These 8 stocks look like winners now as economic growth slows.

As we’re entering the busiest part of the second-quarter earrings season, the market has been mostly treading water.

But for those investors hoping a possible rate cut by the Fed next week will be the catalyst to push stocks higher, Goldman Sachs (NYSE: GS) has some bad news: stocks can’t really go anywhere from here.

“The S&P 500 index trades near fair value relative to interest rates, although we believe policy uncertainty and negative revisions to 2020 earnings-per-share forecasts will limit equity upside,” wrote Goldman’s chief U.S. equity strategist David Kostin in a note to clients. “The stock market’s downbeat response to negative earnings surprises and guidance validates the argument [that] lower interest rates may not lead to higher equity prices.”

The S&P 500 is up around 19% so far this year, and both hit new all-time highs and reached the 3,000 point milestone this month as the Fed hinted at easier monetary policy to help sustain the current economic expansion.

Ahead of the Fed’s meeting next week, the market has priced in a 100% chance of a rate cut, with an 80% chance of a quarter-point cut and 20% chance for a half-point cut. However, a slowdown in earnings and political uncertainties are likely to cap any upside in stocks even if the Fed announces the rate cut the market expects.

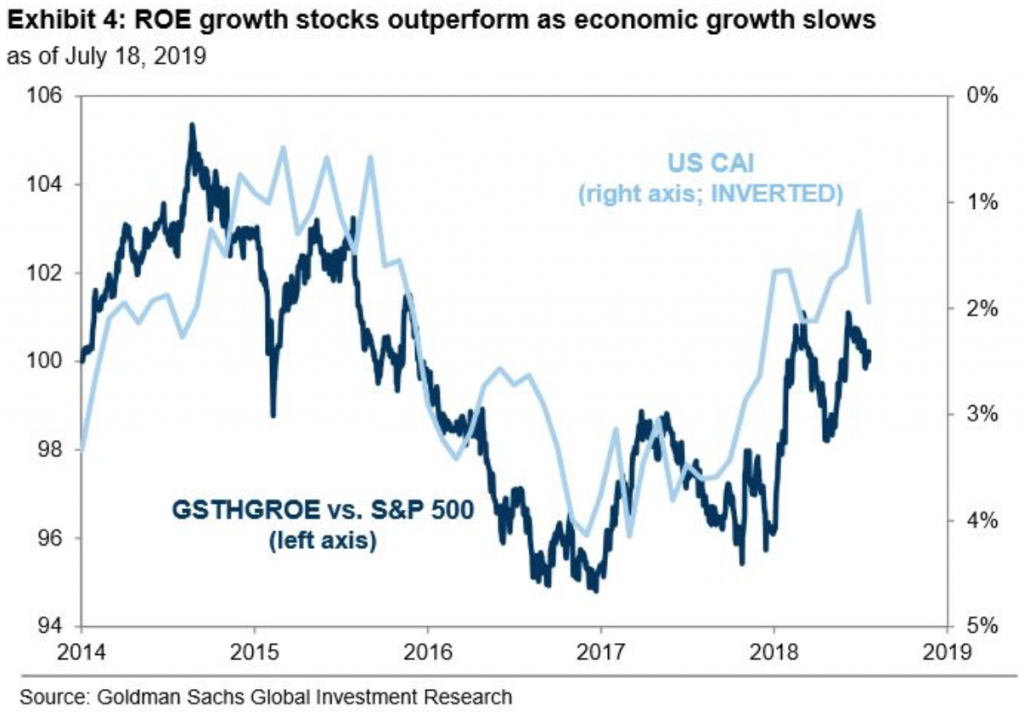

In such a slower growth environment, Goldman has advised its clients to look for stocks with the fastest expected return-on-equity growth, a measure of profitability calculated by dividing net income by shareholders’ equity.

“We forecast flat S&P 500 margins through 2020, with risks tilted to the downside. …Amid concerns about the growth and profitability outlook this year, investors have assigned a premium to companies able to expand ROE,” Kostin wrote in the note.

Goldman developed a basket of 50 S&P 500 stocks with the highest consensus estimates of ROE growth. “Firms with the fastest expected ROE have outperformed year-to-date as the pace of economic growth has slowed,” Kostin wrote.

Among the group, Kostin pointed to Apple (NASDAQ: AAPL), Cisco Systems (NASDAQ: CSCO), DXC Technology (NYSE: DXC), Fidelity National Information Services (NYSE: FIS), Global Payments (NYSE: GPN), Nielsen Holdings (NYSE: NLSN), Sempra Energy (NYSE: SRE), and Under Armour (NYSE: UAA).

“The basket typically outperforms in weakening growth environments as investors assign a scarcity premium to firms that are able to expand ROE despite index-level headwinds,” Kostin wrote.

Of these eight stocks, analysts are most bullish on DXC Technologies. Their average price target for DXC is $82.33, suggesting possible upside of 45.75% over the next twelve months.