The market has gotten pretty shaky over the last couple of weeks, with a lot of investors getting even more nervous to close out the week this last Friday. The World Health Organization (WHO) declared coronavirus a global emergency at the end of the week, which seems to be something that the market is simply using to keep uncertainty high. That’s prompted the broad market to drop by about 4% from its latest high, and into territory that has analysts and talking heads starting to use terms like “correction.”

A correction is still a long way from a bear market, though, and even while short-term uncertainty appears to be high, most forecasts about the long-term impact of coronavirus are pretty modest. That means that while this news could be a catalyst for some continued short-term volatility, without a clear indication that the economy is actually starting to slow, the net effect is likely to remain short-term in nature.

The market’s uncertainty around this latest round of fear about coronavirus has pushed a number of industries market lower, including the Semiconductor industry. As measured by the U.S. Technology iShares ETF (IYW), the industry is down about -5% in the last month. That has put quite a bit of pressure on a number of stocks, including Juniper Networks (JNPR), which is down about -7% over that period, but perhaps more importantly, a little over -13% since early November. That means that the stock’s current momentum is strongly bearish, and is certainly reflective of indications that some important fundamental metrics are lower over the past year. With the prospect of long-term trade peace improving, however, I think it’s reasonable to attribute much of those declines to the impact tariffs between U.S. and China have had on the entire Technology sector. That could mean that this latest decline is a new opportunity to buy a good stock at a nice price. Let’s dive in to the numbers and let you decide for yourself.

Fundamental and Value Profile

Juniper Networks, Inc. designs, develops and sells products and services for high-performance networks to enable customers to build networks for their businesses. The Company sells its products in over 100 countries in three geographic regions: Americas; Europe, the Middle East and Africa, and Asia Pacific. The Company sells its high-performance network products and service offerings across routing, switching and security. Its products address network requirements for global service providers, cloud providers, national governments, research and public sector organizations, and other enterprises. The Company offers its customers various services, including technical support, professional services, education and training programs. The Company’s Junos Platform enables its customers to expand network software into the application space, and deploy software clients to control delivery. The Junos Platform includes a range of products, such as Junos Operating System (OS) and Junos Space. JNPR has a current market cap of about $7.7 billion.

Earnings and Sales Growth: Over the last twelve months, earnings declined about -12%, while revenues improved about 2.2%. These numbers were much better in the last quarter, as earnings jumped about 22% higher, while sales rose 6.6%. The company’s margin profile shows that Net Income as a percentage of Revenues is strengthening, from 7.76% over the last twelve months to 13.9% in the last quarter.

Free Cash Flow: JNPR’s free cash flow has declined steadily since the beginning of 2017, when it was almost $1.3 billion, to about $419.3 million in the last quarter. That translates to a Free Cash Flow Yield of about 5.46%.

Debt to Equity: A has a debt/equity ratio of .37. This is a conservative number. JNPR currently has a little over $1.95 billion in cash and liquid assets against only $1.6 billion in long-term debt. The company’s balance sheet indicates their operating profits are sufficient to service the debt they have, with very strong liquidity that is more than adequate to make up for any potential operating shortfall.

Dividend: JNPR’s annual divided is $.80 per share, and has increased from $.76 late last year; that translates to a yield of 3.49% at the stock’s current price.

Price/Book Ratio: there are a lot of ways to measure how much a stock should be worth; but one of the simplest methods that I like uses the stock’s Book Value, which for JNPR is $13.77 per share, and which translates to a Price/Book ratio of 1.65 at the stock’s current price. Their historical average Price/Book ratio is 2.09, which suggests the stock is currently trading at a discount of about 25.4%. The stock’s Price/Cash Flow ratio suggests the stock is undervalued by just 6.75%. On a Price/Book basis, that offers a long-term target price at around $29 per share.

Technical Profile

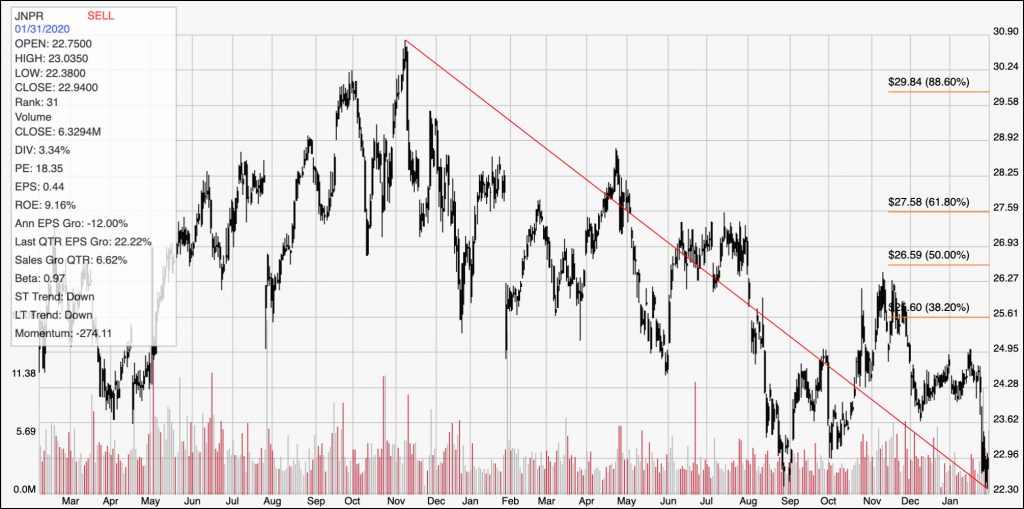

Here’s a look at the stock’s latest technical chart.

Current Price Action/Trends and Pivots: The red diagonal line traces the stock’s downward trend from November of 2018 to its its current price, having driven to a new all-time low at around $22.30 per share; it also provides the baseline for the Fibonacci retracement lines shown on the right side of the chart. More recently, the stock rallied to the 50% retracement and appeared set to reverse the stock’s long-term downward trend until November, when it dropped back yet again, with momentum really picking up in the last last week. Nearest resistance is around $23.50. At the end of last week, the stock dropped below its early September low point, with its next likely support level at around $21 based on pivot lows around $21 in July of 2016.

Near-term Keys: The odds right now are strongly bearish; a continued drop below the stock’s current level could be a useful signal to buy put options, or even to short the stock with an eye in the short-term on $21 as a profit target for a bearish trade. If the stock can pick up bullish momentum and reverse, a push above $23.50 could act as an interesting, if aggressive signal to buy the stock or consider working with call options, with an eye on $25 to $25.50 as a near-term profit target. As far as value is concerned, I think there are some interesting reasons to consider JNPR as a good value investment at its current price; but it does mean that you would have to be willing to accept some additional near-term volatility around the current price. However, the stock offers a strong, stable dividend, and I think the stock’s improving Net Income could signal even more improvements in the fundamentals, like Free Cash Flow that have been declining over the past year. Those could act as solid arguments to support its value proposition.