In the early stages of the arrival and spread of COVID-19 in the United States, I wrote in this space about my belief that one of the best places a smart investor should focus their attention is on healthcare stocks, including companies in the pharmacy space. News media, economists and medical professionals have all turned their focus on dealing with the outbreak, as well as the pressures involved in treating cases as they continue to come in. At the same time, a big focus will continue to be on testing individuals for the virus, and developing both a vaccine (which is a long-term proposition, even with the most optimistic forecasts and models) against the virus as well as anti-viral medications to treat the worst symptoms until a vaccine is found.

The reality is that even as governments reopen different aspects of society and the economy, there is long road ahead before concerns about coronavirus, and its effects on individuals, families, and organizations of every type are behind us. On an individual level, that means that a big part of the onus is on each of us to see to our own well-being, and that of our loved ones. Loosening social restrictions might tempt you to believe you don’t need to be as cautious as you were a month ago; but the truth is the pressure is on each of us even more than before. I think that means, at least in part, that pharmacies are going to continue to be star performers through the rest of the year. On a local level, much of the localized testing that will be available for COVID-19 will come from pharmacies like Walgreens Boots Alliance (WBA) and CVS Corp (CVS), to name just a couple. Along with that is the still, ever-present need to deal with everyday ailments and conditions. It’s pretty safe to say that if the pharmacy isn’t already a pretty regular part of your daily life, it will be in the months ahead in one form or another.

CVS is a stock I’ve kept in my watchlist for years, and that has performed well in the last couple of months, increasing in value nearly 23% from a low point in mid-March at around $52 per share. Much of that increase came as part of broad-based market momentum, but in the last month the stock has started to move in a sideways, range-bound fashion that I like to think of as a consolidation phase. That could be a catalyst for a continued move higher for a company whose last earnings report suggests that it is weathering the economic storm of nationwide shutdowns relatively well. Even with the increase in price, the stock also still offers a compelling value proposition that I think should keep this stock at the top of any value investor’s watchlist.

Fundamental and Value Profile

CVS Health Corporation, together with its subsidiaries, is an integrated pharmacy healthcare company. The Company provides pharmacy care for the senior community through Omnicare, Inc. (Omnicare) and Omnicare’s long-term care (LTC) operations, which include distribution of pharmaceuticals, related pharmacy consulting and other ancillary services to chronic care facilities and other care settings. It operates through three segments: Pharmacy Services, Retail/LTC and Corporate. The Pharmacy Services Segment provides a range of pharmacy benefit management (PBM) solutions to its clients. As of December 31, 2016, the Retail/LTC Segment included 9,709 retail locations (of which 7,980 were its stores that operated a pharmacy and 1,674 were its pharmacies located within Target Corporation (Target) stores), its online retail pharmacy Websites, CVS.com, Navarro.com and Onofre.com.br, 38 onsite pharmacy stores, its long-term care pharmacy operations and its retail healthcare clinics. CVS has a market cap of $81 billion. Aetna Inc. is a diversified healthcare benefits company. The Company operates through three segments: Health Care, Group Insurance and Large Case Pensions. It offers a range of traditional, voluntary and consumer-directed health insurance products and related services, including medical, pharmacy, dental, behavioral health, group life and disability plans, medical management capabilities, Medicaid healthcare management services, Medicare Advantage and Medicare Supplement plans, workers’ compensation administrative services and health information technology (HIT) products and services. The Health Care segment consists of medical, pharmacy benefit management services, dental, behavioral health and vision plans offered on both an Insured basis and an employer-funded basis, and emerging businesses products and services. The Group Insurance segment includes group life insurance and group disability products. Its products are offered on an Insured basis. CVS has a market cap of $83.5 billion.

Earnings and Sales Growth: Over the last twelve months, earnings for CVS improved by almost 18%, while sales rose 8.3%. In the last quarter, earnings were about 10.5% higher, while sales were flat, but slightly negative, by -0.2%. CVS’ margin profile is narrow, but stable; over the last twelve months, Net Income as a percentage of Revenues is just 2.76%, and 3.01% in the last quarter. The trailing twelve month number also marks a reversal from just about a year ago, when Net Income was actually negative.

Free Cash Flow: CVS’s free cash flow is healthy and improving, at about $11.7 billion over the last twelve months (it was around $8.4 billion in April of 2019). That translates to a Free Cash Flow Yield of 14.19%, which is also a useful improvement from early 2019 when it was 7.28%.

