When the economy is on uncertain ground, it’s easy to look at the biggest, most established companies in the market for ways to keep your money working for you. That’s because those are the names that, no matter what industry or sector they operate in, are most likely to have the fundamental strength – in the form of balance sheet assets to carry them through whatever difficulties may lie ahead, or to take advantage of new opportunities to expand and grow as they arise.

COVID-19 is an overhanging cloud that, no matter how much we’d like to ignore it, continues to put pressure on economic activity across the world. I think that is one of the reasons that market media channels, talking heads, and analysts (myself included) for the most part have been gravitating to those larger, more recognizable names. It’s also why there is something of a disconnect between the way the major market indices have all pushed near to or even above pre-pandemic highs, while smaller, less recognizable stocks have underperformed; investors generally assume larger companies will weather economic storms better than their smaller competitors, which also means that the expectation of a return to profitability when difficult conditions finally between to fade is higher for large-cap stocks.

That disconnect between large-cap and smaller-cap stocks makes some sense, but it doesn’t necessarily that smaller companies are categorically disadvantaged. In fact, this kind of divergence is something that a smart, fundamentally focused and value-oriented investor can take advantage of, because smart, well-run companies that happen to be smaller than many of their larger brethren may offer terrific bargain opportunities, even in uncertain economic times.

The Industrial sector has seen its share of difficulty during the pandemic, which isn’t too surprising considering the limitations of the time, not only from broad-based shutdowns that shuttered all kinds of economic activity between the first and second quarters of this year. The impact of that period continues to ripple across economic sectors, but another element that impacts industrial manufacturing is the continued need to enforce stricter safety measures to limit the continued spread of COVID-19. That means a lot of companies have had to invest heavily in ways to monitor employee’s health and ensure social distancing can be practiced as work continues. That means a lot of increased costs have been incurred, and even though manufacturing can continue, it has probably not returned to pre-pandemic production levels.

That brings us to our highlight of the day. Crane Co. (CR) is a manufacturer of a variety of engineered industrial products that are sold into a number of different economic segments and that, like most companies has had to absorb a very real impact from pandemic-induced slowdowns. The industries that make up this company’s customer base will recover, but most analysts are forecasting that recovery to take some time, which means that CR’s revenues and earnings could remain pressured through the rest of this year. That doesn’t sound very attractive, but this is also a company that has been around for more than 150 years, with a very broad product portfolio, and a balance sheet that gives it better resilience and flexibility than many of its larger brethren. Add to that a significant discount in it’s stock price, and this is a company that might be worth a long look for a patient, long-term investor.

Fundamental and Value Profile

Crane Co. (Crane) is a manufacturer of engineered industrial products. The Company operates through four segments, including Fluid Handling, Payment & Merchandising Technologies, Aerospace & Electronics, and Engineered Materials. The Fluid Handling segment is a provider of engineered fluid handling equipment, including Process Valves and Related Products, Commercial Valves and Other Products. The Payment & Merchandising Technologies segment includes Crane Payment Innovations (CPI) and Merchandising Systems. The Aerospace & Electronics segment supplies various components and systems, including original equipment and aftermarket parts, primarily for the commercial aerospace and military aerospace, and defense markets. The Engineered Materials segment manufactures fiberglass-reinforced plastic (FRP) panels and coils, primarily for use in the manufacturing of recreational vehicles (RVs), truck bodies, truck trailers, with additional applications in commercial and industrial buildings. CR has a current market cap of about $3.4 billion.

Earnings and Sales Growth: Over the last twelve months, earnings declined nearly -59.5%, while revenues dropped by about -19.45%. In the last quarter, earnings declined by -44.35%, while sales were -15% lower. The company’s margin profile also reflects the current challenges that the company is facing; over the last twelve months, Net Income was 3.68% of Revenues, and dropped to 0% in the last quarter.

Free Cash Flow: CR’s free cash flow has managed to remain healthy, at $376.7 million over the last twelve months, but it should be noted this metric was around $407 million in the quarter prior. The current number translates to a healthy Free Cash Flow Yield of 11.28%.

