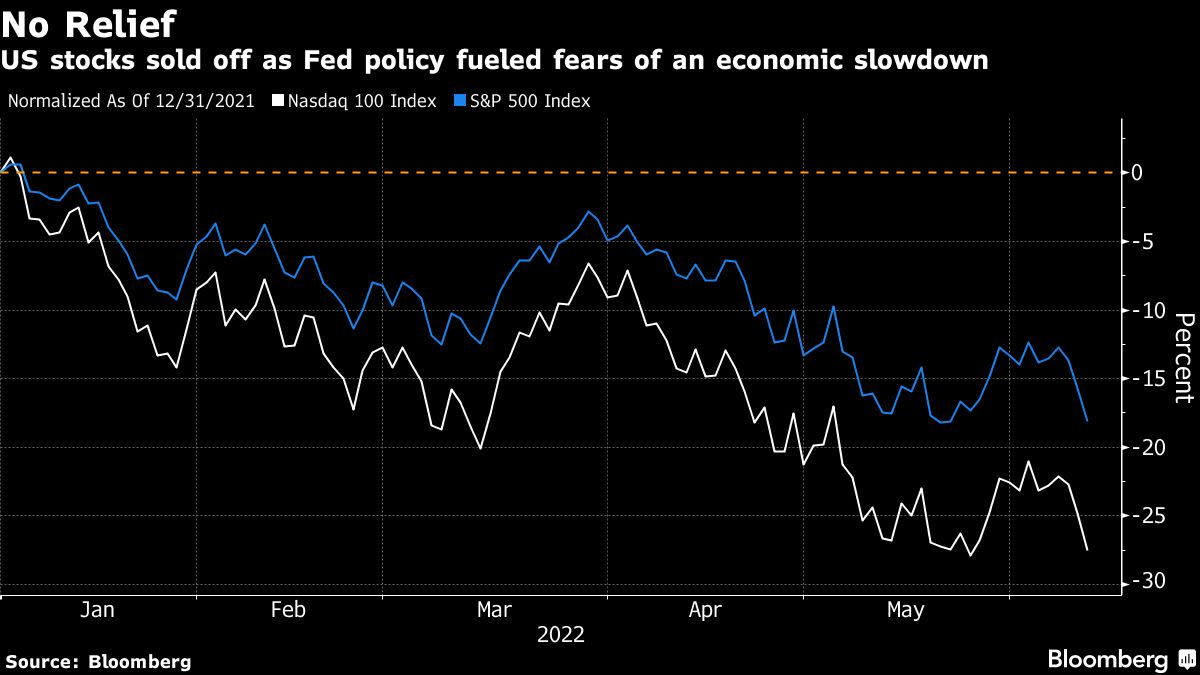

(Bloomberg) — Even after this year’s rapid selloff, equities are still not fully reflecting the vast risks facing corporate earnings and weaker consumer demand, according to strategists at Morgan Stanley and Goldman Sachs Group Inc.

“The Equity Risk Premium does not reflect the risks to growth, which are increasing due to margin pressure and weaker demand as the consumer decides to hunker down,” Morgan Stanley strategists led by Michael Wilson wrote in a note on Monday.

Depressed consumer sentiment is a key risk to the US stock market and economy as the Federal Reserve is set to keep fighting surging inflation with rate hikes, he wrote. Meanwhile, Goldman Sachs Group Inc. strategists led by David J. Kostin said that US earnings estimates are still too high and expect them to be revised downwards even further.

Despite this year’s selloff in the S&P 500, “equity valuations remain far from depressed,” Kostin wrote in a note. The surprisingly strong inflation data show “that the Fed’s battle with inflation has put a ceiling on equity valuations.”

US inflation accelerated to a fresh 40-year high in May, while consumer sentiment plunged in early June to the lowest in data back to 1978. Stocks sold off on Friday and US futures signaled the S&P 500 may near a bear market again today on investor fears the latest inflation figures will likely push the Federal Reserve to extend an aggressive series of interest-rate hikes into the fall.

“The drop in sentiment not only poses a risk to the economy and market from a demand standpoint, but it also, coupled with Friday’s CPI print, keeps the Fed on a hawkish path to fight inflation,” said Wilson.

Wilson has been among Wall Street’s most prominent bears and correctly predicted the latest market selloff. While Morgan Stanley strategists said that margin pressure and waning consumer demand dynamics have been priced in by the market, the risk of excess inventory is just now beginning to be reflected in stock prices. They reiterated their underweight on consumer discretionary shares.

Wilson sees 3,400 points, or about 13% lower from Friday’s close, as a “more reliable level of support” for the S&P 500 by mid-to-late August if a recession is avoided, which accounts for earnings 3% to 5% lower than consensus, a 10-year Treasury yield at 3% and an equity risk premium at 370 basis points.

Goldman’s base case is that equity valuations will remain roughly flat, while earnings growth will boost the S&P 500 to 4,300 by year-end, or about 10% higher than current levels.

©2022 Bloomberg L.P.