This trend may be a contrarian signal that stocks could soon start heading higher.

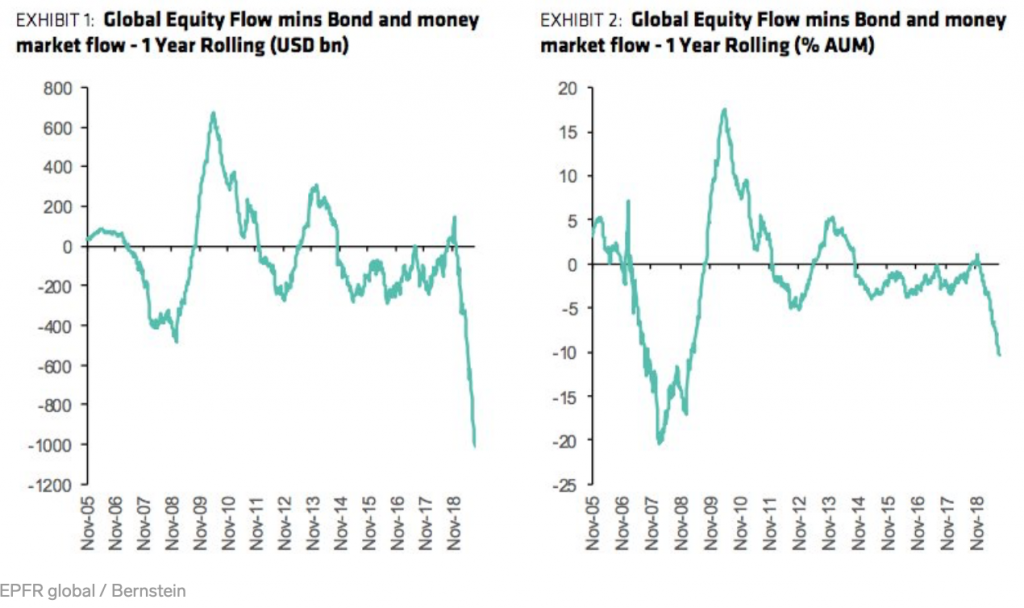

Investors have pulled a record $1.1 trillion out of stocks and into bonds and money market funds over the last year. And according to a research note from Sanford C. Bernstein, this move marks the biggest asset-class rotation in history.

But Bernstein analysts led by Inigo Fraser-Jenkins, global head of quantitative strategy, say this massive rotation could mean gains are ahead for equities.

“If history is a guide, then such periods of outflows tend to see somewhat better equity returns over the following six months,” Fraser-Jenkins wrote in the note. “That message is echoed by the continuing repatriation of overseas equity investment by global investors.”

Fraser-Jenkins noted that when investors move money into safer assets like they have been recently, it’s typically a sign that they’re getting too pessimistic. Such a scenario can ultimately function as a contrarian signal that stock gains are on the horizon.

The Bernstein report notes that while there have been flows out of equities globally, investors are fleeing faster in some places than they are in others. European equity funds have seen $97 billion in outflows, for example, though the selling has been slowing down, Fraser-Jenkins wrote.

And while U.S. equities have suffered in 2019, the pain hasn’t been as great as it has been in Europe, Bernstein found. While the total outflows for the year are $30 billion in the U.S., investors have been starting to make strong moves back into stocks.

Flows into equities jumped to $19.2 billion last week, the largest inflows in a year and a half, according to EPFR Global.

Deutsche Bank echoed that finding and noted that inflows in the last two weeks have been the highest on record. And Bank of America Merrill Lynch said in a note from last Friday that “flows are risk-on” as investor sentiment becomes extremely bearish.

“If you look at valuations, the equity risk premium of equities versus bonds is still very much in equities’ favor,” said Eastspring Investments’ Colin Graham, chief investment officer for multi-asset solutions. “It’s really only the U.S. that’s close to its all-time highs,” as other markets still have much cheaper price-to-earnings ratios.

Bernstein said that while the surge in inflows in the past two weeks, the $33.6 billion flow to global equity funds “needs a magnifying glass to see it on the chart.”

However, there’s still reason to believe the outflows seen in recent months aren’t necessarily done.

“The growth momentum is mediocre at best,” said Tai Hui, chief market strategist for Asia-Pacific at JPMorgan Asset Management. “The global backdrop isn’t awfully constructive for equities. That’s why you’ve seen a lot of investors shift their allocations into fixed income.”