Debt to Equity: CR’s debt/equity ratio is conservative, at .59. The company’s balance sheet is a strong sign of fundamental strength, with long-term debt of about $842.5 million versus cash and liquid assets of about $592.1 million. The company has actually managed to increase its liquidity over the last few months; at the end of the first quarter of 2020, cash was about $300 million. For now, there is no concern about whether the company service its debt; however if Net Income drops into negative territory, CR could burn through its cash very quickly.

Dividend: CR pays an annual dividend of $1.72 per share, which translates to a dividend yield of about 2.99% at the stock’s current price. It should be noted that their dividend payout is much higher right now than earnings, which means that if difficult conditions extend into a longer period of time, management could be forced to cut or even eliminate the dividend payout to preserve cash.

Price/Book Ratio: there are a lot of ways to measure how much a stock should be worth; but I like to work with a combination of Price/Book and Price/Cash Flow analysis. Together, these measurements provide a long-term, fair value target around $76 per share. That implies that CR is significantly undervalued, with about 31% upside from its current price.

Technical Profile

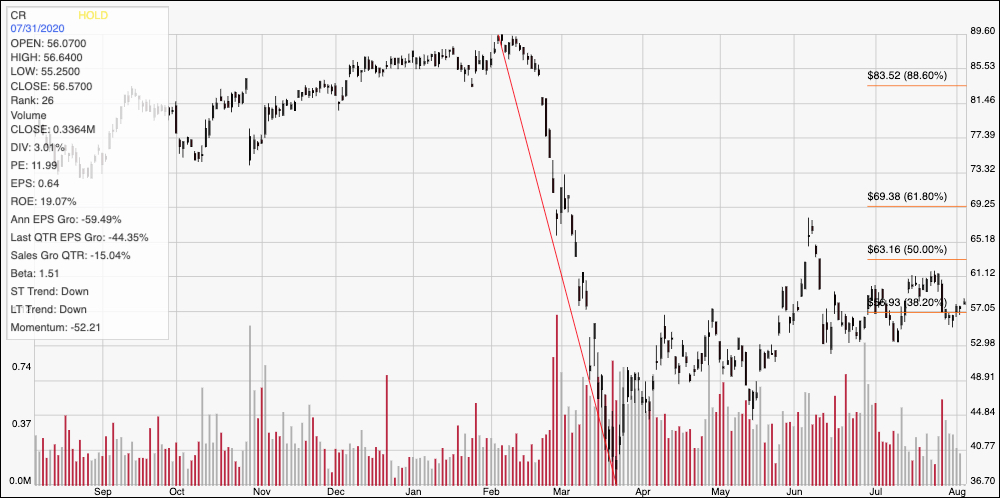

Here’s a look at the stock’s latest technical chart.

Current Price Action/Trends and Pivots: The red line on the chart traces the stock’s downward slide from $89 in early February to its March, bear market low around $37. It also informs the Fibonacci retracement lines shown on the right side of the chart. CR has followed a number of Industrial stocks to rally higher since that low point, but int he last month has narrowed its price activity into a consolidation range, with resistance at around $61 and support around $57, which is roughly inline with the 38.2% retracement line. The stock is currently bouncing off of that support level; a break above $61 should give the stock room to test an early June pivot high at around $67, while a drop below $57 could see the stock fall to next support at around $53.

Near-term Keys: CR’s value proposition is very intriguing, and the strength in the company’s balance sheet is a good sign that, while near-term headwinds may persist, it could be in good position to survive and return to profitability when those pressures begin to fade. If you’re willing to be very patient, that means the stock could offer an interesting value proposition right now, but keep in mind that the longer Net Income remains challenged, the tighter CR’s financial position will become. If you prefer to work short-term trading strategies, the stock’s recent bounce off of a pivot low offers about $4 of upside from the stock’s current price to next resistance, which could a good opportunity for an aggressive, bullish trader to buy the stock or work with call options. If the stock turns drops below $57, you should consider shorting the stock or buying put options, using next support at around $53 as a useful profit target on a bearish trade.