If you read my highlights in this space on a regular basis, you’ve seen me highlight a number of stocks in the semiconductor industry. It’s an interesting segment of the market to me for a number of different reasons. Over the last decade-plus, it’s been one of the highest-performing pockets of the market, arguably one of the biggest catalysts for the bull run that didn’t see any kind of meaningful lapse or drawdown until 2018. Also, since that time, the industry has been among the most sensitive to geopolitical pressure, especially as it relates to trade.

U.S.-China tensions over fair trade and tariffs have used technology, particularly in the semiconductor industry as a central point of discord. Optimism about negotiations between the two countries sent the industry up in a big way through the first five months of this year, with the Philadelphia Stock Exchange Semiconductor iShares ETF (SOXX) rallying about 50% until the latter part of April. From that point, accusations from both sides put a frosty chill back in trade negotiations and sent the sector back down nearly -18%.

I think it’s interesting to see that while uncertainty about trade hasn’t abated, from that low point in late May, the sector is back up significantly; earlier this month, it pushed to a new high before dropping back a bit in the last couple of weeks. Even so, the sector is up a little over 48% year to date, giving a sizable push to a large number of semiconductor stocks, including Intel Corp (INTC), undoubtedly the 600-lb gorilla of them all. Is the bullish run just wishful thinking by a market that seems to be desperate to have a reason to keep the bull market running as long as possible? Maybe; investors seem to grasp even the thinnest threads of hope on the trade front and use them as justification to keep the market churning.

Trade questions aside, I think INTC is a company with an interesting story to tell. For most people, Intel is a name that automatically makes you think – understandably – about PC’s, which is of course where the company carved out their dominant market position. If you stop your analysis there, I don’t think you’ll find much to hang your hat on about their future growth prospects; intense competition among semiconductors in this pocket of their market has eroded much of INTC’s market share. The interesting thing, in my opinion is in the way INTC is moving to identify the next generation of growth opportunities by investing heavily in cloud processing and storage technology as well as 5G mobile processing.

Those investments are expected by most analysts to provide the bulk of their revenue and earnings growth in the foreseeable future. Already a leader in the semiconductor space, it’s pretty natural to expect INTC to maintain its leadership position in these additional markets. Does that mean the stock is a good long-term opportunity? The stock is up about 17% from a low established in late May, but remains a little under -20% below its 52-week high a bit below $60 per share, which means there might be an interesting value opportunity still to be had.

Fundamental and Value Profile

Intel Corporation is engaged in designing and manufacturing products and technologies, such as the cloud. The Company’s segments are Client Computing Group (CCG), Data Center Group (DCG), Internet of Things Group (IOTG), Non-Volatile Memory Solutions Group (NSG), Intel Security Group (ISecG), Programmable Solutions Group (PSG), All Other and New Technology Group (NTG). It delivers computer, networking and communications platforms to a set of customers, including original equipment manufacturers (OEMs), original design manufacturers (ODMs), cloud and communications service providers, as well as industrial, communications and automotive equipment manufacturers. It offers platforms to integrate various components and technologies, including a microprocessor and chipset, a stand-alone System-on-Chip (SoC), or a multichip package. The CCG operating segment includes platforms that integrates in notebook, two in one systems, desktop computers for consumers and businesses, tablets, and phones. INTC’s current market cap is about $226 billion.

Earnings and Sales Growth: Over the last twelve months, earnings and sales were mostly flat; sales increased about 1.92% while sales decreased by -2.69%. The picture improved in the last quarter, with earnings increasing a little over 19%, while sales improved about 2.8%. INTC operates with a very healthy margin profile; Net Income versus Revenues over the past year was about 28%, and narrowed only somewhat in the last quarter to a little over 25%. That operating profile gives INTC a lot of flexibility and is a definite source of strength.

Free Cash Flow: INTC’s free cash flow is healthy and improving; in the last quarter, it came in at $13.6 billion, improving from about $12.5 billion at the end of the first quarter of 2019. That translates to a Free Cash Flow Yield of about 6.19%. The percentage is adequate, but the size of the actual number is a reflection of the company’s operating strength, which should serve it well even if trade tensions do continue to linger and cast a near-term, ongoing cloud over the entire industry.

