Markets are naturally cyclical – they swing from high to low and back again on a consistent, albeit unpredictable basis over a range of time frames. The different time periods associated with any given cycle, as well as the depth of a certain cycle’s direction, can shade the casual investor’s perception about a stock’s opportunity.

The most recent major bull market, which extended itself over a more than ten-year time period, was only briefly interrupted by the global pandemic, and finally found its bear market end earlier this year, is a good example. Because of both the unprecedented time period that market’s bullish run covered, and even more particularly the abnormally-extended rallies that typified the market’s bullish momentum during its last couple of years, a lot of average investors made the mistake of assuming that the market would simply continue that run.

The argument can also be made that, since the market recovered from its technical, pandemic-induced bear-market drop within just a few months in 2020, investors now seem to expect the market quickly recover and rebound from the challenges that pushed it to a new bear market this year. As evidence, consider last week’s price activity in the market as investors spent the week focusing on the Federal Reserve’s Jackson Hole summit. The market rallied strongly in the days leading up to chairman Jay Powell’s speech at the end of the week, apparently on the hope that he would provide signals about whether, or when monetary policy, and interest rate increases would ease.

Mr. Powell’s actual speech on Friday spurred a big selloff, since his comments were far more hawkish than the market hoped, and increase expectations that rates will not only remain high, but continue to increase. The market idiom, “buy the rumor, sell the news” seems to have come true in this case, and the spectre of continued high rates also appears likely to keep the market from finding much upside through the rest of this year at least.

For a somewhat contrarian-minded investor like me, the conditions I’ve just described mean that it’s one thing to be open to good buying opportunities right now – but it is still smart to think in very careful, selective terms about taking on new positions. For the stock market, that means not simply taking a stock’s price action – up or down – at face value without first diving into the company’s fundamentals to get a sense of what is driving current price activity. It is also a good idea to take a step back from typical metrics and look for other factors that may work in a company’s favor in the foreseeable future, or that may represent elements of risk.

Oshkosh Corporation (OSK) is a good example of what I mean. From November of 2020 to May of 2021, the stock more than doubled in price, rising quickly from around $67 to a peak at nearly $138 per share. From that point, the stock has fallen back into a long-term downward trend that has the stock consolidating near its 52-week low at around $81, and about -35% below its 52-week high at around $124.50 per share. Their generally solid fundamental profile does show a few holes that I think have played a role in the market’s treatment of the stock over the past year.

Trying to take a look at the broader picture for OSK means factoring in not only where their business has been, but also where it’s going. Long established as a primary manufacturer of telehandlers, aerial work platforms, and specialty trucks for the defense, fire and emergency, concrete placements, and refuse hauling markets, OSK has signaled a strong commitment to EV product development. Their Pierce Volterra Pumper, for example, is the first electric fire truck in service in North America, with additional EV platforms in place in concrete placement and scissor lifts. In February 2020, the company made headlines when the United States Postal Service (USPS) selected OSK to deliver 50,000 to 165,000 EV and hybrid vehicles over the next ten years in a nationwide, sustainable upgrade of the USPS fleet. More recently, the company announced an additional, $2B+ order from USPS for the same vehicles.

All of this information makes for an interesting mix for a growth-oriented investor; are these elements also enough to make the stock actually work as a legitimate value-driven, long-term opportunity? Let’s dive in to the details and see if we can decide.

Fundamental and Value Profile

Oshkosh Corporation (OSK) is a designer, manufacturer and marketer of a range of specialty vehicles and vehicle bodies, including access equipment, defense trucks and trailers, fire and emergency vehicles, concrete mixers and refuse collection vehicles. The Company’s segments include Access Equipment; Defense; Fire & Emergency, and Commercial. The Access Equipment segment consists of the operations of JLG Industries, Inc. (JLG) and JerrDan Corporation (JerrDan). The Defense segment consists of the operations of Oshkosh Defense, LLC (Oshkosh Defense). The Fire & Emergency segment consists of the operations of Pierce Manufacturing Inc. (Pierce), Oshkosh Airport Products, LLC (Airport Products) and Kewaunee Fabrications LLC (Kewaunee). The Commercial segment includes the operations of Concrete Equipment Company, Inc. (CON-E-CO), London Machinery Inc. (London), Iowa Mold Tooling Co., Inc. (IMT) and Oshkosh Commercial Products, LLC (Oshkosh Commercial). OSK has a current market cap of about $5.3 billion.

