The month of October is one of my favorite times of year. The entire month is like a lead up to Halloween as spooky becomes a central theme for everything from television shows to neighborhood decorations.

What might also seem spooky – but not in a fun way – is when the market decides to remain on uneven, uncertain ground. With the major market indices all hovering around important support levels with the potential to extend this year’s bear market even more, seeing stocks pressing to new lows, or picking up selling momentum in aggressive fashion, spooky might actually just be scary – depending on your view of what a stock’s price action means.

When a stock is experiencing a significant decline, or a downward trend that covers several months at a time, it is often because there are critical problems – in the economy, the industry, or even in the company itself – that have to be addressed to justify the stock’s current price. Sometimes, however, that trend is really nothing more than a seller-driven reaction to broader questions that don’t actually reflect on the company itself. That’s why I’ve learned over time to not take any trend – bullish or bearish – at face value, but to dive in to the details. The opportunity for a smart value investor comes when you can find a positive divergence between a stock’s price action and its underlying fundamental and valuation metrics. For my analysis, a positive divergence means that the stock should be worth more than its current price, trend, or latest swing may be right now.

If you’ve been following me in this space at all, or participating in my weekly options trading webinar, you already know that CVS Health (CVS) is a good, old friend that I’ve followed for quite some time. The stock was a star performer in 2021 and the early part of this year, rising from about $68 at the beginning of March 2021 to a peak in early February at around $111. From that high, the stock followed broad market momentum lower and into a clear downward trend before finding a low point in June at around $88.50. It staged a strong enough bullish rally to mark a new short-term upward trend that peaked in the middle of August at around $107 before pickup bearish momentum that really accelerated at the start of this month – hence the “spooky” description of the stock’s recent movement that included an overnight from drop from about $100 to below $90, and that now has the stock hovering a little below that point. Pickup bearish momentum? You bet. But does that mean CVS is a stock to avoid? I think doing so would mean missing out on a good long-term opportunity.

I think one of the elements longer-term investors should think about in CVS’ market space is the role that CVS and other pharmacy companies play in any economic environment. For the largest players in the U.S. like CVS and Walgreen’s Boots Alliance (WBA), it isn’t just about their ability to fill prescriptions – although that is a core business that is resistant to economic downturns. These are also companies that have spent the last few years actively identifying and investing in ways to evolve and innovate to stay competitive by expanding the scope of their retail locations to do more than just dispense prescriptions and sell consumer goods. Their capital investments include remodeling retail locations to provide expanded health care services and solutions. CVS, in particular was already gaining traction in leveraging its acquisition of insurer Aetna in 2018 to spur its broad transformation from just a drugstore/specialty retailer to a health care company providing a variety of services locally and affordably, and as a result it is hard not to take CVS seriously. I believe the company is uniquely positioned for the current environment, not only in the pharmacy space but also with what I think is a big competitive advantage over the rest of its industry from its Aetna merger. Could the stock also offer a good value at its current price? Let’s dig in to find out.

Fundamental and Value Profile

CVS Health Corporation, together with its subsidiaries, is a health services company. The Company operates through four segments: Pharmacy Services, Retail/LTC, Health Care Benefits and Corporate/Other. The Pharmacy Services segment provides a range of pharmacy benefit management (PBM) solutions, including plan design offerings and administration, retail pharmacy network management services, mail order pharmacy, specialty pharmacy, clinical services, disease management services and medical spend management. The Retail/LTC segment sells prescription drugs and a range of health and wellness products and general merchandise. Its Health Care Benefits segment offers a range of traditional, voluntary and consumer-directed health insurance products and related services. It has approximately 9,900 retail locations, over 1,100 walk-in medical clinics, a pharmacy benefits manager with approximately 105 million plan members, specialty pharmacy services and a senior pharmacy care business. CVS has a market cap of $115.4 billion.

Earnings and Sales Growth: Over the last twelve months, earnings were flat, but slightly negative, by -0.83%, while Revenues rose by 11.04%. In the last quarter, earnings grew by 8.11% while sales were flat, but positive, by 4.96%. The company’s margin profile is historically very narrow; over the last twelve months Net Income was 2.65% of Revenues, and increased to 3.66% in the last quarter.

Free Cash Flow: CVS’s free cash flow is very healthy, at nearly $15.9 billion. That marks a modest improvement from $15.1 billion a year ago, but a small drop from $16.1 billion in the quarter prior. The current number translates to an attractive Free Cash Flow Yield of about 13.76%.

