(Bloomberg) — The S&P 500 is about to drop sharply, Morgan Stanley’s Michael J. Wilson warned, as investors struggle to find havens amid fears of a recession and aggressive tightening by the Federal Reserve.

“With defensive stocks now expensive and offering little absolute upside, the S&P 500 appears ready to join the ongoing bear market,” said Morgan Stanley strategists in a note on Monday. “The market has been so picked over at this point, it’s not clear where the next rotation lies. In our experience, when that happens, it usually means the overall index is about to fall sharply with almost all stocks falling in unison.”

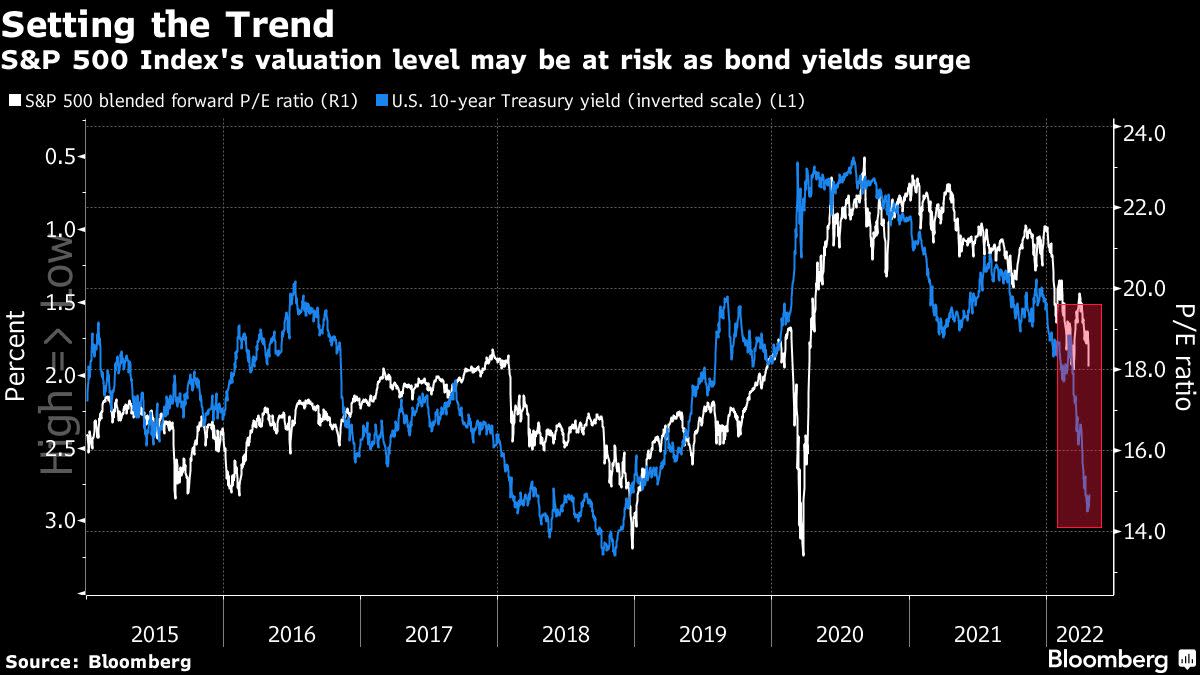

The S&P 500 Index has slumped for three weeks in a row, sinking to the lowest level since mid-March on Friday as investors fled risk assets amid fears of rapid monetary tightening and its impact on economic growth. Fed Chair Jerome Powell’s endorsement of aggressive actions to curb inflation sent traders racing to price in half-percentage-point interest-rate increases at the bank’s next four meetings.

Morgan Stanley strategists said a quickly tightening Fed is looking “right into the teeth of a slowdown” and that while defensive positioning has worked well since November, they don’t see more upside for these stocks as their valuations have swelled.

At the same time, the strategists said that large-cap pharma and biotech shares’ defensive characteristics make them consistent outperformers in an environment of slowing earnings growth, decelerating PMIs and tighter monetary policy.

“As the U.S. economy moves to a late cycle phase and GDP/earnings growth rates decelerate for the overall economy and market, we think Pharma/Biotech’s defensive properties will outweigh policy concern and drive relative performance higher,” they wrote.

©2022 Bloomberg L.P.