(Bloomberg) — The invasion of Ukraine has added to agita among electric-vehicle makers over the supply of nickel, a critical ingredient in EV batteries, since Russia is one of the world’s biggest producers.

But Tesla Inc. had already been scouring the globe for the metal, signing pacts with several nickel suppliers since 2021.

That includes a multiyear supply deal with mining giant Vale SA. The agreement, which hasn’t been announced, covers nickel from Canada, according to people familiar with the matter who asked not to be named discussing private details.

Unlike most of its peer automakers, Tesla has spent years focusing on how to secure its own nickel supplies.

The efforts are part of Chief Executive Officer Elon Musk’s focus on vertical integration to maintain control over Tesla’s supply chain. The company jointly operates a massive battery-cell plant outside Reno, Nevada, with Japan’s Panasonic Corp. Tesla buys cells from other leading suppliers but also makes its own.

And the company is constantly pushing for advances in how raw materials are processed and batteries are made. At a presentation in 2020, executives talked about shortening the processing path from mine to cathode.

“What Tesla has done with nickel is a hidden competitive advantage,” said Gene Munster, managing partner of Loup Ventures. “Tesla continues to be a couple of steps ahead of the rest.”

Musk has repeatedly flagged nickel supply as the company’s biggest concern as it boosts output, and the metal’s availability is a source of anxiety throughout the EV sector. Battery-sector demand for nickel is expected to jump to about 1.5 million tons in 2030 from 400,745 tons this year, according to BloombergNEF.

“Please mine more nickel,” Musk urged producers on an earnings call two years ago. “Tesla will give you a giant contract for a long period of time if you mine nickel efficiently and in an environmentally sensitive way.”

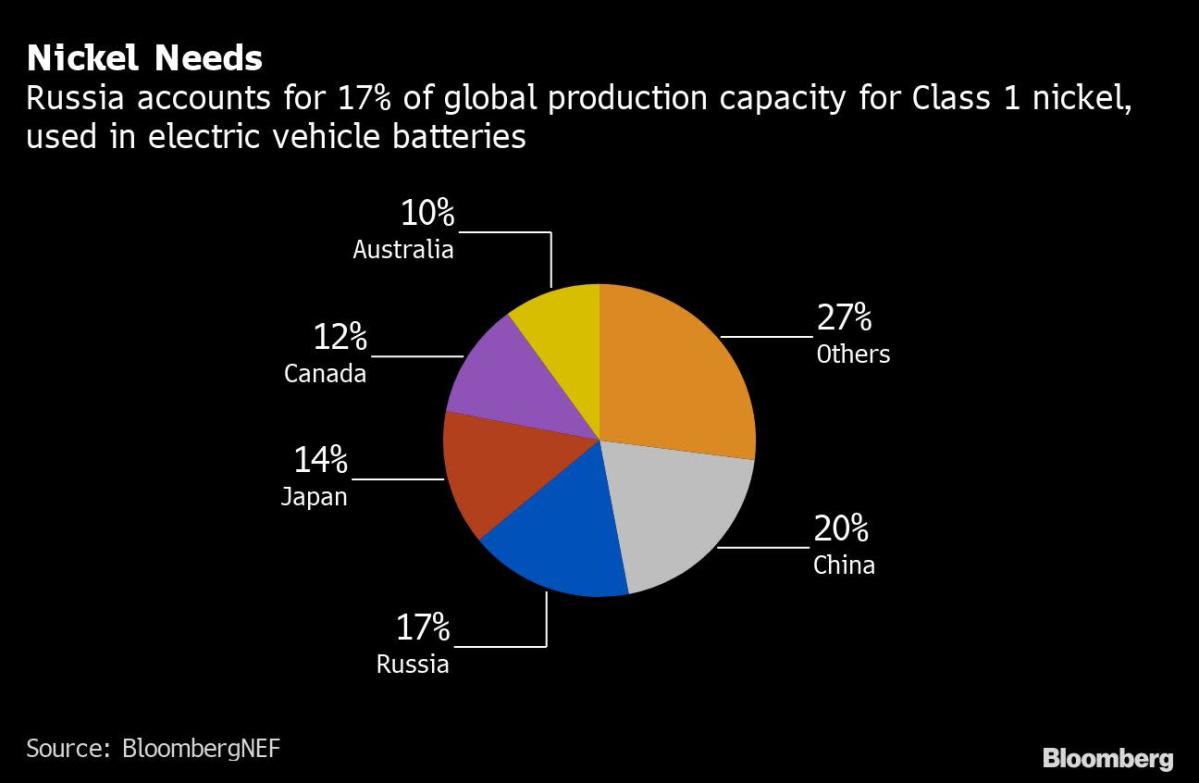

Sanctions against Russia over its invasion have added urgency, since the country holds about 17% of global capacity for refined Class 1 nickel, the type required for EVs. Since the Feb. 24 attack on Ukraine, the price of nickel had climbed 30% though Tuesday on the London Metal Exchange. Prices tripled over two days during that period because of a short squeeze though much of that advance was pared. The market could settle down if there are signs the war will end.

“The nickel price surge and the implications from the Russia-Ukraine invasion are likely to push battery manufacturers, particularly in the U.S., to secure alternate supply chains,” according to a BloombergNEF report.

Tesla’s deal with Vale is one of several that the carmaker has forged over the last year. In January, the Austin, Texas-based EV manufacturer committed to purchase 75,000 metric tons of nickel concentrate from a Talon Metals Corp. project being developed in Minnesota. That followed agreements with BHP Group, the world’s biggest mining company, for material from Australia. Tesla also has a pact with operators of a nickel mine in the South Pacific island of New Caledonia.

“People don’t realize how far ahead Tesla is when it comes to securing the supply chain for raw materials and an integrated approach to battery materials,” said Todd Malan, a spokesman for Talon Metals.

Vale said it has plans to increase its sales to the EV market to between 30% and 40% from 5%. The Brazil-based miner didn’t comment specifically on its Tesla agreement. Tesla didn’t respond to requests for comment.

Vale’s American depositary receipts rose less than 1% at 9:56 a.m. Wednesday in New York after Bloomberg News reported on the nickel deal with Tesla. Shares of the carmaker were little changed.

Nickel is a key component for the cathodes of electric-vehicle batteries, and Tesla is focused on nickel-based chemistries for longer-range vehicles. It uses iron-phosphate for shorter-range vehicles.

Meanwhile, President Joe Biden’s administration is discussing adding battery materials as soon as this week to the list of items covered by the 1950 Defense Production Act, looking to encourage domestic production, people familiar with the matter said. The Senate Committee on Energy and Natural Resources is scheduled to hold a hearing on the domestic supply of critical minerals on Thursday.

©2022 Bloomberg L.P.