There are practically as many methods to analyze the stock market and opinions about the best way to invest your hard-earned dollars as there are investors. As a value-oriented investor, I often find myself on the opposite side of the table with growth-focused investors. Growth investing leans heavily on the principle that “a stock tends to follow the direction of its previous trend,” which is, perhaps, a nerdy way to say that the longer a stock has been going up, the more likely it is to keep going up. It is also why growth investors shun stocks that are at or near historical lows resulting from downward trends.

Value investing, on the other hand holds that trends only last so long; every upward trend is doomed to fail at some point, and every downward trend is destined to recover. This is a contrarian, counter-intuitive idea for many because it means that value investors aren’t afraid to buy a stock when the rest of the market has sold it and is staying away. Sometimes, it means buying a stock at what the value hunter has decided is useful, and then watching the stock drop even more. That is also a hard thing for a lot of investors to endure, and it is why being a successful investor requires discipline as well as patience. It also means that stocks that have been going up, and that are attractive to growth investors usually draw no more than a shrug from bargain seekers.

Over the last three years, I’ve used economic uncertainty – first from a year-long trade war through 2019, and then of course the COVID-19 pandemic starting in 2020 – as the basis for a lot of the analysis, and certainly some of my own investments in the marketplace. I think that when economic conditions become more difficult, defensive positioning by focusing on industries that are traditionally less sensitive to the cyclicality of economic health makes sense. It’s a strategy that has helped me make a number of useful investments throughout the past three years. The early part of 2022 has borne out that opinion, as a number of stocks in the Food Products industry have so far managed to buck the market’s uncertainty and volatile amid rising interest rates, extended, tragic and catastrophic conflict in Ukraine and inflation that I don’t believe is likely to abate in the near future.

That doesn’t mean that I’m calling for a new bear market, even though the major U.S. indices all flirted with the lower end of correction territory in February of this year (the NASDAQ actually dropped a little over -20% from the start of the year in that period). It does mean that as long as uncertainty continues to loom, I think defensively-positioned industries like Food Products will continue to offer reasonable investing opportunities – as long as a stock’s valuation lines up as needed. That’s an important distinction to make, because when a stock recovers from a downward trend and moves into a new, long-term upward trend, that price performance typically outpaces the underlying company’s fundamental strength, which distorts the value proposition and feeds the notion not only that the stock is overvalued, but also that the market could find new reasons to start selling the stock and pushing it back down at any time.

Kroger Company (KR) is the largest traditional food retailer in the United States, and a company that I’ve kept an eye on for some time. This is a stock that has followed a strong upward trend for the pst year, and is currently sitting just a bit off of its 52-week high price. KR has been among the most proactive innovators in the entire Consumer Staples industry over the past couple of years, investing heavily in alternative revenues streams like Kroger Personal Finance and Kroger Precision Marketing, building localized, automated warehouse facilities throughout the U.S. and online shopping and curbside delivery that is now in place in 95% of its coverage area. Many of these initiatives have yielded positive results on the company’s earnings reports, and have enhanced the company’s ability to compete against larger rivals like Wal-Mart and Target Stores, but also represent significant capital investments that have only just begun and are expected to continue for at least the next couple of years. I think the stock’s fundamentals could give a bullish investor good reason to KR to a diversified portfolio, with the current bullish trend lending weight to a growth-oriented investor’s strategy; but that begs the question, has the stock’s performance pushed it past the point of useful value? Let’s dive in and take a look.

Fundamental and Value Profile

The Kroger Co. (KR) manufactures and processes food for sale in its supermarkets. The Company operates supermarkets, multi-department stores, jewelry stores and convenience stores throughout the United States. As of February 3, 2018, it had operated approximately 3,900 owned or leased supermarkets, convenience stores, fine jewelry stores, distribution warehouses and food production plants through divisions, subsidiaries or affiliates. These facilities are located throughout the United States. As of February 3, 2018, Kroger operated, either directly or through its subsidiaries, 2,782 supermarkets under a range of local banner names, of which 2,268 had pharmacies and 1,489 had fuel centers. As of February 3, 2018, the Company offered ClickList and Harris Teeter ExpressLane, personalized, order online, pick up at the store services at 1,056 of its supermarkets. P$$T, Check This Out and Heritage Farm are the three brands. Its other brands include Simple Truth and Simple Truth Organic. KR has a market cap of $33.7 billion.

Earnings and Sales Growth: Over the last twelve months, earnings increased by 12.35%, while sales improved by 7.52%. In the last quarter, earnings increased 16.67% while revenues were improved by 3.73%. Like most Food retailers, KR operates with razor-thin margins, as Net Income was about 1.2% of Revenues for the last twelve months, but did see this metric strengthen in the most recent quarter to 1.71%.