Debt to Equity: CVS has a debt/equity ratio of 1.29. This is higher than I usually prefer to see, but is primarily attributable to the massive increase in debt the company preemptively took on at the end of 2018 when its merger with insurer Aetna was first announced. Total long-term debt is $84.4 billion, while cash and liquid assets are about $12.7 billion (up from $6.5 billion in March of 2019). By standard measurements, the company’s liquidity comes into question; however CVS has also laid out an aggressive debt reduction program that they expect will lower the total debt the combined company will be working with to much more conservative levels in the near future. Management has also suspended dividend increases and share repurchase programs for the time being while they work on debt reduction. Along with indications that integration efforts associated with combining two very distinct enterprises with each other are gaining traction, I believe it is safe to say that the company should have no problem servicing their debt.

Dividend: CVS pays an annual dividend of $2.00 per share. At the stock’s current price, that translates to a dividend yield of about 3.14%.

Price/Book Ratio: there are a lot of ways to measure how much a stock should be worth; but I like to work with a combination of Price/Book and Price/Cash Flow analysis. Together, these measurements provide a long-term, fair value target just a little below $95 per share. That means the stock is trading at a massive discount, with 49% upside from the stock’s current price.

Technical Profile

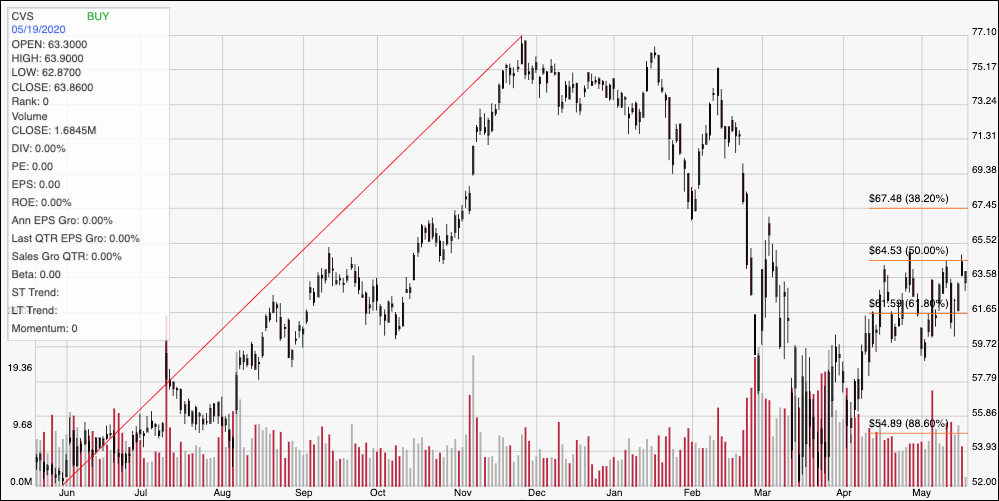

Here’s a look at CVS’ latest technical chart.

Current Price Action/Trends and Pivots: The diagonal red line marks the stock’s upward trend from June to November of last year. It also provides the baseline for the Fibonacci retracement lines shown on the right side of the chart. After peaking around $77, the stock tapered slowly lower until February, when the broad market started picking up volatility. From that point, the slide down was rapid, with the stock falling to a March low at around $52 per share. The stock rebounded nicely into the end of April, but has hovering in a range since then, with $64.50 providing resistance at the top end and support sitting around $60. Currently the stock just a little below resistance, and looks to be pivoting downward off of that resistance. A break above $64.50 could mark a continuation of the stock upward trend begun in February, with room to increase to $67.50 before finding new resistance. On the other hand, a drop below $60 could fall to $55 before finding new support, or possibly to test the March low around $52 if bearish momentum continues.

Near-term Keys: If you prefer to work with short-term trading strategies, the stock’s current consolidation range could offer some interesting signals on either the bullish or bearish side. Use a break above $64.50 as a signal to consider buying the stock or using call options, with $67.50 offering a good, quick-hit profit target. A drop below $60, on the other hand could offer an interesting opportunity to short the stock or to buy put options, using $55 as an early exit target on a bearish trade, and $52 if bearish momentum picks up. The stock’s value proposition is extremely attractive, and from a long-term perspective, I think continues to offer one of the best value opportunities in the stock market right now.