(Bloomberg) — The relief rally in US equities has limited scope to go much further as risks to growth remain prevalent, according to Morgan Stanley’s Michael Wilson.

“Last week’s strength will prove to be another bear market rally in the end,” the strategist wrote in a note. “The key fundamental call we are focused on now is slowing growth, and our view that earnings estimates are too high.”

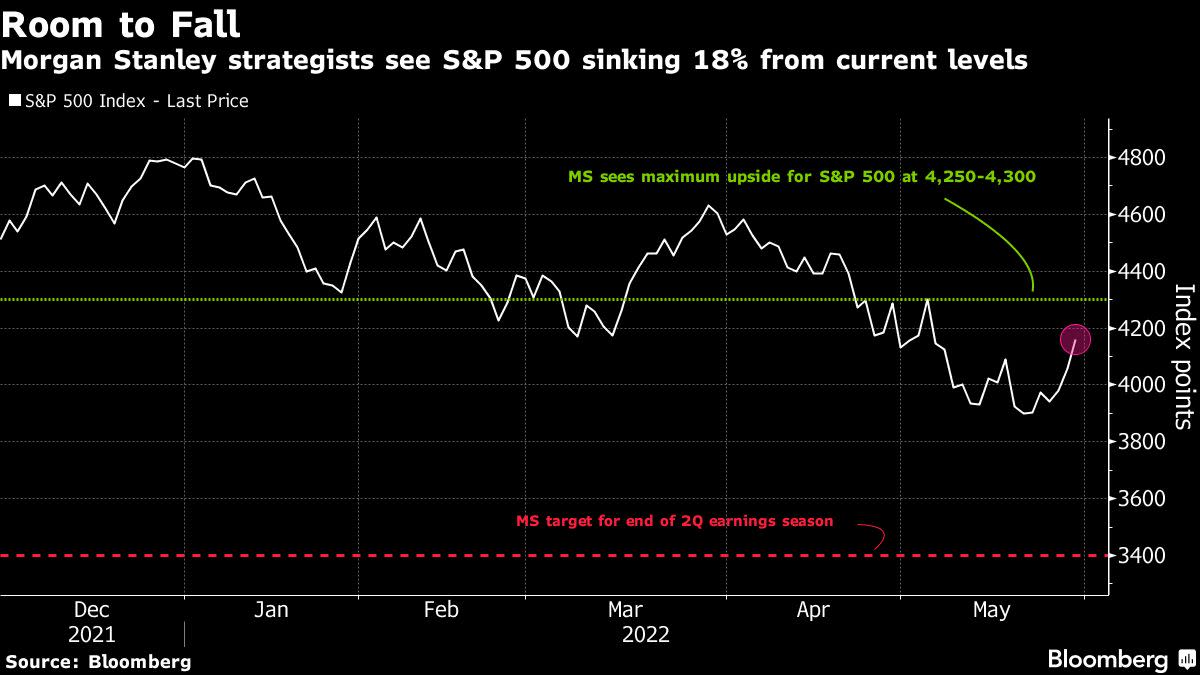

Morgan Stanley sees the S&P 500 reaching a maximum of 4,250 to 4,300 points in the current rally, a 3.4% gain from Friday’s close. The Nasdaq and small cap stocks are likely to rebound more on a percentage basis, as they usually tend to do in such circumstances, Wilson said.

US stocks have had a volatile month amid fears that the economy might enter a recession as the Federal Reserve tightens its policy to tame soaring prices. Still, the S&P 500 recovered last week, and is set for positive returns in May amid lower valuations and expectations inflation may be peaking.

US Stocks Set for Positive Return After May’s Bear Market Scare

Wilson continues to be among Wall Street’s most prominent bears and correctly predicted the latest market selloff. The strategist forecasts the S&P 500 will trade close to 3,400 by the end of the second-quarter earnings season in mid-August, implying 18% downside from its latest close.

“The primary rationale ascribed to this particular rally beyond just an oversold bounce is that the Fed may be contemplating a pause in September,” Wilson wrote. Still, “inflation remains too high for the Fed’s liking and so whatever pivot investors might be hoping for will be too immaterial to change the downtrend in equity prices.”

©2022 Bloomberg L.P.