Over the last couple of weeks, it seems like the market has finally started to look for storylines to help guide its direction other than trade. It’s as though the market has finally realized that tariffs and the ongoing debate between the U.S. and its trading partners, which has been going on for more than a year now isn’t likely to see a final resolution in the near term, making the world of tariffs perhaps a “new normal” to which corporate America and the market will simply have to adjust.

I guess in that light it’s really no surprise that one of the biggest movers of the broad market lately has been speculation and forecasts about interest rates. With Fed chairman Jay Powell on record saying that the Fed was prepared to do “whatever was necessary” to sustain not just the economy, but also the pace of market growth, more and more investors seem to pricing in the likelihood the Fed will cut interest rates when the board meets to discuss interest rate policy at the end of this month.

Whether or not a cut is truly warranted is an interesting debate. While it is true that relative to competing economies, including Europe and Japan where rates are at or even below zero, rates in the U.S. are measurably higher, making borrowing more expensive, it is also true that rates remain not far above historical low levels when you factor in the pace of economic growth in the United States. Cutting interest rates when all indications seem to show the economic picture remains generally healthy is also generally counter-intuitive to traditional logic. One of the concerns that the Fed has cited to justify the consideration of a cut is the effect of the dollar on the slowing global economy. Another element is the advent of a new earnings season, with most forecasts calling for lowered profit results and can be tied to the high degree of volatility a number of stocks have seen in just the last couple of weeks around their earnings reports.

One part of the market that should see a measurable benefit from a rate cut is homebuilding. Real estate in various parts of the country has been pretty healthy for the last couple of years, as economic growth, including rising wages have helped property values increase. Lowering interest rates makes it easier for homeowners to afford mortgages, which should be a good things for stocks like Lennar Corp (LEN), one of the largest homebuilders in the U.S. While the stock is up about 17.5% year to date, it is also nearly -16% below its 52-week high, reached in mid-May of this year. Its valuation metrics point to a remarkable bargain potential. The real question is whether its fundamentals increase or decrease the usefulness of its value proposition?

Fundamental and Value Profile

Lennar Corporation is a provider of real estate related financial services, commercial real estate, investment management and finance company. The Company is a homebuilder that operates in various states. Its segments include Homebuilding East, Homebuilding Central, Homebuilding West, Lennar Financial Services and Lennar Multifamily. It is a developer of multifamily rental properties. Its Homebuilding operations include the construction and sale of single-family attached and detached homes, as well as the purchase, development and sale of residential land. It operates primarily under the Lennar brand name. The Lennar Financial Services segment includes mortgage financing, title insurance and closing services for both buyers of its homes and others.The Lennar Multifamily segment focuses on developing a portfolio of institutional multifamily rental properties in the United States markets. LEN has a market cap of $13.1 billion.

Earnings and Sales Growth: Over the last twelve months, earnings for LEN declined by about -18%, while sales improved about 1.9%. In the last quarter, earnings grew 75.68% while revenue growth was nearly 44%. LEN’s operating profile is healthy, with Net Income as a percentage of Revenues running at 8.86% over the last year, but narrowing somewhat, to 7.57% in the last quarter.

Free Cash Flow: LEN’s free cash flow is solid, at about $1.1 billion million over the last twelve months. In late 2018, free cash flow was a little more than $1.3 billion, so this number has faded a bit in the last couple of quarters, but remains pretty healthy. Its current level translates to a useful Free Cash Flow Yield of 7.55%.

Debt to Equity: LEN has a debt/equity ratio of .62. This is a relatively low number that reflects a mostly conservative approach to leverage. The company’s balance sheet indicates liquidity could be a concern; since the last quarter showed $829.11 million in cash and liquid assets against $9.3 billion in long-term debt. Like free cash flow, the company’s liquidity appears to be deteriorating, from about $1.3 billion at that time. This is a red flag that could be a temporary setback or an indication of broader issues management needs to contain.

Dividend: LEN’s dividend is $.16 per year, which translates to an annual dividend yield of just 0.35%. Still, most stocks in the homebuilding industry do not pay any dividend at all.

