Moving deeper into a new earnings season, it is true that a number of the largest and most recognized names in the market have been posting better earnings results in the last quarter than expected. In many cases, companies have displayed an impressive ability to shift gears from traditional, office-based work arrangements to nearly complete work-from-home set ups while continuing to keep their business moving. Even some companies in the most obviously affected, face-to-face aspects of the economy have shown impressive resilience. That might make for tempting fodder to buy in to the notion that the economy can survive anything, and with the major market averages either making new all-time highs (NASDAQ 100) or within shouting distance of pre-pandemic highs (S&P 500 and Dow Jones Industrials), even to say it’s time to go all-in on the economy and the entire stock market once again.

Despite the market’s impressive performance since March, there are still stocks that remain at or near their lowest points, having never recovered their pre-pandemic levels of price activity. As a value-oriented investor with a contrarian bent, these are stocks that I tend to find intriguing, and like to spend time sifting through, because these are the kinds of stocks that often offer the most useful kind of bargains. It’s important, however to keep in mind that just because a stock is trading at a low price right now, it isn’t automatically a good bargain. Sometimes, a stock is just a cheap stock, with good reasons to be priced as low as it is.

There are a lot of areas of the economy that remain significantly affected by the global economic shockwave that came from broad-based, government-mandated shutdowns in the early stages of the pandemic. The most obvious examples are local small businesses, where family restaurants and shops of all kinds across the country in many cases continue to struggle, and in many cases have been forced to close permanently. This is may be the most dramatic example, but it’s hardly the only one.

The necessary shift of big portions corporate America into extended, work-at-home arrangements that are now starting to look like they will become long-term arrangements, and possibly semi-permanent even after the pandemic is in the rear-view mirror has had a big impact on the industries built on keeping offices running. These are companies that supply everything from computers to printers, to office equipment, paper products and so on. With the biggest portion of corporate populations working from home, the demand for the services these companies provide has remained low – with little to suggest that demand is going to rebound in these cases at any point in the near future.

Consider the case of Domtar Corp (UFS). This is a stock I’ve followed for a few years because of their leadership position as the largest producer of uncoated free sheet paper in North America. This is a small-cap stock that is a perfect example of the current disconnect between broad market performance that might make you think the worst is over and the reality that significant portions of working America continue to struggle with. The shutdowns imposed all over the world at the early stages of COVID-19 immediately shut off demand for this company’s products and have prompted analysts to forecast sales declines of 12%-15% for all of 2020, with any recovery to previous levels of demand described merely as “eventual” – a roundabout way, in my opinion of saying, “it’s not going to happen anytime soon.”

The drawdown on UFS’ business has prompted the company to take drastic measures, suspending its dividend and share buyback programs, reducing inventories and cutting its budget for capital expenditures through the rest of the year to preserve liquidity. Those are defensive moves that are understandable given current conditions. It also helps to explain why UFS’ stock price has remained near its 52-week low, just a little above $20 as of this writing. Whether or not the company have the resources to ride out whatever remains of this current economic storm is a little uncertain, and that means that UFS might not be a good risk to think about taking right now. Let’s dive in.

Fundamental and Value Profile

Domtar Corporation designs, manufactures, markets and distributes a range of fiber-based products, including communication papers, specialty and packaging papers and absorbent hygiene products. The Company segments include Pulp and Paper and Personal Care. The Pulp and Paper segment consists of the design, manufacturing, marketing and distribution of communication, specialty and packaging papers, as well as softwood, fluff and hardwood market pulp. The Personal Care segment consists of the design, manufacturing, marketing and distribution of absorbent hygiene products. The Company is a marketer of uncoated freesheet paper in North America serving a range of customers, including merchants, retail outlets, stationers, printers, publishers, converters and end users. It is also a marketer and producer of a line of incontinence care products, as well as infant diapers. It has a network of wood fiber converting assets that produce paper grade, fluff and specialty pulp. UFS has a current market cap of about $1.2 billion.

Earnings and Sales Growth: Over the last twelve months, earnings declined nearly -94%, while revenues dropped by about -7%. In the last quarter, earnings improved dramatically, by 200%, while sales improved 2.73%. Most of that improvement appears to have come from the Personal Care segment, where margins have been improving. Even so, the company’s margin profile, which was already very narrow before the pandemic, has eroded to razor-thin levels; Net Income as a percentage of Revenues was 0.18% over the last twelve months, and improved only by the barest amount in the last quarter to 0.39%.