Free Cash Flow: KR’s free cash flow is healthy and growing, at $3.7 billion over the last twelve months. That marks a big improvement from $1.9 billion a year ago, and $3.1 billion in the quarter prior. The current number translates to a free cash flow yield of 8.83%.

Debt to Equity: KR has a debt/equity ratio of 1.36. This is higher than I usually prefer to see, but also isn’t unusual for Food Retailing stocks. The company’s balance sheet indicates that operating profits are more than adequate to repay their debt, and is a sign of strength, with $2.9 billion in cash and liquid assets, against $12.8 billion in long-term debt. Their long-term debt is a reflection of the capital-intensive investments in itself the company has made to streamline its operations, modernize and automate its own supply chain, and to stay competitive in its market. Cash is down a bit, from $3.4 billion in the quarter prior. I take that as a reflection of cost increases that KR has actively chosen not to fully pass to their customers, and that some analysts are pointing at a potential headwind to profitability this year and into 2023.

Dividend: KR pays an annual dividend of $.84, which marks an increase from $.64 per share in early 2020 and $.72 per share at the beginning of 2021. The current payout translates to a yield of about 1.46% at the stock’s current price. The increasing dividend over the last two years should be taken as management’s confidence in their operating model and ability to keep the business growing in the long term.

Price/Book Ratio: there are a lot of ways to measure how much a stock should be worth; but I like to work with a combination of Price/Book and Price/Cash Flow analysis. Together, these measurements provide a long-term, fair value target around $56 per share. That means that KR is a bit overvalued, with -3% downside from its current price, and a practical bargain price at around $44.50. It is worth nothing that prior to the company’s latest earnings data, this analysis yielded a fair value target at around $48.

Technical Profile

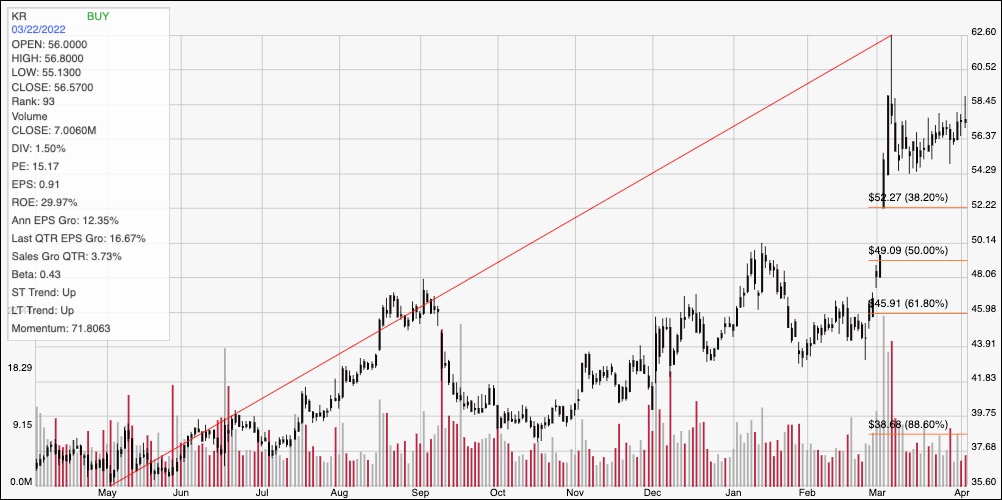

Here’s a look at the stock’s latest technical chart.

Current Price Action/Trends and Pivots: The chart above displays the last year of price movement for KR. The red diagonal line marks the stock’s upward trend from a low point at around $35.50 in May of last year to its early March peak at around $62.50; it also provides the baseline for the Fibonacci retracement lines shown on the right side of the chart. The stock dropped off of that March high and has been moving in a consolidation range for the past month, with $54.50 acting as current support and $58.50 providing immediate resistance. A push above $58.50 should have room to test the stock’s 52-week high at $62.50, while a drop below $54.50 should find next support a little above $52 where the 38.2% retracement line sits.

Near-term Keys: KR’s upward trend over the past year has pushed the stock past the point of practical use as a good value-based investing candidate; but its current price activity and momentum could offer some growth-oriented, short-term opportunities if you prefer to work with swing and momentum-based trading strategies. A push above $58.50 could provide a signal to think about buying the stock or working with call options, with a useful, near-term profit target around the stock’s 52-week high at $62.50 per share. If the stock drops below $54.50, you could also consider shorting the stock or buying put options, using $52 as a practical profit target on a bearish trade.