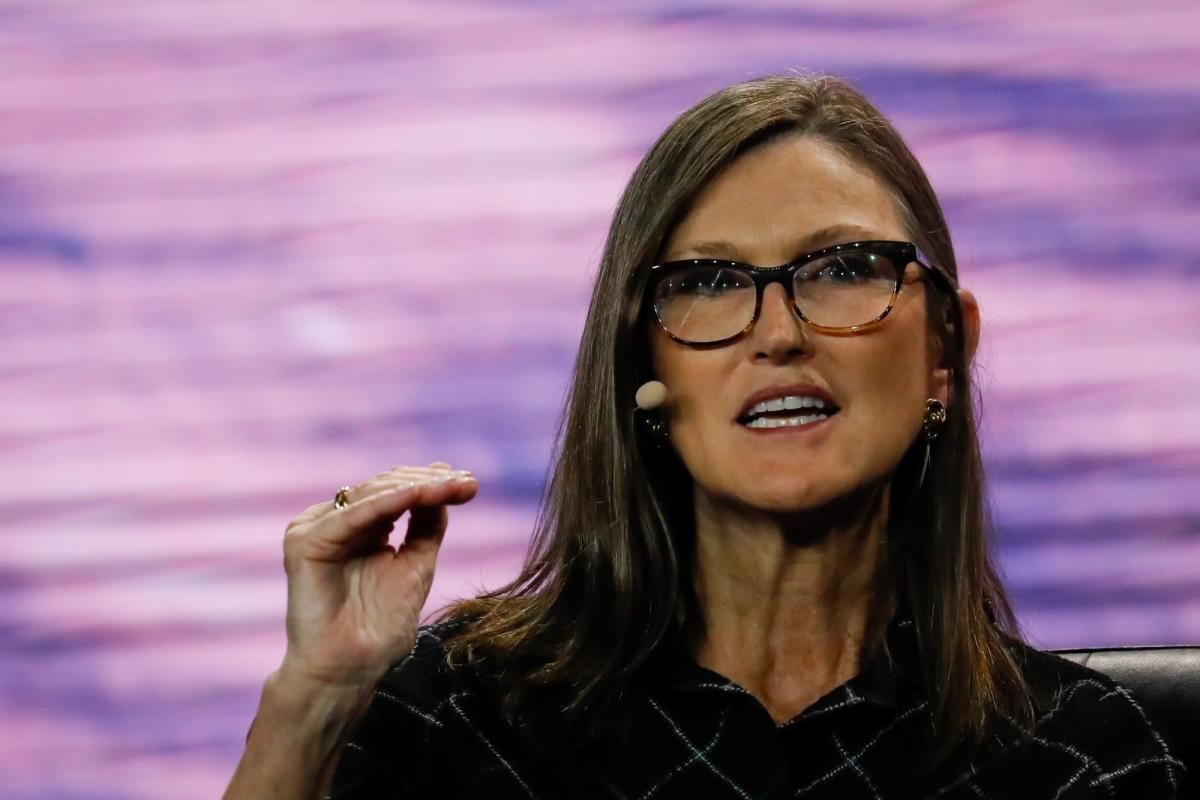

(Bloomberg) — Cathie Wood’s Ark Investment Management now expects Tesla Inc. shares to more than quadruple to $4,600 by 2026.

Ark last year said it saw shares of the electric-vehicle maker hitting $3,000 by 2025, but has since updated its price target amid new expectations around Tesla’s prospective robotaxi business and capital efficiency.

The firm’s bull case suggests the price could rise to around $5,800 by 2026 and the bear case suggests $2,900 — still around three times more than the current share price of $1,005.

“Although tuned to our expectations for 2026, we believe our Tesla model is methodologically conservative,” Tasha Keeney, an Ark analyst, wrote in a blog post last week. “We assume that Tesla’s stock will trade like a mature company rather than a high-growth one in 2026.”

Wood has long been an ardent supporter of Tesla and its chief executive officer Elon Musk. While the flagship Ark Innovation ETF (ticker ARKK) trimmed its position in Tesla last month, the electric-vehicle maker is still its largest holding, making up 10% of the fund. Tesla shares gained about 1.8% Monday.

Not everyone is as positive on the stock after a 40% rally over the past 12 months, however. In fact, David Trainer, CEO of investment research firm New Constructs, sees Tesla’s share price dropping to as low as $150 to $200.

“Tesla enjoyed a first-mover advantage for a short while, but they no longer have that and there are plenty of other EVs on the road that are competing very successfully,” he said. “This is, in my opinion, Cathie Wood dropping words out there that may be attractive or interesting, shiny, glittery things, to unsuspecting retail investors, when they are really missing the point of where Tesla is positioned competitively.”

A key driver of Ark’s new model is expectations of greater demand for autonomous ride-hailing, an estimated $11 trillion to $12 trillion market, according to Keeney. Ark has also increased its conviction in Tesla’s ability to achieve full self-driving, with the carmaker’s prospective robotaxi business contributing to a 60% chunk of its expected value in 2026.

Another factor is the expectation that Tesla will be more capital efficient, Keeney wrote, noting that Tesla’s capital expenditure per incremental unit of capacity has decreased to $7,700 from $84,000 in 2017.

Meanwhile, Tesla’s Bitcoin holdings are included in Ark’s model, but are not seen as a key component of the forecast, increasing the price target by less than 5%, Keeney wrote. Other business opportunities that Tesla could pursue that are not included in the model include an energy storage business, artificial intelligence-as-a-service and a humanoid robot.

Ark has open-sourced its model, allowing people to change inputs and simulate potential outcomes.

©2022 Bloomberg L.P.