If this week is any indication, I think it’s a good bet to say that volatility could be the most accurate description of market activity for the next few weeks. Late in Tuesday’s trading session, all of the major indices turned sharply lower after President Trump tweeted an order to Republicans to halt all talks about a second stimulus bill – even as reports suggest that both sides had begun to close the distance in finding agreement. Later in the evening, Trump tweeted again that he would be willing sign specific elements of stimulus, such as a bill specifically aimed at providing airline relief or putting new direct payments in the hands of taxpayers. That tweet seems to be giving the market momentum back to the bullish side today.

The bipolarity of the White House’s behavior has a lot of people puzzled – especially with elections now only about a month away. I’m not so puzzled at Trump’s swings back and forth – after all, he’s shown a penchant of doing just this ever since being elected – as I am at the way the market swings so sharply day to day – or even hour to hour – on something as “arbitrary and capricious” (to borrow appropriate wording from Jim Cramer) as a Trump tweet.

One of the sectors that has really faded after initially pushing strongly off of its March, bear market lows is Financials. I think much of the mostly sideways movement that sector has seen since June can be attributed to uncertainty, first about whether more stimulus would be needed, and next about the bickering and finger-pointing between parties that have brought the question to what a lot of economists and analysts think is the critical juncture for small business and even many larger businesses. There are indications that once-temporary furloughs are turning into permanent layoffs and that many of the millions of people still without work have reached the limit of the relief the first round of stimulus provided. The most pessimistic analysts are starting to predict increases in evictions and foreclosures, and permanent closures of small businesses all over the country.

Stimulus legislation, if it can be pushed through is likely to be a catalyst for the Financial sector, especially for stocks in the Banking industry. Another segment that I think is interesting is the Insurance industry. Companies that provide insurance products – life insurance, auto, health, and so on – certainly are sensitive to economic cycles, since the average consumer is unlikely to take out new insurance policies if they are already being forced to tighten their belts as much as possible to get by. That said, there is also an element of this business that is resistant to economic downturns; in fact recent indications are that this year’s economic activity has built an increase in interest in protection products, which could provide a headwind for companies that can provide targeted solutions.

Primerica Inc. (PRI) is an interesting example. A mid-cap providers of term life insurance and other financial products, PRI specifically focuses on middle-income households – the consumer segment that usually bears the brunt of economic difficulty while also providing the base of support that most expansive economic cycles are built on. While 2020 has been a chaotic year for the entire financial sector, PRI has seen revenues and earnings improve throughout the year. That positive performance has also translated to a strengthening balance sheet, and improving intrinsic value as measured by the stock’s Book Value that make the stock intriguing to consider from a value basis. The stock plunged more than -50% in the initial wave of the pandemic that forced the entire market to bear market levels in mid-March, but then rebounded by early August to reclaim its pre-pandemic highs around $138 per share. From that point, the stock faded back again to a low in late September at around $108, but appears to be building bullish momentum for a new push higher. Has the stock dropped off of that 52-week high to make the stock a good value? Maybe.

Fundamental and Value Profile

Primerica Inc. (Primerica) is a distributor of financial products to middle-income households in the United States and Canada. The Company operates through three segments: Term Life Insurance, Investment and Savings Products, and Corporate and Other Distributed Products. The Term Life Insurance segment includes underwriting profits on its in-force book of term life insurance policies, net of reinsurance, which are underwritten by its life insurance company subsidiaries. The Investment and Savings Products segment includes retail and managed mutual funds, and annuities distributed through licensed broker-dealer subsidiaries and includes segregated funds, an individual annuity savings product that it underwrites in Canada through Primerica Life Insurance Company of Canada (Primerica Life Canada). In the United States, it distributes mutual fund and annuity products of various third-party companies. It also earns fees for account servicing on a subset of the mutual funds it distributes. PRI has a current market cap of $4.5 billion.

Earnings and Sales Growth: Over the last twelve months, earnings increased by about 10.5% while sales grew 4.14%. In the last quarter, earnings improved a little more than 19%, while revenues were flat, but still positive by 0.17%. The company’s margin profile is healthy and strengthening; over the last twelve months, Net Income was 17.29% of revenues, and increased to 19.3% in the last quarter.