Debt to Equity: INTC has a debt/equity ratio of .33. This is a conservative number. The company’s balance sheet indicates that operating profits are adequate to service their debt, with $11 billion in cash and liquid assets versus $25 billion in long-term debt. They have a lot of debt, but with a healthy operating margin profile and sizable cash position, servicing their debt shouldn’t be a problem.

Dividend: INTC pays an annual dividend of $1.26 per share, which translates to a yield of 2.5%.

Price/Book Ratio: there are a lot of ways to measure how much a stock should be worth; but one of the simplest methods that I like uses the stock’s Book Value, which for INTC is $16.92 and which translates to a Price/Book ratio of 3.01 at the stock’s current price. Their historical average Price/Book ratio is 2.89, which means that on this basis alone, the stock is a bit overvalued, with a useful discount not really being seen until about the $39 price level. The stock’s Price/Cash Flow ratio is more interesting, since that is currently trading 20% below its historical average and provides a long-term target at around $61.50 per share.

Technical Profile

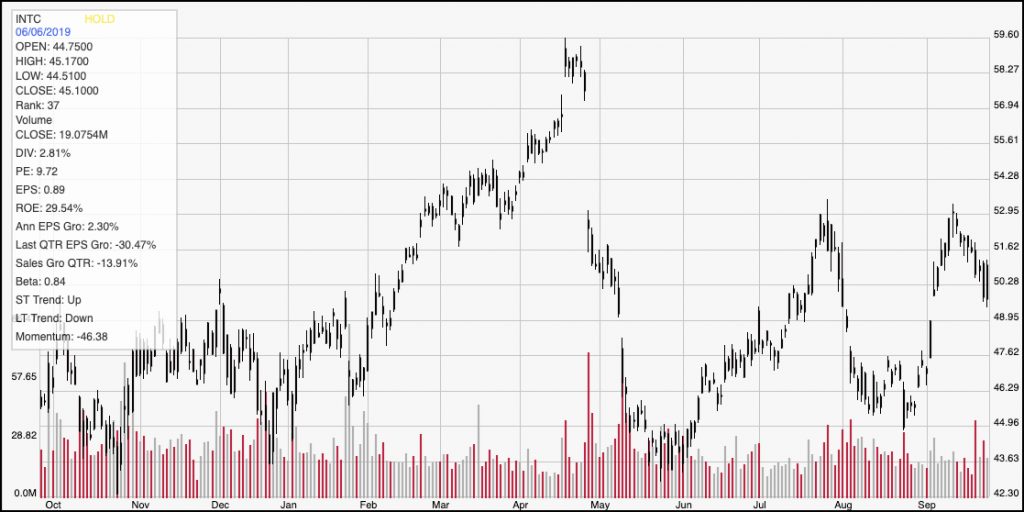

Here’s a look at the stock’s latest technical chart.

Current Price Action/Trends and Pivots: The chart above displays the last year of price activity for INTC. The stock’s volatility over the last seven months is unmistakable, with wide moves between major levels of support and resistance. Most recently, the stock dropped off of a peak at about $53 to retrace to its current level around $51, but it does seem to be finding a new level of support as yet another wave of trade optimism is being seen in the market as the U.S. and China prepare to resume talks next month in Washington D.C. Strong support appears to sit around $49 based on pivot highs in late 2018. The stock would need to break above resistance at $53 to offer any kind of useful near-term bullish opportunity, while a drop below $49 could see the stock drop down to about $45 before it finds new support.

Near-term Keys: Given the current, mostly bearish state of the stock’s momentum, it would be very aggressive to buy the stock or work with call options right now; however, a useful signal could be seen if the stock breaks above $53; in that case, look for an exit target on a short-term trade anywhere between $55 and $59 per share. If the stock drops below $49, consider shorting the stock or working with put options, with a bearish target price around $45 per share. What about the stock’s value proposition? It’s a bit surprising to see that, despite the stock’s strong move since the end of May, there could still be some interesting long-term upside. Making that bet right now means being willing to tolerate additional volatility going forward, since any concrete resolution on trade is unlikely to be seen at any point in what remains of 2019.