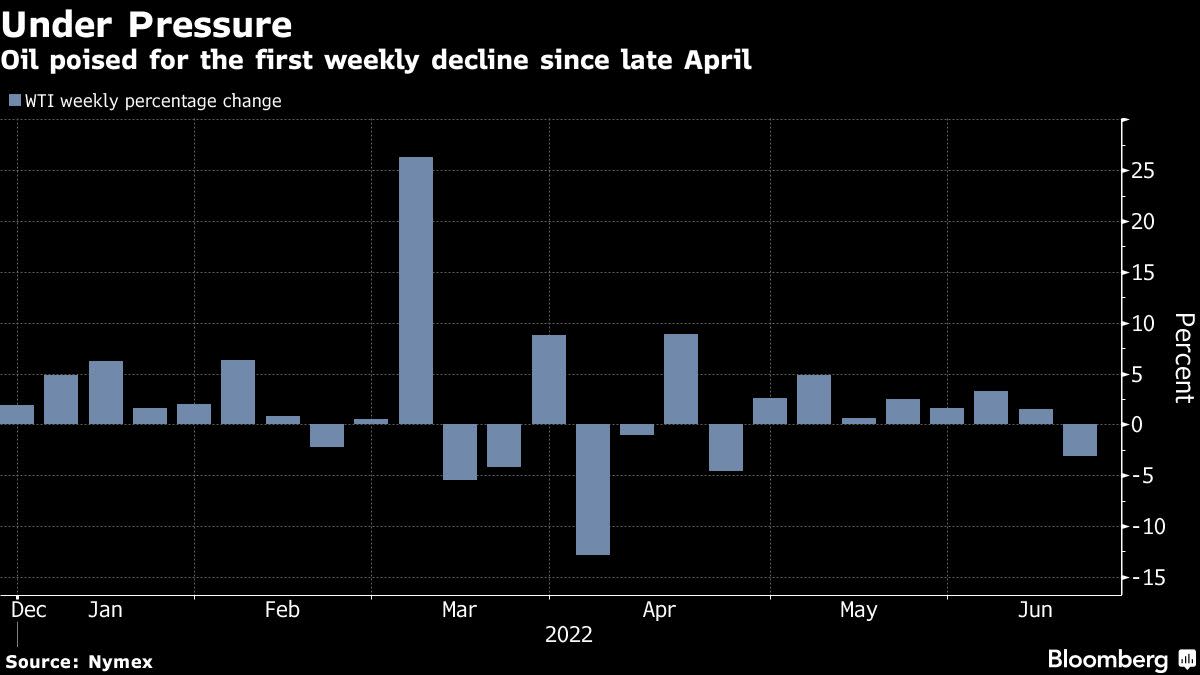

(Bloomberg) — Oil fell the most in 5 weeks as Federal Reserve Chair Jerome Powell reiterated his will to curb the hottest inflation in decades with more aggressive rate hikes.

West Texas Intermediate dropped to near $110, shedding as much as 6.3%. Federal Reserve Chair Jerome Powell this week openly endorsed for the first time raising interest rates well into restrictive territory, a strategy that’s often resulted in an economic downturn and could blunt energy consumption. On Friday he reiterated that the Fed is focused on returning inflation to its 2% target.

“Consumers’ disposable incomes have fallen sharply across the world because of the big rise in inflation, hurting some emerging markets particularly badly,” said Fawad Razaqzada, market analyst at City Index. “It is possible that the slowdown will be more severe than expected, and that’s what investors are worried about the most.”

Fears that rising interest rates and a slowdown in economic growth will lead to demand destruction have gripped the market but in the long run, supplies still look tight, market participants said.

“While the recession may cool off prices in the short term because of the lack of energy investment upstream and downstream, we will continue to see a very tight market and any dip in oil price may be short-lived,” said Phil Flynn, senior market analyst at Price Futures Group Inc.

Russia’s invasion of Ukraine has compounded global price increases and helped to drive up the cost of everything from food to fuels. US retail gasoline prices have repeatedly broken records and the national average recently topped $5 a gallon. The White House is weighing limits on fuel exports to try to alleviate the pain at the pump.

Crude is still up more than 50% this year as rebounding demand combined with upended trade flows following Russia’s invasion of Ukraine to squeeze the market. All commodity price moves have become more extreme as market liquidity has slumped and if crude comes under Western secondary sanctions oil could spike sharply higher, JPMorgan Chase & Co. analysts including Natasha Kaneva wrote in a report.

As the war in Ukraine continues, the focus remains on the extent to which Russian oil flows will be altered. On Friday, the country’s Deputy Prime Minister Alexander Novak said throughput at the nation’s refineries could fall 10% this year.

©2022 Bloomberg L.P.