(Bloomberg) — A level analysts flagged as a battle line for stocks held up Wednesday, handing bearish equity traders their biggest defeat in a month.

Indeed, a rush to cover short sales appeared to contribute to a gain of almost 2% in the S&P 500. A Goldman Sachs Group Inc. basket of the most-shorted stocks rallied 4.4%, more than double the index’s advance.

In fixed income, Treasury yields halted a surge to multiyear highs with traders sifting through remarks from a slew of Federal Reserve speakers ahead of next week’s report on the consumer prices index.

Two of the biggest exchange-traded funds tracking the S&P 500 (ticker SPY) and Treasuries (ticker TLT) jumped at least 1.5%, the second time this year each has advanced that much.

Oil is retreating, easing inflation pressure, while the spigot for the corporate debt market remains open — two factors that supported stocks. Yet with little material improvement on the fundamental side, traders turned to technical patterns for guidance. One factor at play, they say, is the massive short position that investors have accumulated during the 2022 bear market.

Trend followers, such as commodity trading advisers, for instance, were “max short” on both stocks and bonds, according to an estimate by Nomura Securities International. Meanwhile, hedge funds’ equity exposure trailed 98% of periods over the past three years, data from Goldman’s prime broker show.

All the extreme bearish positioning means the likes of CTAs would be forced to unwind their short positions should the latest decline reverse its course, as was the case Wednesday.

“The short base is over-extended,” said Andrew Brenner, the head of international fixed-income at NatAlliance Securities. “While we do not think we are at the bottom of Treasury prices, a light is at the end of the tunnel for a CPI rally.”

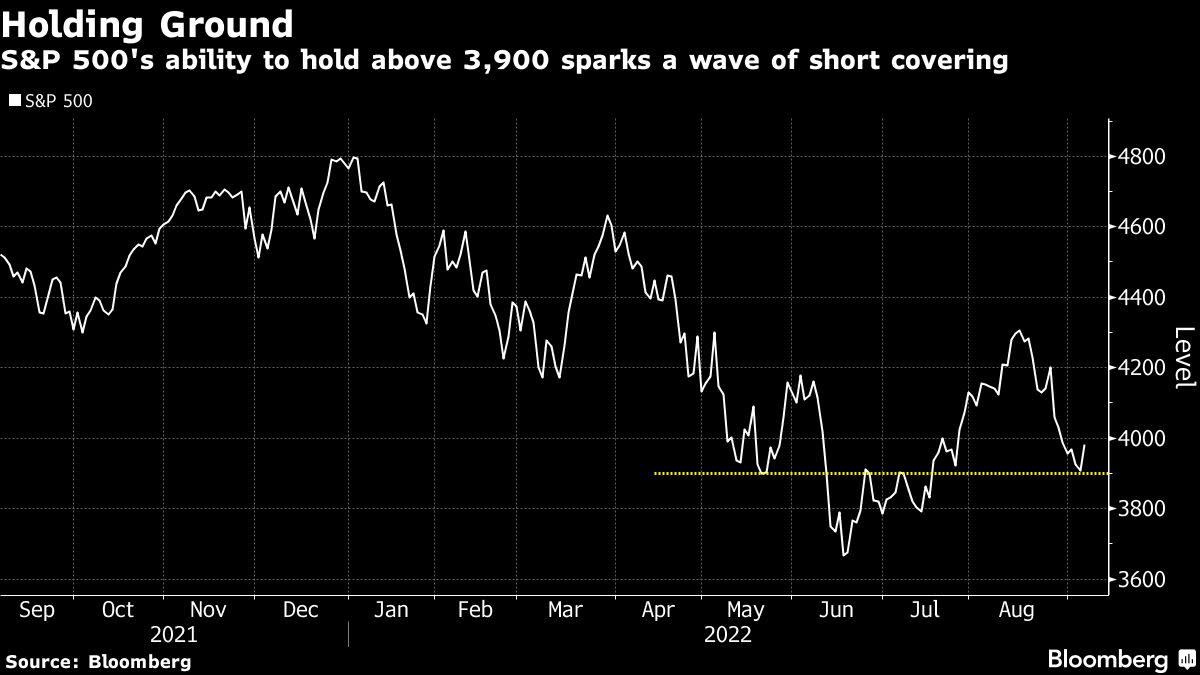

After managing to close above 3,900 during Tuesday’s slide, the S&P 500 mounted a comeback Wednesday. The threshold acted as support in mid-May and then worked as upside resistance briefly in June and July. The ability for the market to hold the line, for now, defies bear warnings that the worst is yet to come.

Along with a resurgence in corporate bond market, Chris Harvey took comfort in the S&P 500’s potency to refrain from touching fresh lows, even as two-year Treasury yields climbed to the highest since 2007. The resilience is a departure from June, when stocks sank to the year’s lows while yields spiked higher.

“Although the S&P 500 has sold off again, it is holding the 3,900 level. This is a constructive development,” said Harvey, head of equity strategy at Wells Fargo Securities LLC. “When credit markets are open for business, it lubricates the capital markets machine –and vice-versa. This is also a constructive sign.”

©2022 Bloomberg L.P.