(Bloomberg) — The July stock-market rebound has emboldened bulls hoping prices will defy the gravity of the Federal Reserve’s escalating fight against inflation.

Don’t be fooled, though, Morgan Stanley Wealth Management’s Lisa Shalett said: It’s just another false dawn.

The nearly 5% gain in the S&P 500 Index this month has been supported by speculation that inflation is peaking and the job market is cooling. If so, the theory goes, the Fed could have room even to start cutting interest rates early next year.

But Shalett, the division’s chief investment officer, said that “while this theory may be directionally correct, stock market pricing seems premature.”

In the past, she wrote in a note to clients Monday, the Fed hasn’t stopped tightening monetary policy until a key measure of inflation — the core personal consumption expenditure index — is below its benchmark overnight lending rate.

That’s far from the case now. Even if the Fed pushes up its target rate to 2.5% on Wednesday, as expected, it would still be significantly below the rate of inflation. That index, which excludes volatile food and energy prices, was running at a 4.7% annual rate in May.

“The latest bear market rally in our view is full of wishful thinking,” she wrote. “We worry that equity investors are conflating a peak in the acceleration of Fed policy with an end to Fed tightening. History suggests inflation needs to peak before the Fed will stop tightening, but that’s not all.”

There are other reasons not to think the Fed will rush to stand down. Since another inflation gauge, the consumer price index, rose 9.1% in June from a year earlier, Shalett said, it would take month-over-month reports of 0% or even outright deflation to get it below the 5% level at which the Fed could “declare victory.”

Moreover, the modest uptick in unemployment claims from historically low levels is unlikely “enough to allow the Fed to declare mission accomplished and that the equity bear market is over,” she said.

Read more: Yardeni Says S&P 500 Has Already Bottomed, Sees No Hard Landing

Read more: Morgan Stanley’s Shalett Says Analysts Are ‘Deer in Headlights’

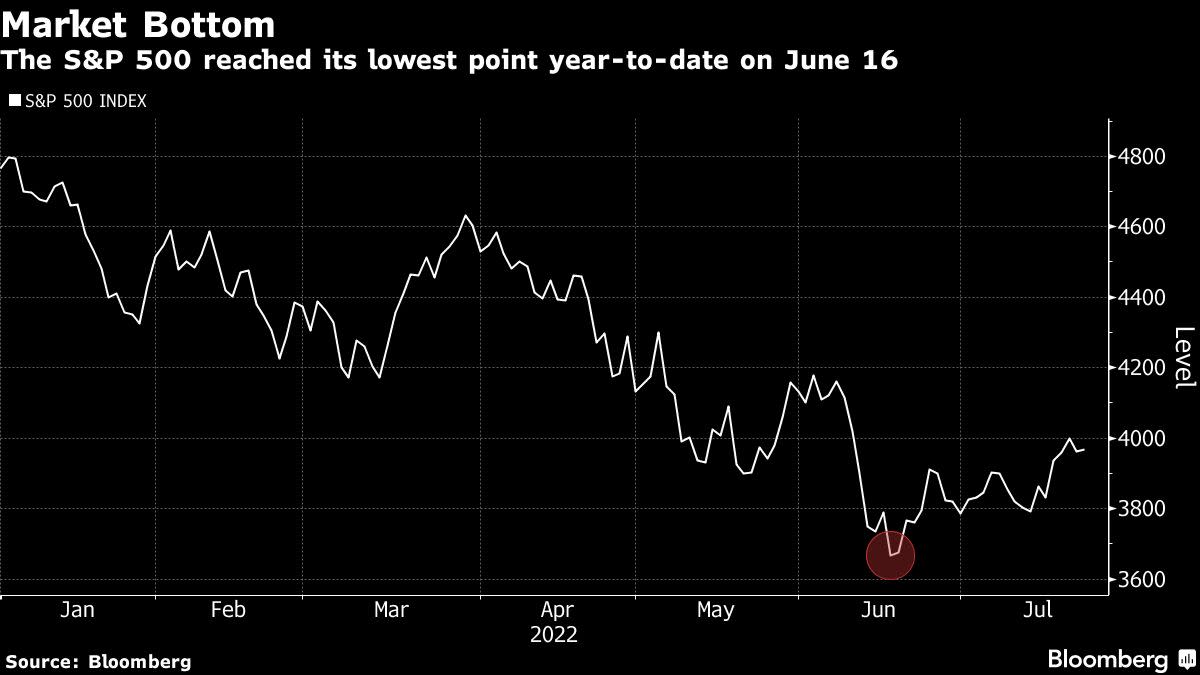

Shalett’s view adds to the growing debate on Wall Street over whether equity prices hit bottom after June’s rout plunged the S&P 500 into a bear market. Earlier Monday, Ed Yardeni said the index’s plunge to a 3,666.77 low in June likely marked the trough of the 2022 downturn. Yardeni in March 2009 correctly called the market bottom when the benchmark index reached an intraday low of 666.79 — 3,000 points below this year’s trough, in what he calls another “devilish number.”

Shalett argues that not only will the Fed tightening cycle persist longer than bulls appear to anticipate, but expectations for corporate-profit growth will also likely remain too high to support even diminished valuations.

“One might make the case that the positive stock market reaction to second quarter earnings misses indicates an ‘it’s all in the price’ attitude,” she wrote. “However, we doubt that even if the Fed ends its tightening campaign with a fed funds rate of 3.2% in December that next year’s earnings will deliver the 8% year-over-year growth that is currently forecast, especially if the Fed is prompted to cut rates early next year as the futures market suggests.”

©2022 Bloomberg L.P.