(Bloomberg) — Big Oil’s record profits are a huge hit on Wall Street but increasingly provocative in the corridors of power from Washington to London as politicians lash out against executives for funneling windfall profits to investors.

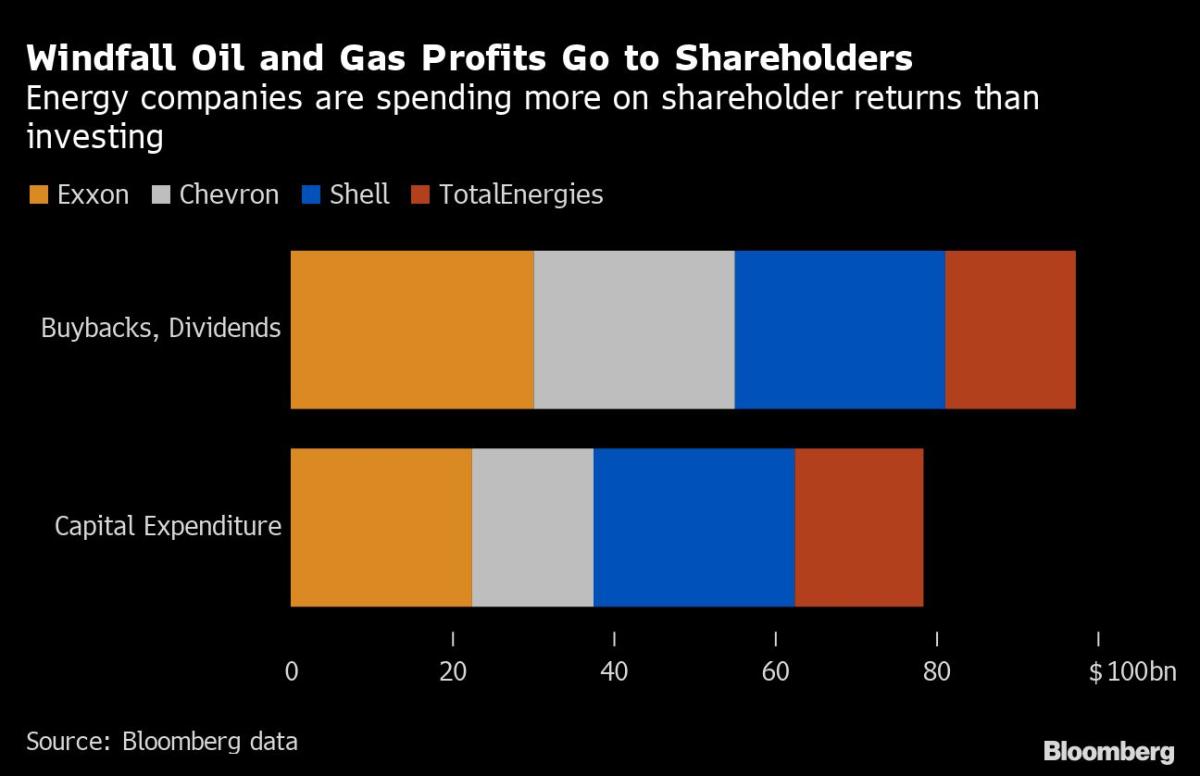

The controversy this week was not so much about the gargantuan dollar amounts earned but what the world’s largest energy companies chose to do with them. Exxon Mobil Corp., Chevron Corp., Shell Plc and TotalEnergies SE are handing almost $100 billion to shareholders annually in the form of buybacks and dividends while reinvesting just $80 billion in their core businesses this year, according to data compiled by Bloomberg.

“Can’t believe I have to say this, but giving profits to shareholders is not the same as bringing prices down for American families,” President Joe Biden tweeted Friday in response to Exxon’s dividend increase.

Biden assailed Exxon again Friday evening at a Democratic fundraiser in Philadelphia, saying the company’s earnings were “the most it’s made in its 152-year history, while the rest of America is struggling.”

“Those excess profits are going back to their shareholders and their executives instead of going to lower prices at the pump and giving relief to the American people, who deserve it and need it,” he added.

“I’m going to keep harping on it,” Biden vowed. “They talk about me picking on them — they ain’t seen nothing yet. I mean it. It outrages me.

Representative Ro Khanna, a California Democrat, called energy profits “obscene,” and introduced legislation to prohibit fuel exports, a move he said would lower prices at the pump. Senate Majority Leader Chuck Schumer called the earnings “unconscionable.”

Russia’s post-invasion halt to natural gas shipments to much of Europe and sanctions on the country’s oil exports triggered a global scramble for energy supplies, bidding up prices in the process. With gasoline prices and household utility bills squeezing consumers and pushing up inflation, politicians are demanding major oil companies reinvest more profits in drilling and refining to ease the strain.

For their part, oil executives, under pressure on emissions and years of poor returns, are in no mood to back down.

“There are hard times, as we saw just two years ago where we had enormous losses,” Chevron Chief Executive Officer Mike Wirth said on Bloomberg TV. “You move into another part of the cycle and you have strong earnings. Good times don’t last just like the difficult times don’t last. We have to invest through those cycles.”

Wirth rejected the idea that current profits are a windfall and warned politicians against enacting any “short-sighted” policies that would restrain investment.

“Typically if you want less of something, you tax it,” he said.

Earlier this year, the UK passed a windfall-profits tax on domestic oil and gas producers including BP Plc and Shell to claw back some of their extraordinary earnings, and there may be more measures on the way. Prime Minister Rishi Sunak says all options are on the table as he attempts to fill a £35 billion ($40.7 million) budget shortfall.

The European Union also gave a green light earlier this year for countries to implement windfall levies. An analysis from Boston Consulting Group found that the measure could raise as much as 150 billion euros ($149 million) in the next year.

“There’s just a big gap in country finances and this is a way to fill that,” said Anders Porsborg-Smith, a managing director at BCG. “And it’s rarely unpopular to tax supernormal profits.”

California Governor Gavin Newsom, also a Democrat, said it’s time to “crack down on oil’s price gouging tactics and put their profits back into our pockets,” adding “gas prices shouldn’t be this high.” But analysts say California’s strict clean-fuel standards are a major reason why the state pays more for gasoline than any other in the US.

Windfall taxes may be popular but whether they’re effective is another matter. Shell hasn’t had to pay any windfall tax in the UK so far, despite making record-setting profits this year, due to increased investment in the North Sea. More importantly, the industry says such taxes risks chilling investment by the oil majors at a time when they’re most needed.

Exxon and Chevron are increasing oil and gas output fast in the Permian Basin, and both reported strong refining throughput in the third quarter, but there’s a limit to how much they can do to ease prices in the short-term. Major projects take years of planning and development. Bad policy is a factor behind today’s energy crisis, according to Exxon CEO Darren Woods.

“Unfortunately, the markets that we’re in today are a function of many of the policies, and some of the narrative that’s floated around in the past,” he said. “Our focus is really making sure people understand what the potential consequences of some of these policies are.”

–With assistance from Justin Sink.

©2022 Bloomberg L.P.