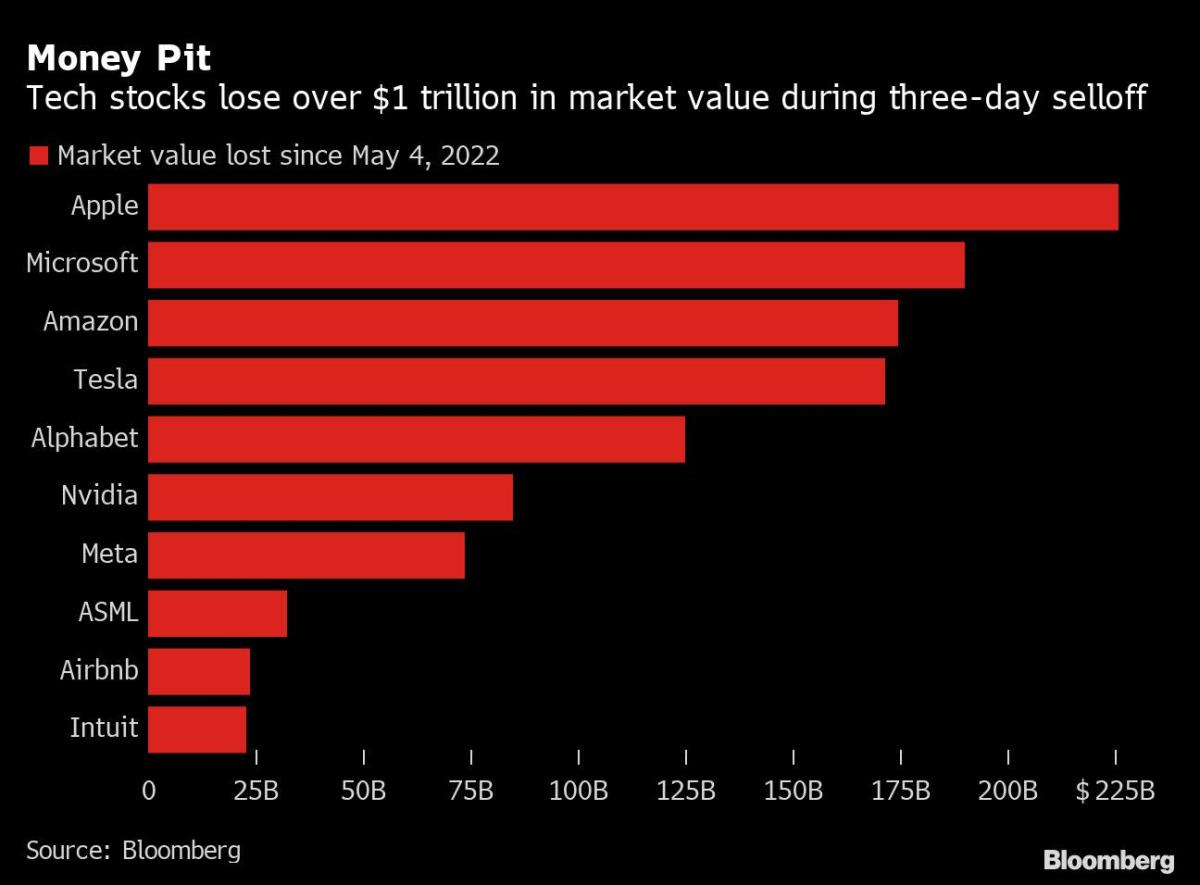

(Bloomberg) — Three days of heavy selling in technology stocks has erased about $1.5 trillion in market value from the Nasdaq 100 Index.

The tech-heavy benchmark sank 4% on Monday, extending its decline to 10% since the Federal Reserve raised interest rates half a percentage point last week and Chair Jerome Powell signaled the Fed would continue hiking at that pace. That’s the biggest three-day drop for the index since September 2020, according to data compiled by Bloomberg.

Tech wasn’t alone in this slump. The S&P 500 tumbled 3.2% and closed at 3,991, below the psychologically key 4,000 point threshold. Broad stocks benchmark is in its worst three-day stretch since its March 20, 2020, pandemic low.

The Nasdaq 100 is down 25% this year amid a jump in U.S. Treasury yields and mounting concerns that higher interest rates and soaring inflation could tip the U.S. economy into recession. It’s the biggest drawdown since the start of the Covid-19 pandemic when the index dropped 28% in the span of about a month.

Few tech companies have been spared in this year’s selloff. Microsoft Corp. sank below $2 trillion in market value on Monday for the first time since June 2021, with the stock now down 21% this year. Amazon.com Inc. has fallen more than 40% from a 2021 record.

Apple Inc. came within a whisker of being surpassed by oil giant Saudi Aramco as the world’s biggest company after falling as much as 3.7% on Monday. The iPhone maker closed with a market value of $2.47 trillion after falling 14% this year, while Aramco sits at $2.45 trillion.

Cybersecurity stocks Crowdstrike Holdings Inc., Zscaler Inc. and Okta Inc. are among the biggest Nasdaq 100 decliners over the past three days, with each falling more than 26%.

©2022 Bloomberg L.P.