(Bloomberg) — The latest warning sign for U.S. stocks is emerging from a corner of the market that investors closely watch to get a read on the state of the economy and the health of American consumers.

Transportation shares, especially trucking and railroad stocks, make up the worst-performing group in the U.S. in the past week amid growing concern that aggressive interest rate hikes by the Federal Reserve and surging inflation will curb consumer spending. As a result, companies responsible for moving and delivering goods may see demand drop at a time when soaring oil prices squeeze margins.

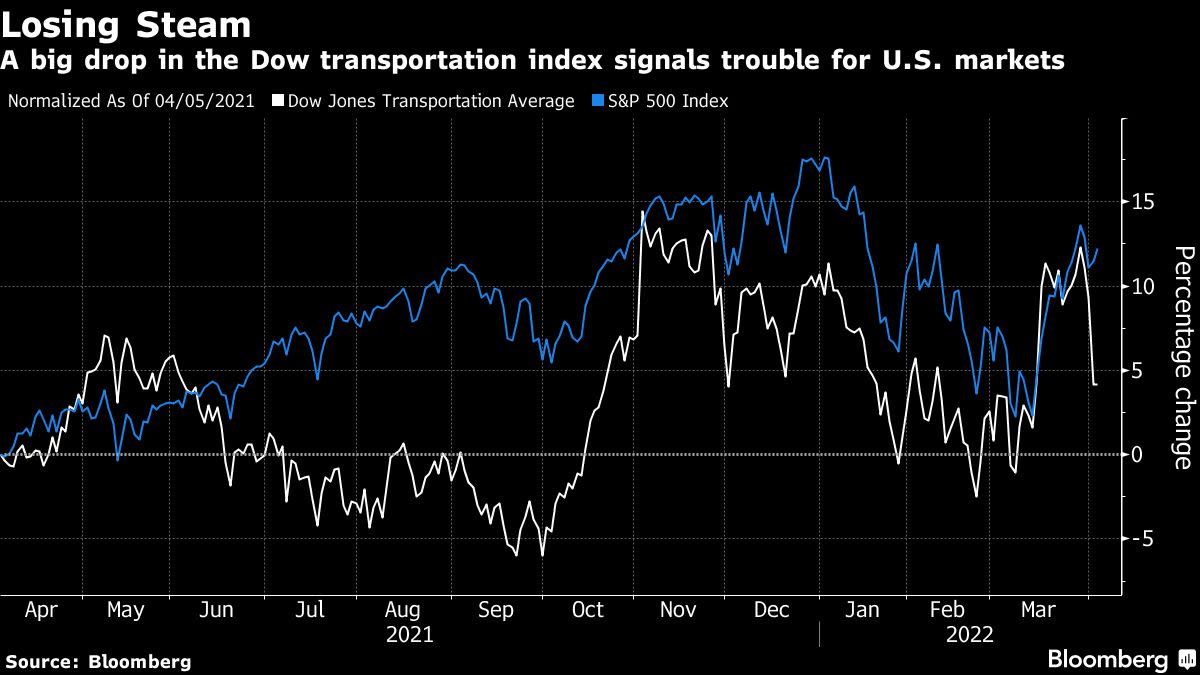

The Dow Jones Transportation Average, whose gains from the depth of the pandemic outpaced those of the broader market, has plunged 7.3% since March 29 compared with a 1.1% decline in the S&P 500 Index. The transportation gauge posted its biggest four-day drop since Dec. 1.

“It is another nail in the market’s possible coffin,” said Sam Stovall, chief investment strategist at CFRA. “If transports are underperforming, investors are inferring that consumer orders will likely be slowing as well, due to ongoing supply disruptions, rising inflation, and inverting yield curves.”

On Friday, Stephens analyst Jack Atkins said he saw risks to freight demand later this year and into 2023, as Fed rate hikes remove liquidity from the economy and spending on goods likely returns to historical levels with Covid restrictions easing.

The weakness in transports fits right in with the broader mood in cyclical stocks lately, with groups such as banks, homebuilders, recreation vehicles, and semiconductors either in, or threatening relative downtrends.

“This is not a particularly risk-on message, and we maintain a cautious view broadly,” BTIG’s chief market technician Jonathan Krinsky wrote in a note.

The recent selloff in transports has been led by truckers, parcel delivery companies and railroad operators, with airlines remaining relatively unscathed. JB Hunt Transport Services Inc., Matson Inc., Old Dominion Freight Line Inc., Ryder System Inc. and Landstar System Inc. have dropped the most. In Europe, logistics giant Maersk plunged on Monday amid worries that a fresh round of Russian trade sanctions, along with a weaker global economy, might lead to a dip in demand for goods around the world. Shares of peers DSV, Kuehne + Nagel and Hapag Lloyd also took a beating.

‘Risks Are Rising’

And though investors have yet to decide whether this hints at a possible economic slowdown or recession, the weakness is adding to the growing cacophony of ominous signals, particularly from the bond market and geopolitical circles.

“The weakness in transports, along with deteriorating relative price trends of other important economically-sensitive areas — such as financials, homebuilders, and semiconductors alongside the yield curve inversion — suggests risks are rising,” said Keith Lerner, chief market strategist for Truist Advisory Services.

Still, some see a possibility that the rout in transports stocks will be restricted to the sector and only reflects a shift from spending on goods to travel, experiences and services, given the reopening of the economy is finally gathering pace.

“I do not believe that the transports are telling us that we’re going through a significant economic slowdown but rather that consumption patterns are shifting back to what I’ve been historical norms of the last quarter of a century,” said Arthur Hogan, chief market strategist at National Securities.

©2022 Bloomberg L.P.