Free Cash Flow: PRI has generally healthy free cash flow of about $588 million over the last twelve months. This number has increased from the beginning of the year at around $460 million. At the stock’s current price, this also translates to a Free Cash Flow Yield of 12.38%.

Debt to Equity: the company’s debt to equity ratio is 0, which reflects the absence of long-term debt on PRI’s balance sheet. The company’s balance sheet indicates their operating profits are more than sufficient to service their debt, with $382.75 million in cash and liquid assets on hand – a number that increased from $318 million at the end of the first quarter of the year.

Dividend: PRI pays an annual dividend of $1.60 per share, which translates to an annual yield of 1.42% at the stock’s current price. In an environment where the stability of dividend payouts is an open question for a lot of companies, I think it is also worth mentioning that PRI’s dividend is less than 20% of their earnings per share over the last twelve months.

Price/Book Ratio: there are a lot of ways to measure how much a stock should be worth; but I like to work with a combination of Price/Book and Price/Cash Flow analysis. Together, these measurements provide a long-term, fair value target around $125 per share. That means that PRI is somewhat undervalue right now, with about 10% upside from its current price. Its actual bargain price is right at $100.

Technical Profile

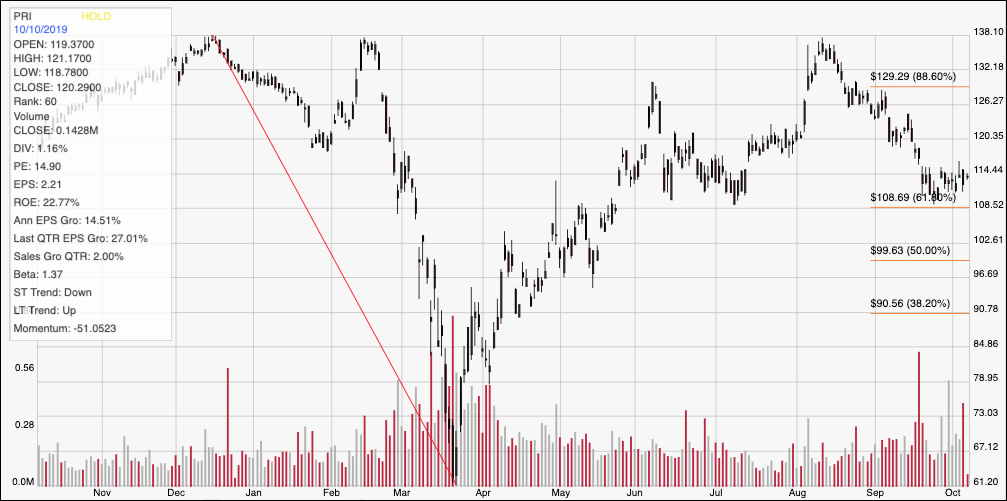

Here’s a look at the stock’s latest technical chart.

Current Price Action/Trends and Pivots: The diagonal red line traces the stock’s downward slid from its pre-pandemic high at around $138 to its March low at close to $61 per share. It also provides the baseline for the Fibonacci retracement lines shown on the right side of the chart. From that low, the stock rebounded quickly, reclaiming its 52-week high by early August. From that point, the stock dropped back, finally finding good support at the 61.8% retracement line in the $109 price area. The stock has stabilized around that point, and is currently about $5 above that level. Immediate resistance is at around $120 based on pivot activity in June and August, with additional upside to about $129 if bullish momentum picks up. A drop below $109 could see the stock fall to about $100 before finding next support right around the 50% retracement line.

Near-term Keys: PRI has some interesting fundamental metrics working in its favor right now, including a somewhat surprising pattern of revenue and earnings growth given the current state of the economy. That said, the stock isn’t discounted enough to call it a good value, which means that the best probabilities for success lie in short-term trades. If the stock can keep pushing higher off current support, consider buying the stock or working call options, using $120 as an initial, useful profit target, with an eye on $129 if bullish momentum increases. A drop below $109 would be a good signal to consider shorting the stock or working with put options, using $100 as a good profit target on bearish trade.