(Bloomberg) –ConocoPhillips said volatility in global gas markets may last years, as it joined other Western energy firms by investing in a $29 billion project to boost Qatar’s exports of the fuel.

The Houston-based company will buy a 3.1% holding in the North Field East project. Chief Executive Officer Ryan Lance announced the deal alongside Qatar’s energy minister, Saad Al-Kaabi, in Doha on Monday.

Italy’s Eni SpA and TotalEnergies SE of France were previously announced as investors in the project with respective stakes of 3.1% and 6.3%. Shell Plc and Exxon Mobil Corp. were among the firms to make bids. State-controlled Qatar Energy, of which al-Kaabi is also CEO, is scheduled to announce another deal on Tuesday.

The expansion will increase Qatar’s annual liquefied natural gas capacity to 110 million tons from 77 million, just as demand surges across the world, particularly in Europe. Buyers have rushed to secure non-Russian supplies since Moscow’s invasion of Ukraine. Gazprom PJSC last week reduced pipeline gas flows, which highlighted the continent’s vulnerability and raised the specter of fuel rationing. Prices in Europe surged.

“None of us knows how long this is going to last,” Lance said, referring to the large price swings in the gas market. “We have to be prepared for it lasting months and even years.”

Al-Kaabi said that high gas prices were hitting demand and causing some consumers to switch to the dirtier fossil fuel of coal, which he described as “really distrubing.”

“As producers, we like healthy prices,” al-Kaabi said. “But prices that are too high are destructive to demand. You don’t want a broke customer. It’s causing a lot of economic slowdown around the world. The energy bill is becoming so large and slowing economies around the world.”

Qatar Energy expects North Field East to start operating in early 2026, meaning European buyers will need to look for alternative supplies in the meantime.

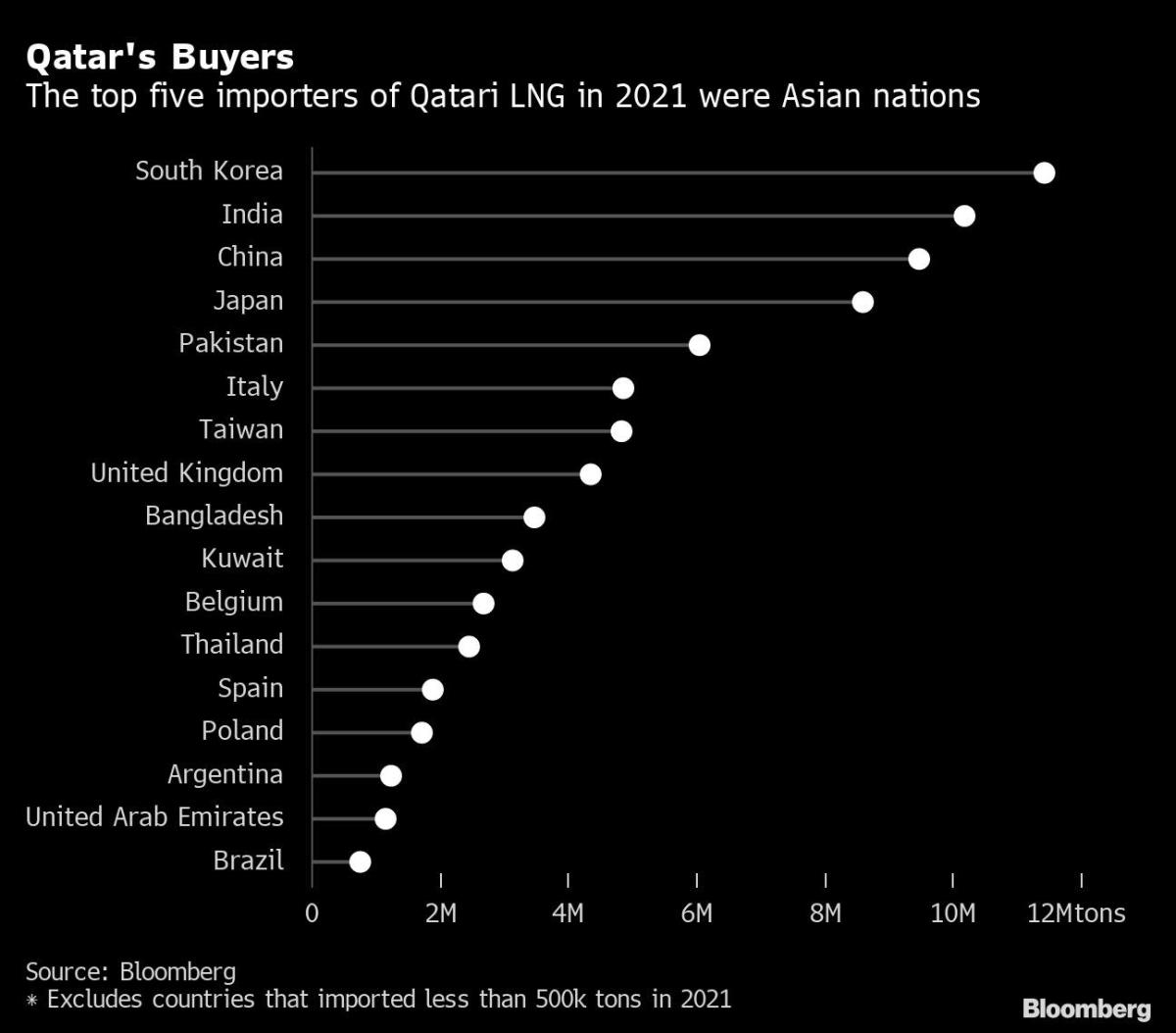

Once the extra gas is flowing, Qatar expects to send more shipments to Europe. Around 80% of Qatari LNG currently heads to Asia but the proportion being shipped to Europe will rise to 40%-50%, according to al-Kaabi.

Higher Qatari output will help the Persian Gulf nation retain its position as one of the world’s biggest suppliers. North Field East will grow Qatari LNG output capacity for the first time since 2011. Even so, Qatar will still be the second-largest LNG exporter in 2028 behind the US, according to BloombergNEF.

©2022 Bloomberg L.P.