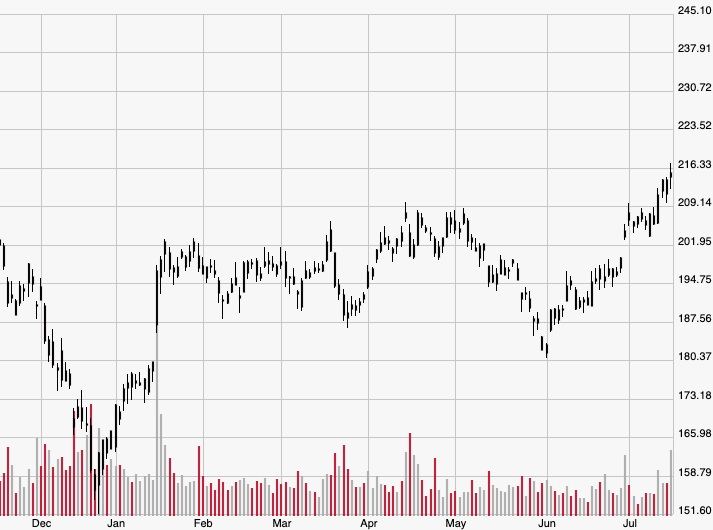

Investors pushed shares of GS up 1.9% on the day from $211.58 to $215.52, the best close of the year and the highest settlement since Nov. 9 when they ended the session at $222.65. The stock is now up 29% on the year from the Dec. 31 close of $167.05.

The Bigger Picture

Although investors reacted positively to the firm beating analyst estimates, most financial headlines swirled around the year-over-year profit decline and the ways in which Goldman’s new pivots led to it. Those pivots have primarily come in the form of appealing more to Main Street over Wall Street, specifically moving more into the retail banking sector to catch up with well-rounded peers like JPMorgan Chase & Co. (JPM) and Citigroup Inc. (C).

While those endeavors seem well-intentioned, they still took a massive bite out of the bank’s cash pile last quarter. The cost of the retail banking initiative — as well as its broadening wealth-management business and new deal to release a joint credit card with Apple Inc. (AAPL) — rang up at $1.3 billion before taxes. For context, that’s roughly 15% of Goldman’s annual profit.

CFO Stephen Scherr commented that those new initiatives may take five years to turn a real profit, thus forcing the firm to keep relying on bread-and-butter revenue streams from trading and equities. However, those two streams could also leave Goldman more exposed than JPMorgan and Citigroup, which have already built out successful retail banking operations. If trade tensions continue to ratchet up as more bearish economic data comes out — including this week’s report that China’s GDP growth just reached the lowest level in 27 years — then a potential market downturn may leave Goldman with less time than it thought to build out those new streams.

Looking Ahead

Goldman is still one of the global financial industry’s most dominant forces, but its biggest error was ignoring the areas that competitors have already capitalized on. GS stock is now more susceptible to macro-induced volatility than its peers, and the situation is made all the more hazardous by the fact that the stock price currently hovers at eight-month highs.

All things considered, investors should wait for a significant dip before establishing a position in Goldman. For investors who already own GS, maintain a diligent wait-and-see approach to ensure personal losses don’t stack up from any future volatility.