One of the most successful investors in the entire history of the U.S. stock market, and arguably the most famous of our era is Warren Buffett. His annual reports for Berkshire Hathaway have long been considered required reading for any serious fundamental or value-oriented investor because of the way he outlines his views of current conditions and where he is finding useful opportunities to keep his capital working for him. As a value investor, I’ve borrowed from the principles I’ve seen Mr. Buffett lay out in his annual reports to develop my own approach to value identification.

Snippets and quotes from Buffett’s writings and interviews can be found just about anywhere, but one of the most pertinent to a value-oriented investment approach is, “It’s far better to buy a wonderful company at a fair price than a fair company at a wonderful price.”

That concept is something that has reinforced my approach to both fundamental and value analysis over the years and helped me refine my own system to what it is today.

One of the things that the last few years has made very clear, at least from an economic perspective, is the difference between “fair” companies and “wonderful” ones. It isn’t as simple as looking at the way a stock’s price has moved, no matter what talking heads and growth-oriented investors would have you believe, and considering the way that the market has dropped into its own bear market levels right now, it isn’t just about the sectors or industries that might be best suited to weathering an economic downturn. The truth is that every sector of the economy has to find ways to adjust to whatever the current economic climate may be at any given time – and that is often where the difference between “wonderful” and “fair” lies.

One of the sectors that has been really interesting to watch over the past two years is the Industrial sector. This segment is interesting because when economic activity picks up, a comparable increase in demand for many of the companies in this space is generally anticipated. A healthy real estate market with persistently high demand in multiple areas of the country in 2021, for example, meant that home builders could keep new projects going. That is usually is good news for Machinery stocks like Paccar Inc. (PCAR). Real estate and construction is hardly the only place PCAR operates, of course; it is really just one example where continued high housing demand in a lot of areas of the country should give this company’s business a lift. PCAR’s leading position in the industry in battery-electric trucks has attracted the interest of analysts, many of whom expect the company to benefit from increasing attention from the public and the government in charging station infrastructure to facilitate wider adoption of electric vehicles, even in heavy equipment and machinery.

PCAR’s stock underperformed for most of 2021, falling from a January high at around $103 to a low in October at close to $78 per share. From that point, the stock picked up a lot of momentum, moving into a new short-term upward trend that peaked in January at around $97.50. From that point, broad market uncertainty has forced the stock into a new, intermediate-term downward trend that now has the stock just a few dollars away from its October 2021 low. This is a company that has come through the last two and a half years with a generally healthy balance sheet and operating profile, and with a leading position in the U.S. trucking market. Could the stock’s current drop near historical lows also translate to a useful opportunity to work with it on a long-term, value-oriented basis? Let’s find out.

Fundamental and Value Profile

PACCAR Inc (PACCAR) is a technology company. The Company’s segments include Truck, Parts and Financial Services. The Truck segment includes the design, manufacture and distribution of light-, medium- and heavy-duty commercial trucks. The Company’s trucks are marketed under the Kenworth, Peterbilt and DAF nameplates. It also manufactures engines, primarily for use in the Company’s trucks, at its facilities in Columbus, Mississippi; Eindhoven, the Netherlands, and Ponta Grossa, Brazil. The Parts segment includes the distribution of aftermarket parts for trucks and related commercial vehicles. The Financial Services segment includes finance and leasing products and services provided to customers and dealers. Its Other business includes the manufacturing and marketing of industrial winches. The Company operates in Australia and Brazil and sells trucks and parts to customers in Asia, Africa, Middle East and South America. PCAR has a current market cap of about $27.5 billion.

Earnings and Sales Growth: Over the last twelve months, earnings increased by about 27.4%, while revenues increased by 10.73%. In the last quarter, earnings grew by 17%, while revenues were nearly -3.19% higher. The company’s margin profile is healthy, and strengthening; over the last twelve months, Net Income was 8.2% of Revenues, and improved to 9.26% in the last quarter.

Free Cash Flow: PCAR’s free cash flow is healthy, at about $1.3 billion over the last year. That translates to a modest Free Cash Flow Yield of 4.71%. It does mark a decrease from the last quarter, when Free Cash Flow was almost $1.5 billion, as well as below the $1.67 billion mark from a year ago.

