(Bloomberg) — Asian stocks look set for a wary open after sizzling US inflation data buffeted Wall Street, hardening bets on an even more aggressive Federal Reserve campaign of monetary tightening and an ensuing economic downturn.

Futures pointed to muted starts Thursday in Japan, Australia and Hong Kong, while S&P 500 and Nasdaq 100 contracts shed about 0.5%. A volatile US session ended with modest losses, a resilience possibly rooted in speculation over whether the 9.1% consumer-price reading marks the peak.

Traders shifted toward expectations of an historic one percentage-point Fed interest-rate hike later this month. Fed Bank of Atlanta President Raphael Bostic said “everything is in play” to combat price pressures.

Fed Bank of Cleveland President Loretta Mester said in a Bloomberg Television interview the CPI report was uniformly bad and that the central bank will need to go well beyond the neutral level of rates. The figures don’t suggest a smaller hike than in June, she added.

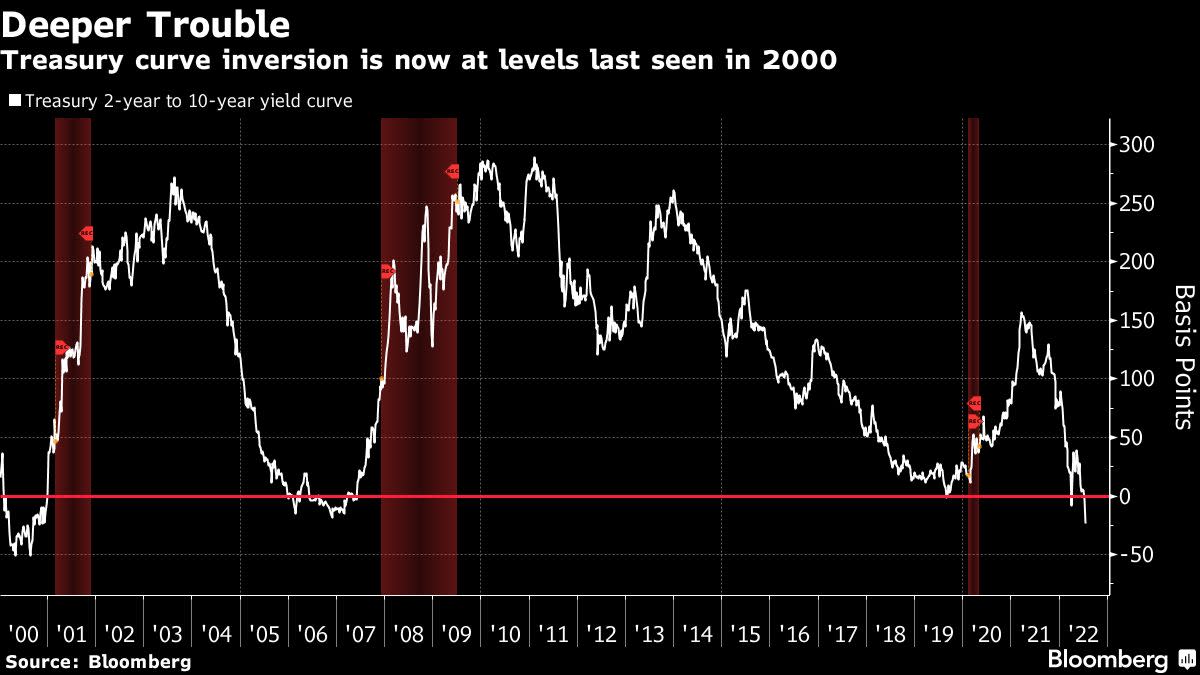

Treasury two-year yields, sensitive to imminent Fed moves, rose Wednesday while longer-maturity rates fell. The inversion between two-year and 10-year yields — a potential recession indicator — hit levels unseen since 2000.

The euro snapped back after briefly falling below $1. The loonie mostly held gains following a 100 basis points hike by the Bank of Canada. Crude oil hovered around $96 a barrel. Bitcoin headed back toward $20,000.

The big question for markets is whether the latest inflation print marks the peak. Commodity prices, pushed up this year in part by supply disruptions related to Russia’s war in Ukraine, have moderated somewhat of late.

But if higher costs prove to be persistent and come alongside an economy buckling under rate hikes, that could be toxic for a range of assets already nursing heavy losses this year.

“Stubbornly high inflation increases the risk that the FOMC continues to hike aggressively and triggers a recession,” Kristina Clifton, senior economist at Commonwealth Bank of Australia, wrote in a note. That’s increasingly the market’s base case and recession fears will continue to support the dollar, she added.

Swaps referencing Fed meeting dates are priced for the policy rate to peak at almost 3.7% this December, up from the current target range of 1.50%-1.75%. Traders then expect the Fed to start cutting rates, with more than three quarters of a percentage point of reductions priced in between the expected peak and the end of March 2024.

In China, a central bank official said liquidity in the interbank market is more than “reasonably ample,” a sign that further rate cuts are unlikely.

Meanwhile, draft projections by the European Commission indicate the euro area’s rebound from the pandemic will be weaker than anticipated while inflation will be faster because of the war in Ukraine.

What to watch this week:

- Earnings due from JPMorgan, Morgan Stanley, Citigroup, Wells Fargo

- US PPI, jobless claims, Thursday

- China GDP, Friday

- US business inventories, industrial production, University of Michigan consumer sentiment, Empire manufacturing, retail sales, Friday

- G-20 finance ministers, central bankers meet in Bali, from Friday

- Atlanta Fed President Raphael Bostic speaks, Friday

Will the eurozone avoid a recession or a debt crisis? How will the euro and stocks perform in the next six months? Share your views and participate in the latest MLIV Pulse survey. It only takes a minute, so please click here anonymously.

Some of the main moves in markets:

Stocks

- S&P 500 futures slid 0.5% as of 7:51 a.m. in Tokyo. The S&P 500 fell 0.5%

- Nasdaq 100 futures fell 0.6%. The Nasdaq 100 fell 0.1%

- Nikkei 225 futures rose 0.3%

- S&P/ASX 200 futures were little changed

- Hang Seng futures increased 0.2%

Currencies

- The Bloomberg Dollar Spot Index rose 0.1%

- The euro was at $1.0054

- The Japanese yen was at 137.44 per dollar

- The offshore yuan was at 6.7297 per dollar

Bonds

Commodities

- West Texas Intermediate crude was at $96.04 per barrel, down 0.3%

- Gold was at $1,734.34 an ounce

©2022 Bloomberg L.P.