(Bloomberg) — Goldman Sachs Group Inc. lowered earnings estimates for the S&P 500 Index for each year till 2024, saying margins contraction in the third-quarter signals more pain ahead.

“We believe S&P 500 margins have inflected downwards and lower our estimates to incorporate greater margin contraction,” strategists including David J Kostin wrote in a note dated Nov. 4. “We forecast S&P 500 margins excluding energy will contract by 86 bp in 2022 and 50 bp in 2023 and return to the pre-pandemic 2019 level of 11.3%.”

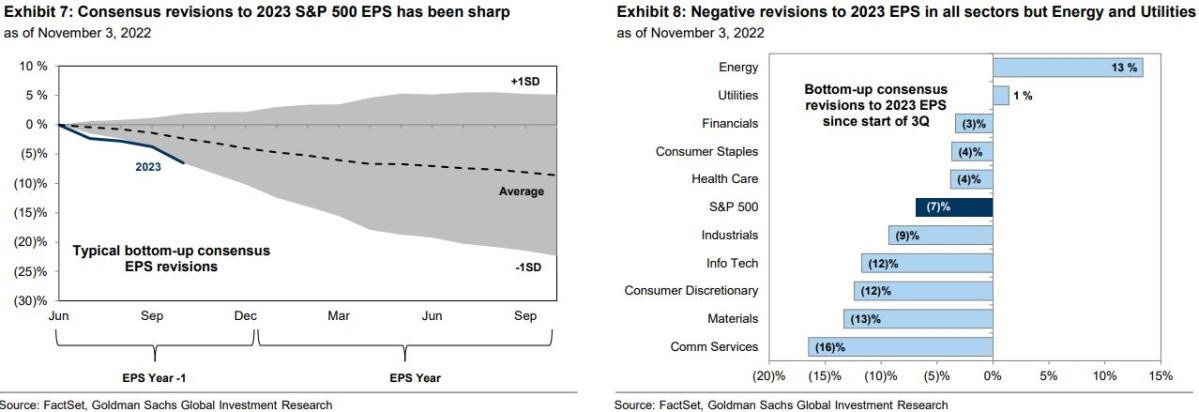

The margin contraction seen in the September-quarter is the first since the pandemic, marking a flash point for estimates, particularly for next year, Kostin and team wrote. They now expect earnings to remain flat in 2023 versus a 3% growth earlier.

Goldman strategists lowered earnings estimates for this year to $224 from $226, for next year to $224 from $234, and for 2024 to $237 from $243. The revision implies annual growth of 7%, 0%, and 5%, respectively, for the key metric.

They kept year-end S&P 500 targets unchanged for 2022 and 2023 at 3,600 and 4,000. This means the gauge is expected to fall by 4.5% by the end of this year.

While the cuts in 2023 estimates have been sharp, there are more downside risks as the S&P 500 Index’s earnings per share could fall a further 11% during a recession, the strategists wrote.

©2022 Bloomberg L.P.