Being a value-oriented investor means that seeing stocks trading at or near historical lows tends to pique a value investor’s interest. For growth investors, that sounds odd since growth investing puts an emphasis on upward trends and stocks trading at or near historical highs.

Sometimes a long decline in a stock’s price can be attributed to significant problems in a company’s profitability and operations; but if the market inflates a stock’s price faster than a company builds its profits, it also often depresses a stock’s price much faster, and much further than a company’s book of business suggests. That creates the kind of bargain opportunity that a deliberate, analytical value investors looks for.

Broad market conditions can contribute to the perception of value or growth as well. As the economy cycles from expansion and growth to contraction and even recession, different sectors and industries experience their own, separate cycles from prosperity to scarcity. That’s why a smart value-focused investor also likes to keep track of sector-based analysis, since industries and sectors that may be following strongly bearish patterns can provide clues about where to find some of the strongest companies in those sectors at bargain prices.

For most of the past three or four years, one of the interesting sectors that I have put a lot of focus on is the Consumer Staples sector. This is where you’ll find the companies that make a lot of the products you’ll find all over your house – in your pantry, refrigerator and freezer, as well as the household goods in your bathrooms, kitchens and bedrooms. The products made by these companies are needed in just about all economic conditions, which is why they are considered “staples” – you’ll always have a need for those products in your home.

McCormick & Company Inc. (MKC) is a company in this sector that makes a lot of the products that you might not realize make up such a big part of what we use to feed our families. Spices, condiments, and seasonings are this company’s core. The pandemic drove consumer trends to emphasize food-at-home, and that is a trend that, even while it has moderated a bit over the past year, has also shown some “stickiness” even as market and public focus has shifted away from COVID-19 to the issues – inflation, interest rates, and war – that have defined 2022. While the past year has been good for the company’s bottom line, the stock has been following a downward trend since peaking in March of this year at around $107, and is now around -31% below that high. Does that mean the MKC fits the classic value-based description of a stock you should pay attention to? At what point does the stock’s downward trend actually represent a useful value-based opportunity? Let’s find out.

Fundamental and Value Profile

McCormick & Company, Inc is engaged in manufactures, markets and distributes spices, seasoning mixes, condiments and other flavorful products to the food industry-retailers, food manufacturers and foodservice businesses. The Company also partners with various companies that are involved in the manufacture and sale of flavorful products. The Company operates in two business segments: Consumer and Flavor Solutions. The Company’s sales, distribution and production facilities are located in North America, Europe and China. Additional facilities are based in Australia, India, Central America, Thailand and South Africa. MKC has a market cap of $20.1 billion.

Earnings and Sales Growth: Over the last twelve months, earnings declined -13.75%, while revenues were about 3% higher. In the last quarter, earnings were 43.75% higher, while sales increased by 3.83%. The company operates with a healthy margin profile that strengthened in the last quarter. Over the last twelve months, Net Income was 10.86% of Revenues, and increased in the last quarter to about 13.97%. This is an interesting contrast to the broad economic climate that a lot of companies in this sector are dealing with, where rising costs have forced operating margins lower.

Dividends: MKC pays a dividend of $1.48, which translates to an annualized yield of 1.98% at the stock’s current price. It is worth noting that in 2021, MKC’s dividend was $1.36 per share, and that MKC is among an elite group of companies that are considered “dividend aristocrats,” having maintained and increased their dividend every year for the past 39 years (they have paid a dividend every year since 1925).

Free Cash Flow: MKC’s free cash flow is $450.6 million and translates to a modest Free Cash Flow Yield of 2.25%. That is a decline from a year ago at around $550.3 million, and contrasts negatively against the company’s improving margins. This bears watching in the quarters ahead.

Debt to Equity: MKC has a debt/equity ratio of .85. This is a relatively low number that signals a conservative management approach to leverage. Their balance sheet indicates that in the last quarter, cash and liquid assets were a little over $343.9 million, versus $3.9 billion in long-term debt. The company’s operating profile suggests that servicing their debt isn’t a problem, however their modest Free Cash Flow and limited liquidity also imply the company doesn’t have a lot of room for error.

Price/Book Ratio: there are a lot of ways to measure how much a stock should be worth; but I like to work with a combination of Price/Book and Price/Cash Flow analysis. Together, these measurements provide a long-term, fair value target around $67 per share, which means that MKC is overvalued, with about -10% downside from its current price, and a useful discount price at around $54. It also bears mentioning that last year, this same analysis yielded a long-term, fair value target price at around $76 per share.

Technical Profile

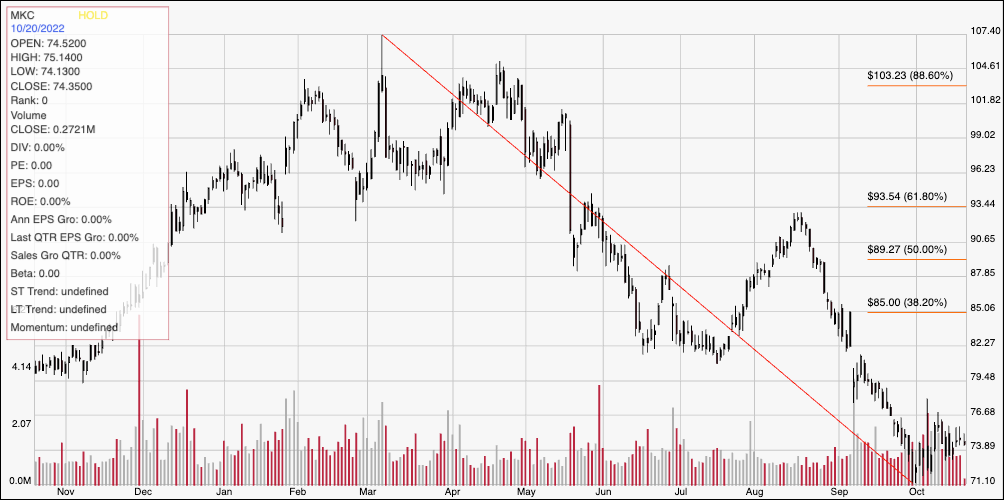

Here’s a look at the stock’s latest technical chart.

Current Price Action/Trends and Pivots: This chart traces the stock’s movement over the last year. The diagonal red line traces the stock’s downward trend from a February peak at around $107.50 to its low, reached this month at around $71. It also provides the baseline for the Fibonacci retracement lines shown on the right side of the chart. The stock has rallied from that low, narrowing the distance between current support, at around $73, and immediate resistance, at around $77. A push above $77 could see upside to about $82, where the last significant pivot occurred in July. A drop below $73 should have limited downside, with the stock’s 52-week low at around $71 acting as next support.

Near-term Keys: While I am a fan of a lot of the stocks in the Food Products industry, MKC unfortunately doesn’t fit the description of a stock that is trading at a useful value price, even with its big drop over the last several months. That means that if you’re interested in working with this stock, the best approach will be to focus on short-term trading strategies. A bounce off of current support at around $73 could offer an interesting, if aggressive signal to buy the stock at its current price, or to work with call options, using $77 as a good initial profit target. A drop below $73, on the other hand could be a signal to consider shorting the stock or buying put options, using the stock’s yearly low at around $71 as a practical, if relatively close profit target on a bearish trade.