Debt to Equity: CVS has a debt/equity ratio of .67. That is a generally conservative number that has dropped steadily from 1 at the beginning of 2021 as management has successfully managed to pay down a significant portion of the debt incurred to complete its merger with Aetna. In the last quarter, cash and liquid assets were about $14.9 billion versus $50.7 billion in long-term debt. The fact that long-term debt has dropped from about $65 billion since the beginning of 2020, and a little over $6 billion in the last year, is a good reflection of the company’s success so far in transitioning these disparate organizations into a larger, productive company.

Dividend: CVS pays an annual dividend of $2.20 per share, and which translates to an annual yield that of about 2.5% at the stock’s current price. It is also noteworthy that, while dividend increases had been suspended to give the company flexibility to reduce debt gradually from the Aetna merger beginning in 2020, management maintained the dividend throughout the pandemic and announced the first increase, along with the implementation of a new stock buyback program at the beginning of this year.

Value Proposition: there are a lot of ways to measure how much a stock should be worth; but I like to work with a combination of Price/Book and Price/Cash Flow analysis. Together, these measurements provide a long-term, fair value target at about $125 per share. That suggests the stock is undervalued, with about 43% upside from its current price. It’s also worth noting that in the last quarter, this same analysis yielded a fair value target price at around $93 per share.

Technical Profile

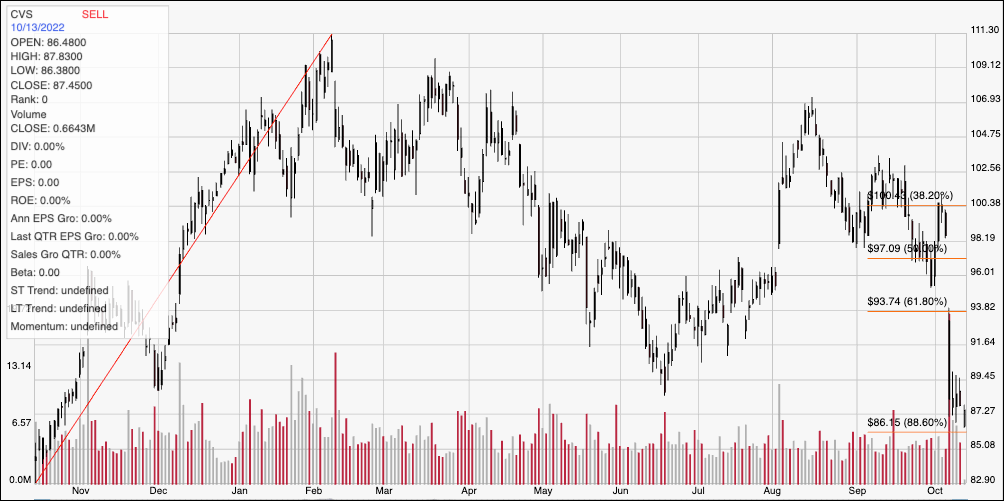

Here’s a look at CVS’ latest technical chart.

Current Price Action/Trends and Pivots: The diagonal red line marks the stock’s upward trend from an October 2021 low at around $82 to its peak in February at around $111. It also provides the baseline for the Fibonacci retracement lines shown on the right side of the chart. After dropping to a low at around $88.53 by mid-June, the stock staged a new rally to peak at around $107 in the middle of August before picking up bearish momentum again. That momentum really accelerated in the first week of October, as the stock dropped overnight from about $98 to $87 per share, just a little above the 88.6% retracement line (considered an extreme extension of a Fibonacci trend). That should put current support at around $86, with immediate resistance around $89.50. A push above $87.50 should find next resistance at around the mid-point of the overnight drop (gaps tend to fill themselves by about 50% in the short term), which is just about inline with the 61.8% retracement a little below $94. A drop below $86 should see the stock test its yearly low around $82.

Near-term Keys: If you prefer to work with short-term trading strategies, a break above resistance at $89.50 could offer an attractive signal to buy the stock or work with call options with an eye on $94 as a useful exit point. A bearish signal would come from a drop below $86, with $82 providing a useful target no matter whether you choose to short the stock or buy put options. From the standpoint of value and long-term opportunity, the stock’s recent drop offers a very attractive opportunity to consider the stock as a useful long-term, value-driven investment.