Debt/Equity: The company’s Debt/Equity ratio is .58, which is a pretty conservative number for stocks in this industry. PCAR’s balance sheet shows $4.8 billion in cash and liquid assets in the last quarter (up from $3.3 billion at the start of 2020) against $7.1 billion in long-term debt. Their operating profile indicates that profits are sufficient to service their debt, with healthy liquidity to provide additional flexibility.

Dividend: PCAR’s annual divided is $1.36 per share and translates to a yield of about 1.67% at the stock’s current price. Management increased the dividend payout from $1.28 per share at the beginning of 2021, which is a positive sign of confidence and strength.

Price/Book Ratio: there are a lot of ways to measure how much a stock should be worth; but I like to work with a combination of Price/Book and Price/Cash Flow analysis. Together, these measurements provide a long-term, fair value target around $74 per share. That means the stock is overvalued at its current price, by about -6%, with a useful value price down at around $60 per share. It is also worth nothing that at the beginning of this year, this same analysis yielded a fair value target at around $45 per share.

Technical Profile

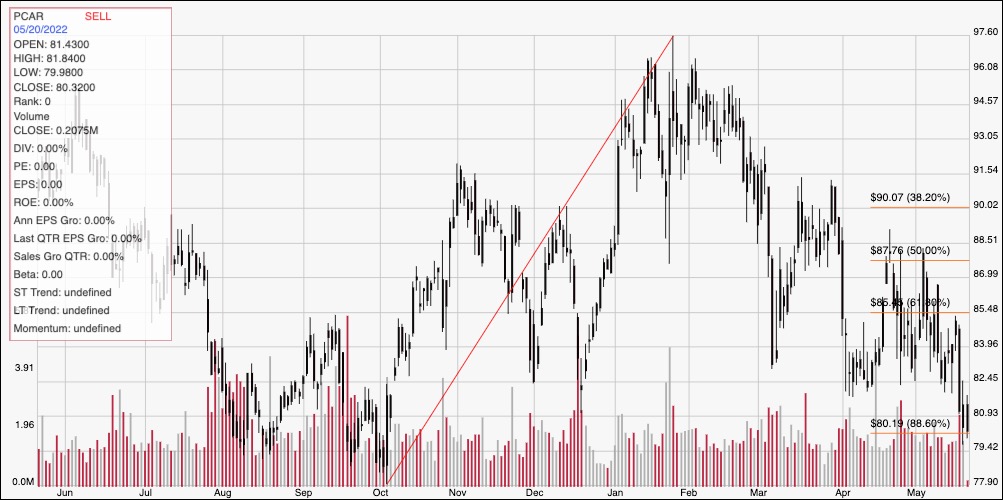

Here’s a look at the stock’s latest technical chart.

Current Price Action/Trends and Pivots: The chart above shows the last year of price activity for PCAR. The red diagonal line traces the stock’s upward trend from its October 2021 low at around $78 to its January peak at around $97.50. It also provides the baseline for the Fibonacci retracement lines shown on the right side of the chart. The stock has dropped into a strong downward trend since late January, pushing near to the 88.6% retracement line at around $80 per share where current support is expected to sit. Immediate resistance is around $82.50 based on pivot low activity in early April. A drop below $80 should test the stock’s 52-week low at around $78, while a push above $82.50 should see short-term upside to about $85.50 where the 61.8% retracement line waits.

Near-term Keys: PCAR’s fundamentals are solid, with healthy Net Income to indicate strong profitability. Declines in Free Cash Flow and and liquidity in the last quarter have been minimal, which is encouraging against the backdrop of rising in input costs and generally inflationary conditions. The stock’s current drop, however hasn’t yet reached the point of useful value, which means that the best possibilities lie on the short-term side, via momentum-based trades. A push above $82.50 could offer an interesting opportunity to buy the stock or work with call options, with an eye on $85.50 as a useful, near-term profit target. If the stock drops below $80, consider shorting the stock or buying put options, using $78 as a practical exit target on a bearish trade.