(Bloomberg) — Just as worries from the fallout of Russia’s invasion of Ukraine and surging Covid cases pummel Chinese stocks, a local hedge fund that jumped almost 30 times over the past five years by picking undervalued shares is ready to dive in.

Guangdong Zhengyuan Private Fund Investment Management Co., which saw its assets surge fivefold from the start of last year to about 14 billion yuan ($2.2 billion) now, is planning to raise money again next month as stock valuations become increasingly attractive, founder and fund manager Liao Maolin said.

“With the market having fallen to this level, there are so many stocks that I want to buy now but we have no more money” as the company is already fully invested, he said in a March 8 phone interview from Guangzhou, where the company is based.

While that sounds like a risky bet, Liao has built a solid track record after his funds returned a whopping 2,944% since 2017, topping five-year rankings for stock hedge funds at Shenzhen PaiPaiWang Investment & Management Co.

His rationale is simple: all the gloom out there — from the war in Ukraine to monetary tightening in the U.S. and economic headwinds at home — reinforces the possibility that policy makers will refrain from pricking more bubbles and move faster to spur encouraged areas like new infrastructure and digital transformation.

“Everything you see this year could be bad news and uncertainty, but the government will likely take counter-cyclical measures,” Liao, 37, said. “The negative news you see has been mostly priced in and we would instead see more unexpected policy support down the road.”

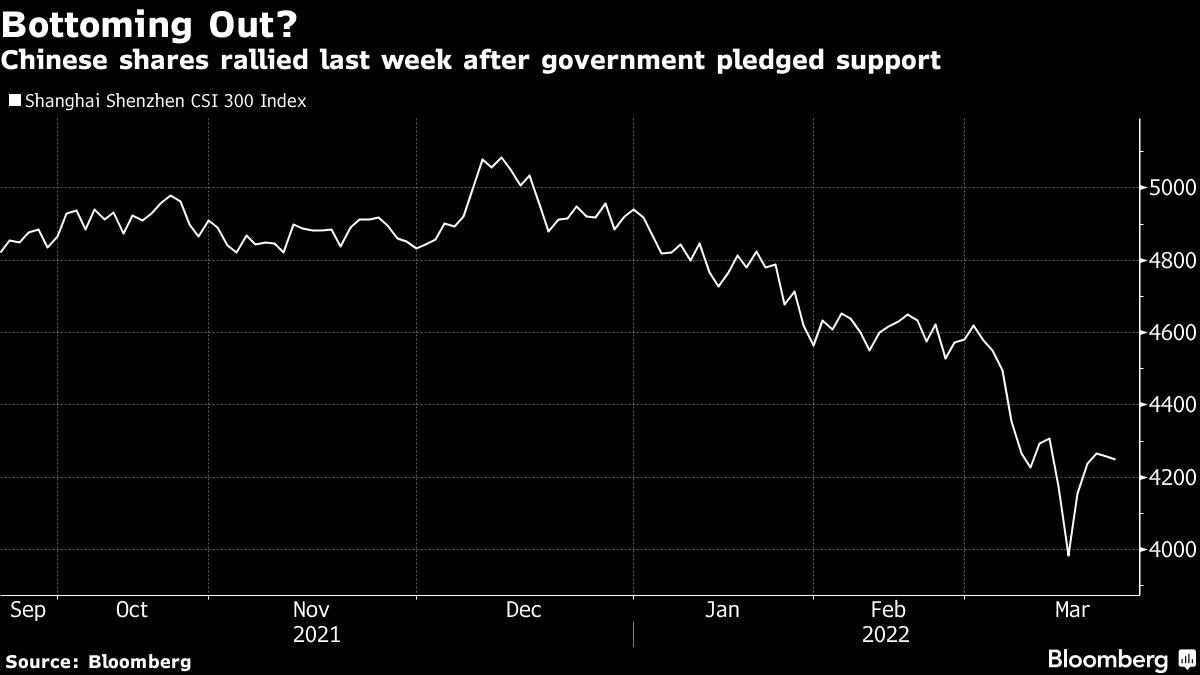

His comments were borne out last week, when Beijing pledged to stabilize markets, a move that triggered the biggest two-day rally in Chinese stocks since 1998. Policy makers are now expected to loosen monetary policy and ease up on technology and property industry crackdowns.

Liao favors middle- and downstream firms in emerging strategic industries like batteries and new-energy vehicle parts, he said, declining to name specific targets. Such companies now suffering from soaring raw material costs will only benefit when commodity prices eventually subside, according to Liao.

By sticking to areas supported by the government and steering clear of those in the cross-hairs of regulators, Zhengyuan has avoided “land mines” from real estate developers to internet platforms, which have imposed huge losses on investors in the past two years.

For the same reason, the company has shunned once-hot stocks like liquor makers that mutual funds were heavily exposed to, as well as gaming industry shares — even as those could perform well.

‘Positive Energy’

“What we buy is full of positive energy — we walk in the sunshine,” Liao said. “Therefore it’s very unlikely for us to step on policy or ethical mines.”

The firm’s Zhengyuan No. 1 fund, which manages more than 1 billion yuan, gained more than 160% last year by focusing on upstream plays like rare earths, industrial silicon and raw materials for new-energy vehicles — areas that benefited from the local economy’s rebound from that stage of the pandemic.

This year, Liao said he’s focusing instead more on downstream firms, in industries including new energy infrastructure such as charging piles for electric vehicles, database construction, information security and environmental protection. He reckons depressed valuations due to high costs will translate into profits when their performance rebounds. “The surge in commodity prices clearly can’t be sustained,” he said.

When tensions in Ukraine escalated ahead of Russia’s invasion, Zhengyuan added to its photovoltaic holdings in anticipation that higher costs of traditional energy like natural gas would fuel demand for solar power in Europe, Liao said, declining to provide details. Such investments returned about 40% last year, he said.

Zhengyuan targets undervalued stocks that are expected to show substantial improvements within a year to attract other investors, providing it with opportunities to realize profits, Liao said. It borrows leverage less than 30% but doesn’t short.

While stock prices and economic growth fluctuate, the key for long-term returns at Zhengyuan is picking the right industries and companies.

“The structure is really important these days,” Liao said. “When you get it right, it feels good every time. When you get it wrong, it can really hurt.”

©2022 Bloomberg L.P.