Earnings and Sales Growth: Over the last twelve months, earnings declined by about -80%, while revenues declined -6.5%. In the last quarter, earnings improved by almost 71%, while sales were 6.2% higher. The company’s operating margin has survived the difficulties of the past two years better than most in the industry, but hasn’t been immune to the challenges that persist; over the last twelve months, Net Income as a percentage of Revenues was a mere 1.54% and weakened in the last quarter to 1.3%. The quarterly number does mark an improvement from negative Net Income. I attribute the narrowing, temporary drop to negative Net Income, at least in part to rising input costs in EV’s, more specifically in electric battery costs. Whether that is a headwind that is resolved quickly, or extends into a long-term basis is an open, to-be-answered question.

Free Cash Flow: OSK’s free cash flow is modest, at about $316.5 million over the past year. This number marks a decline from the last quarter, which was $1.06 billion. The current number also translates to a Free Cash Flow Yield of 5.96%. I take the company’s Free Cash Flow pattern as a confirmation of the headwinds reflected by the current Net Income pattern.

Debt to Equity: OSK has a debt/equity ratio of .21, implying a conservative approach to leverage and debt management. GRMN also has $397.4 million in cash and liquid assets (down from about $944.5 million in the quarter prior) versus $594.6 million in long-term debt. Servicing their debt isn’t a problem – but the current net income and free cash flow patterns could challenge that stability if they aren’t corrected in the quarters ahead.

Dividend: OSK’s annual divided is $1.48 per share, which translates to a yield of about 1.82% at the stock’s current price. It also marks an increase from $.96 per share, per annum around the middle of 2018, $1.20 per share in 2020 and $1.32 per share in 2021. An increasing dividend is a strong sign of management’s confidence in its business plan and operating model.

Price/Book Ratio: there are a lot of ways to measure how much a stock should be worth; but I like to work with a combination of Price/Book and Price/Cash Flow analysis. Together, these measurements provide a long-term, fair value target at about $109 per share. That suggests the stock is trading at a tempting discount, with 34% upside from the stock’s current price.

Technical Profile

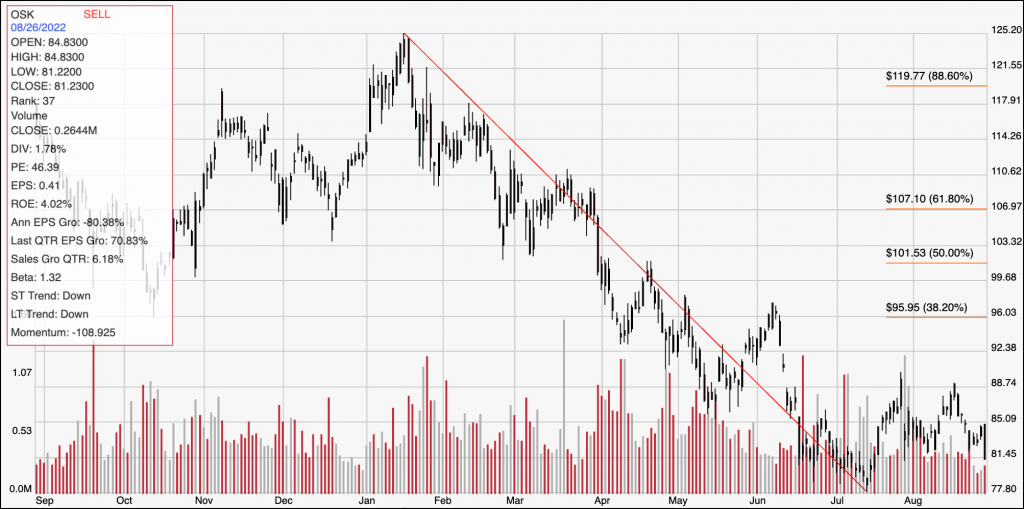

Here’s a look at the stock’s latest technical chart.

Current Price Action/Trends and Pivots: The red diagonal line measures the length of the stock’s downward trend from its June 2021 peak at around $126.50 to its 52-week low, reached in July at around $78 per share. It also informs the Fibonacci trend retracement lines shown on the right side of the chart. The stock has stabilized after finding that bottom, and is now moving in a sideways, consolidation range, with current support at around $81 and immediate resistance at around $85. A push above $85 should find next resistance at around $89, where the stock saw two pivot high points in late July and again earlier this month, while a drop below $81 should retest the stock’s yearly low at around $78 as secondary support.

Near-term Keys: OSK’s value proposition might seem tempting right now, but I think the stock’s downward trend, along with the red flags shown and the company’s balance sheet are strong reasons to hold off on using this stock as a long-term value opportunity right now. If you prefer short-term trading strategies, a break above $85 could act as a signal to consider buying the stock or working with call options, using $89 as a useful, short-term profit target. A drop below $81, on the other hand could be a signal to consider shorting the stock or buying put options, with $78 offering a practical exit target on a bearish trade.