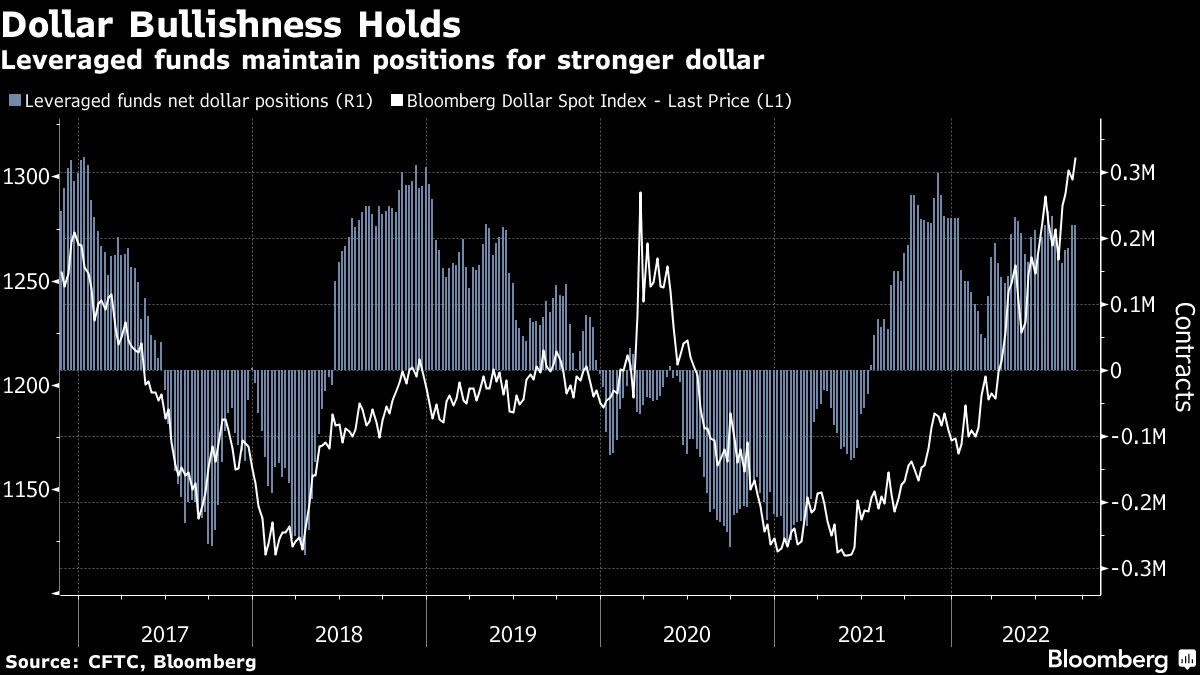

(Bloomberg) — Equities extended declines on Friday, with an index of global stocks on track for the worst week since June, while a gauge of the dollar soared to a fresh record, reflecting bets for outsize Federal Reserve interest rate hikes.

US futures dropped, suggesting the selloff that drove the S&P 500 index to its lowest close in about two months on Thursday isn’t over yet. Europe’s benchmark share gauge headed for a fourth day of losses, with real estate and miners leading a broad-based retreat. Stocks slumped in Japan, Australia and Hong Kong. Mainland China equities also fell, with little impact on sentiment from industrial production and retails sales data that beat expectations.

Policy-sensitive two-year Treasury yields extended a rise to the highest since 2007, deepening the curve inversion that’s seen as a recession signal. The latest US economic data painted a mixed picture for the economy that backed the view for hawkish monetary policy. Swaps traders are pricing in a 75 basis-point hike when the Federal Reserve meets next week, with some wagers appearing for a full-point move.

“Everything points to another 75 basis-point rate hike by the Fed when it meets next week. The likelihood that it will have to go ‘big’ again in November is elevated, too,” said Raphael Olszyna-Marzys, and economist at Bank J Safra Sarasin “What’s more, its new projections should indicate that the fight against inflation will be more painful than previously acknowledged.”

The market weakness follows data showing applications for US unemployment insurance fell for a fifth straight week, suggesting demand for workers remains healthy. Retail sales indicated spending on goods is moderating. Other figures showed factory production rose slightly in August while total industrial production, including mining and utilities, fell. University of Michigan data Friday will be parsed for clues on inflation expectations.

Adding to concerns about a slowing economy, FedEx Corp. withdrew its earnings forecast on worsening business conditions. The package-delivery giant flagged weakness in Asia and challenges in Europe as it pulled its prior outlook and reported preliminary results for the latest quarter that fell well short of Wall Street’s expectations. The conditions could deteriorate further in the current period, FedEx said.

European mail and parcel delivery companies took a hit, led by Deutsche Post AG, down as much as 7.6% to July 2020 lows.

Market participants could face additional volatility on Friday from the quarterly expiry event known as triple witching, with contracts for stock index futures, stock index options and stock options all expiring, while re-balancing of major equity indexes also takes place.

Meanwhile, the offshore yuan remained on the weaker side of 7 to the dollar, even as the People’s Bank of China set the reference rate for the currency stronger-than-forecast for a 17th straight day.

“While China activity showed some improvement this morning, equity investors really want to see substantial easing in China’s policies related to Covid to turn a bit more constructive,” said Chetan Seth, Asia-Pacific equity strategist at Nomura Holdings Inc. in Singapore. “That has not happened.”

Oil was poised to fall for a third week amid the deteriorating global economic backdrop, which has fueled demand concerns at a time when the buoyant dollar makes crude more expensive for most buyers.

Here are some key events to watch this week:

Some of the main moves in markets:

Stocks

- The Stoxx Europe 600 fell 1.2% as of 8:56 a.m. London time

- Futures on the S&P 500 fell 0.8%

- Futures on the Nasdaq 100 fell 1%

- Futures on the Dow Jones Industrial Average fell 0.7%

- The MSCI Asia Pacific Index fell 1.2%

- The MSCI Emerging Markets Index fell 1.3%

Currencies

- The Bloomberg Dollar Spot Index rose 0.3%

- The euro fell 0.4% to $0.9956

- The Japanese yen was little changed at 143.43 per dollar

- The offshore yuan fell 0.3% to 7.0314 per dollar

- The British pound fell 0.9% to $1.1369

Bonds

- The yield on 10-year Treasuries was little changed at 3.46%

- The yield on 2-year Treasuries rose three basis points to 3.90%

- Germany’s 10-year yield was little changed at 1.76%

- Britain’s 10-year yield declined three basis points to 3.14%

Commodities

- Brent crude rose 0.4% to $91.17 a barrel

- Spot gold fell 0.6% to $1,655.22 an ounce

©2022 Bloomberg L.P.