Five oil stocks made up the S&P’s top 10 biggest gainers during Wednesday’s session as investors celebrated a better-than-expected weekly report from the U.S. Energy Information Administration (EIA). Shares of the companies soared alongside West Texas Intermediate (WTI) oil prices, which leaped to their best close in more than a week.

While market participants typically understand how the EIA’s weekly report makes or breaks oil’s short-term performance, Wednesday’s gain says far more about the commodity’s seasonal demand than anything else. Investors are now anxious to learn if the unexpected good news was simply a fluke or if it actually indicates a better supply-demand picture ahead.

Here’s exactly what happened across the energy sector Wednesday — and what it may mean for individual oil stocks moving forward…

The News

In its weekly inventory report, the EIA said that U.S. oil supplies declined by 10 million barrels from last week, marking the biggest decline since the week ended July 19. The number shocked energy analysts who widely expected a weekly decline of just 4.7 million barrels. Petroleum products like gasoline and other distillates also declined by 2.1 million barrels last week, besting analysts’ expected drop of 530,000 barrels.

The enormous decrease indicated that demand is far outpacing record production levels across the country, as nationwide output jumped 1.6% from 12.3 million barrels to 12.5 million last week.

How Investors Reacted

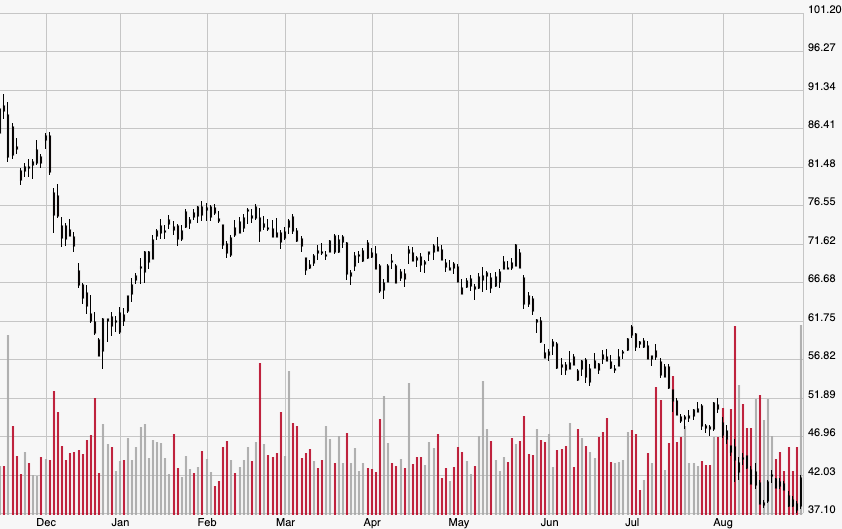

Investors pushed front-end WTI futures contracts for October delivery up 1.5% on the day from $54.93 to $55.78, the highest settlement since Aug. 20 when they ended the session at $56.34. Front-end futures for Brent — the international oil price benchmark — jumped even higher, rising 1.6% from $59.51 to $60.49 per barrel.

Shares of several oil producers rocketed on the strong supply news, with Cimarex Energy Co. (XEC), Diamondback Energy Inc. (FANG), Halliburton Co. (HAL), National Oilwell Varco Inc. (NOV), and Marathon Oil Corp. (MRO) ranking among the S&P’s 10 biggest gainers on Wednesday. Those climbed 10.55%, 4.6%, 4%, 3.85%, and 3.6%, respectively.

The Bigger Picture

While energy investors celebrated a bullish session, analysts were quick to point out how last week’s supply drawdown likely marked a final hoorah for strong summer gas demand before traveling starts to wind down in the coming weeks. Ion Energy Group consultant Kyle Cooper told the Wall Street Journal that while the data “doesn’t imply any economic concerns,” it still seemed like “that surge in demand may simply be a last-gasp summer spike.”

Of course, that’s not to say oil prices always nosedive when consumers buy less gas at the pump. Crude oil demand relies on a swath of domestic, international, and even climate factors, ensuring it can remain steady in an already strong market. For instance, hurricane season during the early fall months can shut down refineries and wells in the exposed Gulf region, thus boosting prices to unexpected highs.

However, broader energy producers with their skin in the natural gas market should maintain a stronger bottom line as natural gas demand offsets gasoline demand during the colder fall and winter months. When consumers experience abnormally cold weather, market participants can see tremendous disparities between natural gas demand and production on a daily basis. For example, on Jan. 1, 2018 — which Forbes called “the coldest day of the century” — the U.S. devoured a record 143 billion cubic feet of natural gas, nearly double the 72 billion cubic feet produced that day.

Looking Ahead

Investors and energy companies alike tend to become skittish this time of year over worries of declining gasoline consumption and consequently lower oil demand. Oil revenue is certainly the energy sector’s bread and butter, but natural gas revenue can still offset any short-term downturn in oil demand that, by all accounts, is always solid on a long-term timeline.

That being said, companies like Cimarex — whose 591 million barrels of oil equivalent as of Dec. 31 is roughly 45% natural gas — should maintain strong profitability thanks to their natural gas businesses. That stock in particular still trades at record lows following Wednesday’s rally, so investors may consider taking a small position in the company while also keeping a close eye on the EIA’s weekly natural gas numbers in the months ahead.