(Bloomberg) — Oil edged higher after a punishing week as traders weighed up the outlook for global demand amid mounting recessionary concerns.

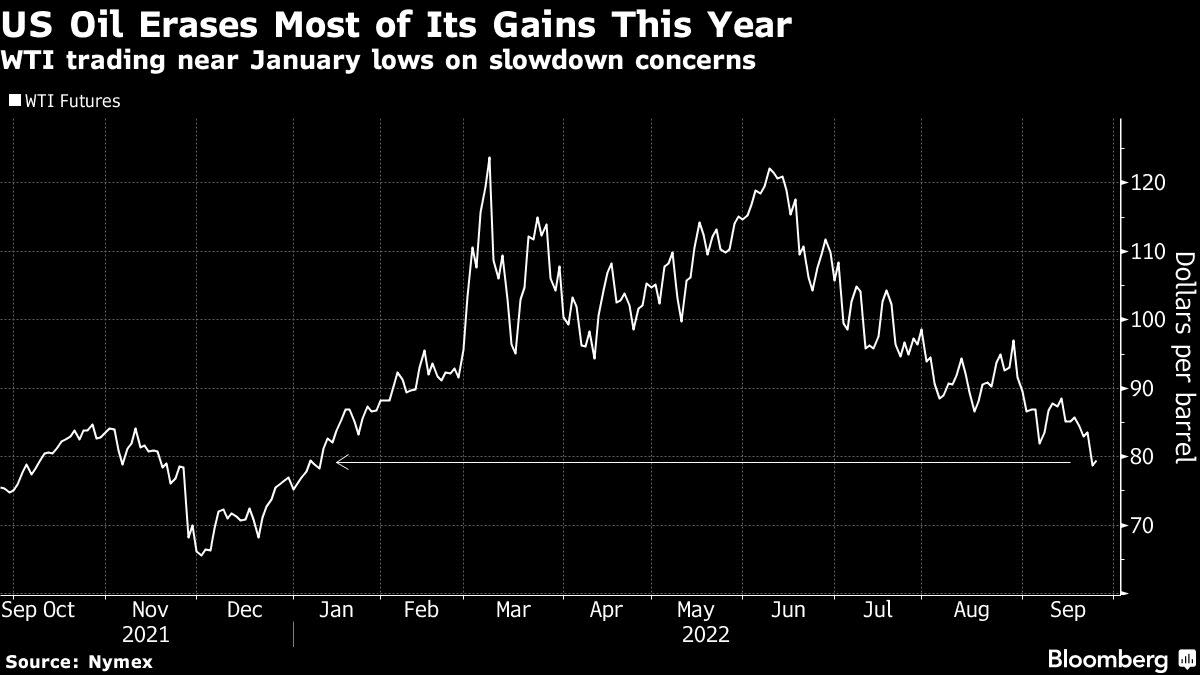

West Texas Intermediate rose above $79 a barrel after collapsing more than 7% last week to end at the lowest close since mid-January. The decline was the US benchmark’s fourth consecutive weekly drop, the longest losing run this year.

Crude is on track for its first quarterly slump in more than two years as central banks including the Federal Reserve raise interest rates aggressively, hurting the outlook for energy demand and sapping investors’ appetite for risk. The Fed’s tightening has helped to drive the US dollar to a record, making commodities priced in the currency more expensive for overseas buyers.

The slump in prices may induce the Organization of Petroleum Exporting Countries and its allies to consider intervening to stem the slide, either verbally or by announcing a reduction in output. Earlier this month, OPEC+ announced a token supply cut, and said members would monitor the market.

“Oil markets came under pressure as the Fed signaled it was willing to enter a recession in order to beat inflation,” said James Whistler, managing director of Vanir Global Markets Pte. “This may be enough to trigger action from OPEC+ as the current price level is likely below internal forecasts for member nations.”

Crude traders were also keeping tabs on the path of Tropical Storm Ian, which is expected to strengthen into a hurricane this week as it approaches the Florida mainland. At present, forecasters are struggling to pinpoint where it will make landfall, possibly anywhere from the Panhandle south to Tampa Bay.

Widely-watched time spreads have narrowed, suggesting an easing of near-term tightness. Brent’s prompt spread — the gap between its two nearest contracts — was at $1.13 a barrel, down from almost $2 a month ago.

“At current levels, it appears the market is now pricing-in the typical impact of a deep recession,” Australia & New Zealand Banking Group Ltd. said in a note. “The sell-off could see OPEC intervene again.”

©2022 Bloomberg L.P.