Price/Book Ratio: there are a lot of ways to measure how much a stock should be worth; but one of the simplest methods that I like uses the stock’s Book Value, which for LEN is $47.33. At LEN’s current price, that translates to a Price/Book ratio of .97. The stock’s historical average is 1.66, which suggests the stock is undervalued by about 70%. The stock is also trading more than 84% below its historical Price/Cash Flow average; together, both of these metrics puts the stock’s long-term “fair value” target between $78 and $84 per share.

Technical Profile

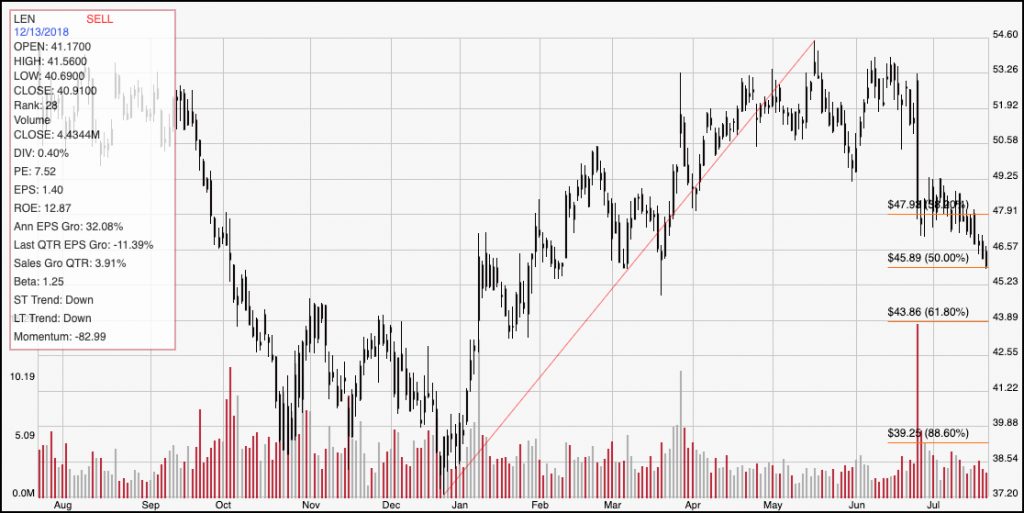

Here’s a look at LEN’s latest technical chart.

Current Price Action/Trends and Pivots: The chart above shows the stock’s price movement over the past year. The red diagonal line traces the stock’s upward trend from the end of 2018 to its peak in May; it also informs the Fibonacci retracement lines shown on the right side of the chart. Since hitting that May high, the stock has dropped back significantly, touching the 50% retracement line at around $46 just yesterday. That is a pattern that marks a short-term downward trend, which means that current momentum and sentiment for the stock is clearly bearish. If support doesn’t hold at the stock’s current level, it should find its next support level a little below $44 per share. If, however the stock can maintain support, and even pick up some bullish momentum, it could rally back to its high earlier this month a little above $49 per share. A push above that level could see the stock rally back near to its May high, to around $53.

Near-term Keys: While the valuation metrics are compelling, I think that the timing right now isn’t very good to consider taking a long-term position on LEN. While the market really seems to be betting on the likelihood of a rate cut at the end of the month, the underlying fear, and risk is that it will just be a confirmation that there are broader concerns that could affect not just the global economy, but also ripple into the U.S. economic picture. That could be one of the reasons LEN’s momentum right now appears clearly bearish. That also means that the highest probabilities with this stock right now lie with short-term oriented trades. If the stock breaks below support a little below $46, consider shorting the stock or working with put options, with a near-term eye on the $44 level. If the pace of bearish momentum appears to be picking up at that pint, the stock could test its next support between $39 and $40 per share. Betting on a bullish bounce off of $46 is an aggressive, even speculative bet right now; the best signal for a bullish trade would really come from a break above the 38.2% retracement line at about $48 per share. That signal would offer a good opportunity to buy the stock or work with call options, with an eye on the $53 to $54 the stock reached in May.