U.S. crude oil prices just earned a much-needed win during Tuesday’s session, sharply reversing the energy commodity’s enormous downtrend over the last three months. Investors were galvanized by a plethora of geopolitical news, sending the front-end September futures contract for West Texas Intermediate (WTI) — the price benchmark for all oil traded in the U.S. — above $57 a barrel for the first time since July 31.

Oil’s rally on Tuesday was part of a broader rebound across all market sectors, but what will influence the commodity’s future appears much different than what will move equities and other sectors. Energy markets rely on a multitude of global demand factors, and there are three emerging factors in particular that have some investors worried that supply may eventually outpace demand down the road not just in the U.S. but also on the global energy stage.

Here’s what lifted oil prices on Tuesday — and why the energy picture is growing increasingly bearish right now…

The News

Both WTI and Brent — the global benchmark for crude oil purchases worldwide — rallied alongside the stock market after U.S. officials announced they would delay tariffs on certain Chinese products. The office of U.S. Trade Representative Robert Lighthizer opened up an avenue to new trade talks by holding off the recently announced 10% tariffs on $300 billion in Chinese goods — mainly retail-oriented products like cellphones, laptops, and video games — until December 15.

The oil market’s boost came more from a rising-tide-lifts-all-boats mentality than from energy-specific news. With the entire U.S. economy constantly at the mercy of Chinese trade relations, investors were excited to rebound everything from energy to tech stocks to bond markets, all of which were slammed by volatility last week. Marshall Steeves, an energy analyst with IHS Markit Ltd. (INFO), said the delay announcement “boosted all financial markets and reversed losses not just in crude oil but in equities as well.”

How Investors Reacted

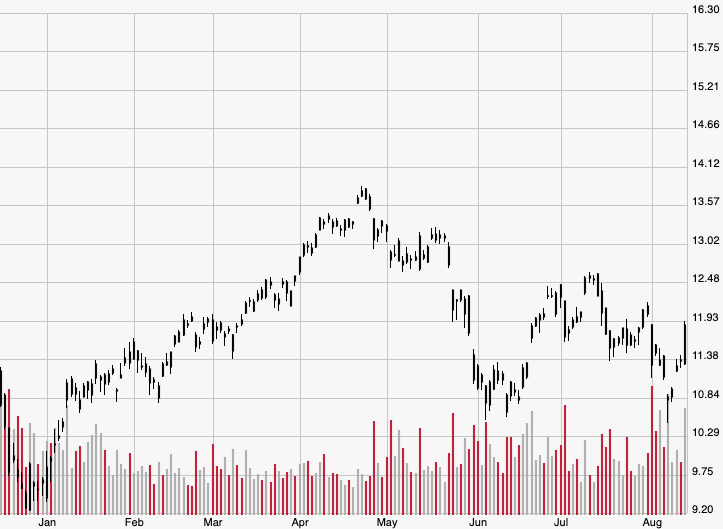

The price of September WTI futures leapt 4% on Tuesday from $54.93 to $57.10 per barrel, the best settlement since July 31 when they closed the day at $58.58. Futures for October Brent performed even better, climbing 4.7% on the day to $61.30 for the benchmark’s biggest one-day rise of 2019.

As mentioned earlier, the entire stock market also soared following the trade announcement. The S&P 500 and Dow Jones gained respectively gained 1.5% and 1.4%, while the tech-centric Nasdaq jumped 2% on the day.

The Bigger Picture

Although oil prices are experiencing a short-term upswing, they’ve experienced a dramatic decline since early spring. WTI has tumbled more than 13% from its April 23 high of $65.79, while Brent is down more than 15% over the same period.

The historic volatility of the commodity notwithstanding, oil may be headed for rougher times later in the year due to three primary factors, the first of which is rising U.S. production. Weekly output has grown 2.5% from 12 million barrels the week ended July 12 to 12.3 million the week ended August 2. Furthermore, the Energy Information Administration (EIA) expects daily shale production to hit 8.8 million barrels next month, an increase of 85,000 barrels a day this month.

The second and most worrying factor is China’s slowing growth. China is the fifth-highest oil-consuming country in the world at 4.8 million barrels a day, but the country will consume far less if the economy keeps slowing at its current pace. The trade war led the country’s GDP to increase only 6.2% last quarter, marking the lowest quarterly growth in 27 years. This growth reversal will likely continue if trade negotiations keep getting stifled, which is likely if the last 18 months are any indication. A worsening Chinese economy can only lower global energy demand and simultaneously send prices into a tailspin.

The last factor focuses on consumer use primarily in relation to concerns over climate change. The United Nations has published several reports warning of climate change’s devastating economic and social consequences, having said just last week that many nations could suffer food and water shortages as a result. Despite pushback from the Republican-controlled Senate, a higher frequency of warnings may entice more consumers to reduce fossil fuel use, which would consequently kill oil demand and refining margins. Several states like California are already implementing measures to urge consumers and companies toward renewable energy and away from traditional energy consumption.

Looking Ahead

There’s a specter of hope for oil prices in the form of Saudi Arabia’s Aramco IPO, which was newly revived this past weekend and would incentivize the Kingdom to keep oil prices aloft. However, the oil market’s prospects remain bleak on a purely fundamental level, as global growth moves in the wrong direction thanks to ongoing trade tiffs and climate change concerns.