If you’ve followed my posts in this blog for very long, you know that my preference when considering a stock as a new investing opportunity is to look at it from a combination of fundamental strength as well as value. It isn’t enough to simply find a company with a strong book of business and a healthy balance sheet; I find the best odds of success come when I can also make a good case that the stock should be worth more than it is today.

One of the quickest ways to determine if a stock might represent a good value is to just look at its current price activity. It’s natural to assume that a stock that has been going up should continue to do so; after all, one of the core tenets of technical analysis is that a stock tends to follow the direction of its trend. I’ve found better success in mining bargain opportunities by looking for the reverse, and picking stocks that are currently on the lower end of their historical trading ranges.

My bias towards stocks that the market has beaten down has given me a nice way to uncover a number of under-appreciated gems throughout the course of this latest bull market. It’s a method that that is better suited to any potential downturn the market could see into a bear market, whenever it happens. However, the mere fact that a stock is trading at a major discount to its recent history doesn’t automatically it is a good value; the fundamentals also have to be strong enough to suggest that there is healthy growth potential lying in wait.

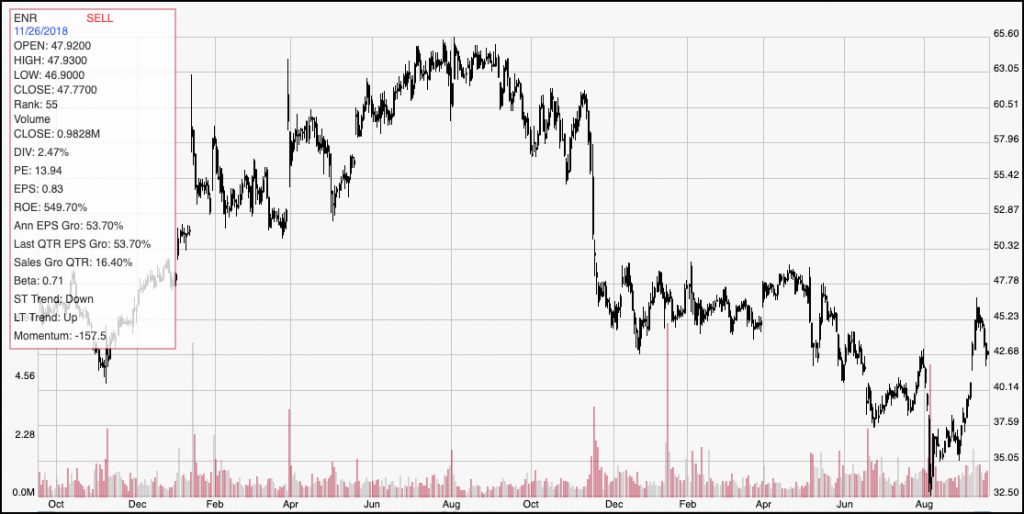

Energizer Holdings, Inc. (ENR) is an intriguing example. Over the last year, the stock has declined a little over -35% from a peak at around $65.50, but has picked up some good bullish momentum in the last month, rallying off of a trend low at around $32.50 per share. ENR is a small-cap stock with an easily recognizable name; does its extended decline, and recent rally imply the time is right to jump in? Let’s take a look.

Fundamental and Value Profile

Energizer Holdings, Inc. is a manufacturer, marketer and distributor of household batteries, specialty batteries and lighting products. The Company is a designer and marketer of automotive fragrance and appearance products. It operates through four geographic segments: North America, which consists of the United States and Canada; Latin America, which includes its markets in Mexico, the Caribbean, Central America and South America; Europe, the Middle East and Africa (EMEA), and Asia Pacific, which consists of its markets in Asia, Australia and New Zealand. The Company offers batteries using lithium, alkaline, carbon zinc, nickel metal hydride, zinc air and silver oxide constructions. These products are sold under the Energizer and Eveready brands in the performance, premium and price segments and include primary, rechargeable, specialty and hearing aid products. It manufactures, distributes and markets lighting products, including headlights, lanterns, kid’s lights and area lights. ENR’s current market cap is $2.9 billion.

Earnings and Sales Growth: Over the last twelve months, earnings declined about -31.5%, while revenues were almost 65% higher. In the last quarter, earnings and sales both increased; earnings grew by 85%, while sales improved a little over 16%. ENR operates with a very narrow margin profile, with Net Income over the past twelve months that was just 2.86% of Revenues; in the last quarter, this number deteriorated by more than half, to a mere 1.14%. These are razor-thin numbers that don’t give ENR any margin for error, and are a significant concern.

Free Cash Flow: ENR’s free cash flow is just $4.4 million, and translates to a Free Cash Flow Yield of 1.48%. At the beginning of 2019, Free Cash Flow was a little over $189 million, which marks not only a significant decline but adds an additional, major red flag.

Dividend Yield: ENR’s dividend is $1.20 per share, which translates to an annual yield of about 2.83% at the stock’s current price.

Debt to Equity: ENR has a debt/equity ratio of 6.12. This is an extremely high number, and is primary explanation of the stock’s narrow operating profile. The balance sheet shows a little over $206 million against about $3.5 billion in long-term debt. The concern is that ENR may not earn enough from day-to-day operations to cover interest payments, which means they will have to draw from available cash; this is already a bit limited, and unless the company can show some improvement in cash flow and net income, liquidity is likely to worsen.

Price/Book Ratio: there are a lot of ways to measure how much a stock should be worth; but one of the simplest methods that I like uses the stock’s Book Value, which for ENR is $8.17 per share. That translates to a Price/Book ratio of 5.18, which is high compared to the Price/Book levels I usually look for. The company, unfortunately has not had a useful Book Value long enough to make comparing the current value to historical a useful metric; but in its place we can use the industry average, which is 3.12 an implies the stock is overvalue by almost -40% and puts the stock’s “fair value” at a little below $26 per share.

Technical Profile

Here’s a look at the stock’s latest technical chart.

Current Price Action/Trends and Pivots: This chart traces the stock’s movement over the last two years. The stock’s rally from the bottom of the trend in the last month has been impressive, and pushed the stock to a recent high at about $45 per share. The stock has retraced a bit from that point, and appears to be near support from previous pivots at around $42. If that support holds, and provides the stock with a point for a new pivot low, it could push above that recent peak at around $45; that could act as confirmation of the current short-term upward trend and provide room to run to somewhere between $52 and $53, based previous pivots last seen in spring of 2018. If the stock drops below $42, its next support is probably around $40, but continued weakness from that point could push the stock as low as about $37.40 per share.

Near-term Keys: If you’re looking for a short-term, bullish trade, look for a break above resistance at $45 as a good signal to buy the stock or to work with call options. If the stock shows weakness, and pushes below support at $42, consider shorting the stock or working with put options. Given the fundamental problems ENR shows, particularly in its deteriorating Net Income, weak Free Cash Flow and high debt load, there really is no way to call this stock a good value, or even to suggest there is a fundamental reason it should be higher than it is today. From that perspective, ENR offers more downside risk than reward potential.