Uncertainty in the market makes a lot of people want to sit on their hands and wait for things to turn around before taking a new opportunity seriously. Value-oriented investors, however, understand that when more and more stocks are testing historical lows, there are also more and more useful targets of opportunity.

That doesn’t mean value investing turns a blind eye to risk. The strictest form of contrarian-minded, value-focused analysis works to mitigate risk, at least in the long term, by focusing on a company’s fundamental strength and what that strength (or weakness) means about its current stock price. When economic times suggest risk is increasing, stocks at historical lows, but who also show underlying strength in their core businesses represent the best overall opportunities. That’s because when conditions shift back to positive price movements, fundamentally strong companies are the ones that are the most likely to increases in their stock prices.

2022 is the year that, after dealing with a pandemic, saw inflation rise to levels not seen in about four decades, which not surprisingly has forced the Fed to adopt an increasingly hawkish approach to monetary policy. That includes interest rates that aren’t expected to stop rising anytime soon, and that more dovish investors and analysts fret will push the economy headlong into a recession. That hasn’t happened yet, but the risk is still there. What has proved to be a long-term conflict in Ukraine, with increasing political and economic isolation of Russia from the West response only adds to that risk, since the area is a major exporter of energy products to Europe and also to the rest of the world.

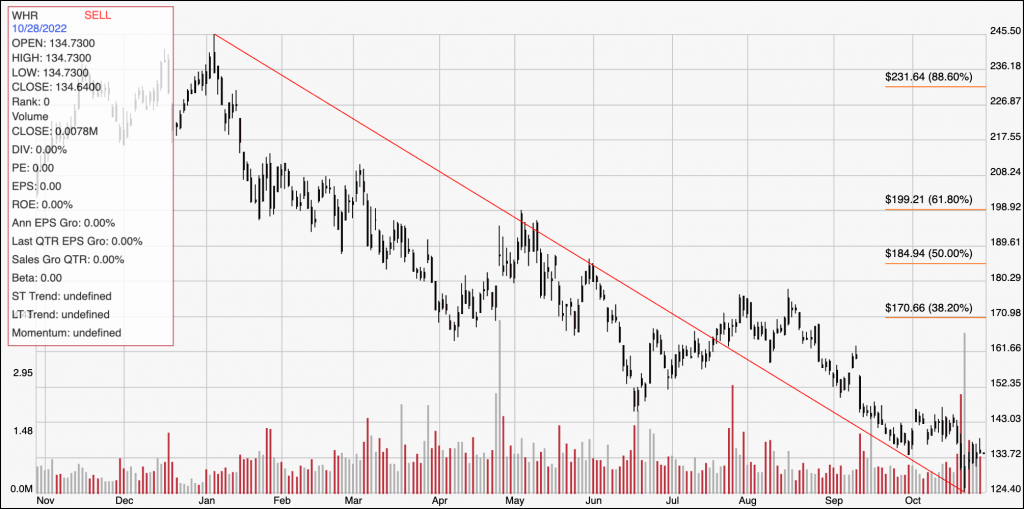

Those broad risks are among the reasons that stocks in economically sensitive industries, like Retailing and Household Durable Goods have struggled for most of the year. A good example is Whirlpool Corp (WHR). This is a well-known home appliance manufacturer that more than quadrupled from its pandemic low at $60 in May 2020 into the end of the first quarter of 2021, when it peaked at around $258 per share. The stock has since fallen into a decisive downward trend that pushed to a low earlier this month at around $125, with the stock only a bit above that price as of now. The question of this company’s exposure to the cyclical nature of economic growth and contraction is a good one to ask. Should you take the stock’s downward trend as a sign to stay away from this stock, or do the company’s fundamentals provide a reasonable basis to suggest that the stock could offer a useful value at this current price? Let’s dive in to find out.

Fundamental and Value Profile

Whirlpool Corporation is a manufacturer and marketer of home appliances. The Company’s segments include North America; Europe, Middle East and Africa (EMEA); Latin America, and Asia. In North America, the Company markets and distributes home appliances and small domestic appliances under a range of brand names. In EMEA, it markets and distributes its home appliances primarily under the Whirlpool, Bauknecht, Ignis, Maytag, Laden, Indesit and Privileg brand names, and domestic appliances under the KitchenAid, Hotpoint and Hotpoint-Ariston brand names. In Latin America, it markets and distributes its home appliances and small domestic appliances primarily under the Consul, Brastemp, Whirlpool and KitchenAid brand names. The Company markets and distributes its products in Asia primarily under the Whirlpool, Maytag, KitchenAid, Amana, Bauknecht, Jenn-Air, Diqua and Royalstar brand names. It manufactures and markets a line of home appliances and related products. WHR’s current market cap is $7.4 billion.

Earnings and Sales Growth: Over the last twelve months, earnings declined about -33%, while sales also decreased by about -13%. In the last quarter, earnings declined almost -25% while sales were about -6% lower. The company’s margin profile is diverging from the earnings pattern I just described, as Net Income was 1.86% of Revenues over the last year and increased to about 3% in the last quarter.

Free Cash Flow: WHR’s free cash flow is healthy, at about $718 million. That number also translates to a Free Cash Flow Yield of 9.76%. This is a measurement that has dropped from about $2.9 billion in mid-2021 and $1.9 billion a year ago. The broad, long-term decline is a reflection of the impact rising input costs have had on WHR’s bottom line.

Debt to Equity: WHR has a debt/equity ratio of 1.09. This number is a bit high, but the company’s operating profile indicates that profits are sufficient to service their debt. The company’s balance sheet shows $1.6 billion in cash and liquid assets (versus $3 billion three quarters ago) against $4.7 billion in long-term debt.

Dividend: WHR pays an annual dividend of $7 per share, which translates to an impressive yield of about 5.18%. It is worth noting that at the end of 2018, the company’s dividend was about $4.60 per share, and $5.60 about a year ago. The rise over that period in the midst of broadly difficult conditions is a strong sign of fundamental strength.

Price/Book Ratio: there are a lot of ways to measure how much a stock should be worth; but I like to worth with a combination of Price/Book and Price/Cash Flow analysis. Together, these measurements provide a long-term target at about $146 per share. At the stock’s current price, that means WHR is somewhat undervalued, by about 8%, and with a practical discount price at around $117 per share.

Technical Profile

Here’s a look at the stock’s latest technical chart.

Current Price Action/Trends and Pivots: The chart above displays the stock’s downward trend over the past year. The red diagonal line traces that trend, and also provides the baseline for the Fibonacci retracement lines shown on the right side of the chart. The stock has been rallying off the latest low, reached earlier this month at around $124.50, and marking current support at that point. Immediate resistance is around $135, with the stock pushing near to that level now. A push above $135 could see upside to about $143 to next resistance, while a drop below $124 could have additional downside to about $115 before finding next support, using the current distance between support and resistance as a benchmark.

Near-term Keys: The stock’s current price activity suggests that a push above $135 could give an interesting, albeit aggressive short-term signal to buy the stock or work with call options, with a useful profit target at around $143 per share. A drop below $124 would provide a strong signal to consider shorting the stock or buying put options, using next likely support at around $115 as a useful bearish profit target. For most investors, WHR’s current stock price is elevated to a point that makes it hard to work with, even with the stock’s long-term trend taken into account. Even if you don’t mind working with high-priced stocks, however, I think there are some red flags in the company’s fundamental profile, in the form of declining liquidity, free cash flow, and historically narrow margins that justify the argument the stock still isn’t offering a useful value at its current price.