Free Cash Flow: UFS’s free cash flow has managed to remain healthy, at $205 million over the last twelve months, but it should be noted this metric was around $260 million at the end of 2019. The current number translates to a healthy Free Cash Flow Yield of nearly 18%.

Debt to Equity: UFS’s debt/equity ratio is conservative, at .54. The company’s balance sheet shows that long-term debt is about $1.16 billion, with cash and liquid assets of about $152 million in cash and liquid assets. The company has actually managed to increase its liquidity over the last few months; at the end of 2019, cash was about $93 million. I attribute this increase to the suspension of dividend payments, stock buybacks, and cost-cutting. For now, the company should be able to continue servicing its debt; however if Net Income drops into negative territory, UFS could burn through its cash very quickly.

Dividend: UFS has suspended their dividend payout for the time being.

Price/Book Ratio: there are a lot of ways to measure how much a stock should be worth; but I like to work with a combination of Price/Book and Price/Cash Flow analysis. Together, these measurements provide a long-term, fair value target around $35 per share. That implies that UFS is significantly undervalued, with about 65% upside from its current price.

Technical Profile

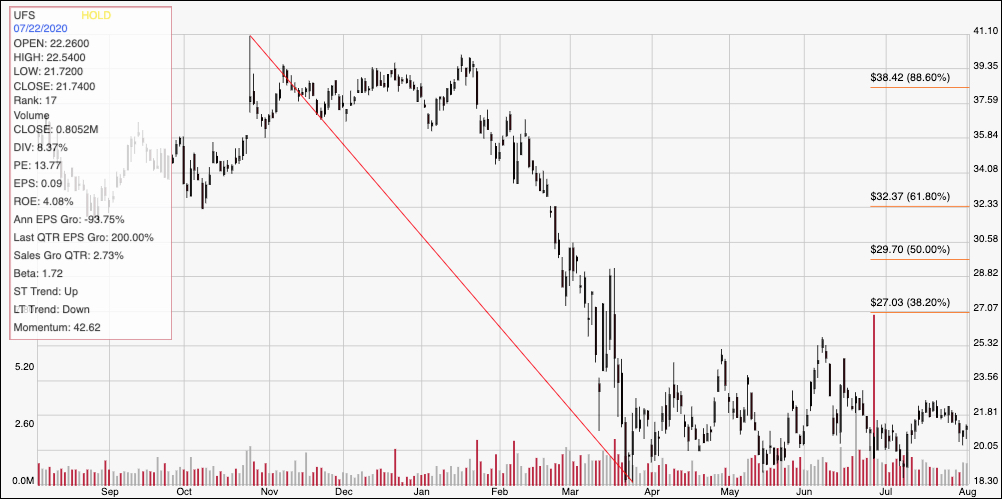

Here’s a look at the stock’s latest technical chart.

Current Price Action/Trends and Pivots: The red line on the chart traces the stock’s downward trend a late 2019 high around $41 to its bear market low around $18. It also informs the Fibonacci retracement lines shown on the right side of the chart. While the stock has experienced a few temporary rallies since first hitting that low in March, hitting short-term highs around $25, the stock has started to settle into a relatively narrow trading range, with immediate resistance at around $22 and support sitting around $19. A break above $21 should see the stock test its last high around $25, with room to push to the 38.2% retracement line around $27 if bullish momentum remains strong. A drop below $19 has limited downside right now, with the stock’s 52-week low a little above $18 per share.

Near-term Keys: UFS’s current price remains at levels that suggest there is very little in the way of downside; in fact its value proposition is temptingly attractive. While the company has taken what I think are appropriate steps to preserve cash and shore up its balance sheet, I don’t think this is the right time to get bullish about this stock’s long-term prospects. I would look for more improvement in Net Income as a sign that demand has started to shift back in the company’s favor before taking the bargain argument seriously. From a technical standpoint, there also appears to be limited downside, so if you don’t mind being aggressive, you could take a break above $21 as a signal to buy the stock or work with call options, with $25 acting as a useful bullish target. I wouldn’t think about shorting the stock or buying put options right now, unless it drops below $18. If that happens, the stock will have broken its bear market low, which means that downside risk will be much higher and offer new trading opportunities on the bearish side.