One of the traps that a lot of investors tend to fall into comes from the idiom “a rising tide lifts all boats.” In the broadest sense, the implication is that when the broad market is going up, stocks in general should be going up. The concept also drills down to individual sectors and industries in the market, meaning that if you can see a sector is generally moving in a bullish direction, it doesn’t really matter too much which stock in the sector you buy – they’re probably all going to be winners.

The problem with the saying is that there are always outliers and exceptions to the rule. Assuming right now, for example that because the S&P 500 and NASDAQ are approaching the new 52-week highs they set in August, and the Dow nearing its pre-pandemic high, the entire stock market is also going up is a mistake. As the months go by, pandemic-induced economic pressures have drawn increasingly clear distinctions between the “haves” (generally the biggest, most established names in any sector) and the “have nots,” which have by and large been made up of small, local businesses.

Massive economic shutdowns have forced a lot of companies to adjust their operating models. One of the biggest changes that has taken place in corporate is the shift to remote, work-at-home models. Initially, companies set up remote work arrangements as a way to keep the business running while being mindful of the health crisis; there is a lot of data coming out, however that is showing that remote work can not only be as productive as in-office, but in many cases even more so. Tech companies who offer services and solutions that facilitate remote work, and who have benefitted from the initial shift are perfectly positioned to keep growing as remote operating models become an increasingly more permanent part of the way corporate America does business.

The shift I just described is one of the big reasons the Tech sector has been the clear star performer since the market hit a bear market low in March. That makes it easy to think that the stocks that are tied to remote workforce solutions, including wide area and virtual private networking, video conferencing and cloud services should also have all been riding the bullish wave; but there are still exceptions and outliers.

Consider Juniper Networks (JNPR), a mid-cap network products and services company. JNPR’s products fit nicely into the enterprise networking space and can be used to facilitate remote networking capabilities of all kinds; but it operates in a very crowded, competitive space against a number of larger competitors, which keeps continuous pressure on profit margins, not matter how favorable broader market conditions may be. The company’s balance sheet is extremely healthy, and has held up extremely well during the pandemic; but the stock has lagged its industry. Over the last month, the industry has increased by more than 8% as measured by the Vanguard Information Technology ETF (VGT), while the stock is down about -3.2% over the same period and a little over -15% since it found its own 52-week high at $26.50 in mid-August. For contrarian-minded investors, that could mean the stock is offering an interesting opportunity; but that depends on whether the stock can also be considered a good value. Let’s run the numbers and see if it passes the test.

Fundamental and Value Profile

Juniper Networks, Inc. designs, develops and sells products and services for high-performance networks to enable customers to build networks for their businesses. The Company sells its products in over 100 countries in three geographic regions: Americas; Europe, the Middle East and Africa, and Asia Pacific. The Company sells its high-performance network products and service offerings across routing, switching and security. Its products address network requirements for global service providers, cloud providers, national governments, research and public sector organizations, and other enterprises. The Company offers its customers various services, including technical support, professional services, education and training programs. The Company’s Junos Platform enables its customers to expand network software into the application space, and deploy software clients to control delivery. The Junos Platform includes a range of products, such as Junos Operating System (OS) and Junos Space. JNPR has a current market cap of about $7.5 billion.

Earnings and Sales Growth: Over the last twelve months, earnings declined about -11%, while revenues were -1.47% lower. These numbers were much better in the last quarter, as earnings jumped about 118% higher, while sales rose 8.85%. The company’s margin profile shows that Net Income as a percentage of Revenues is narrowing, from 7.89% over the last twelve months to 5.63% in the last quarter.

Free Cash Flow: JNPR’s free cash flow declined steadily since the beginning of 2017, when it was almost $1.3 billion, to about $419.3 million in the last quarter of 2019. 2020 has seen that number start to improve however; over the last twelve months, Free Cash Flow was $552.3 million. That translates to a Free Cash Flow Yield of about 7.35%.

Debt to Equity: A has a debt/equity ratio of .39. This is a conservative number. JNPR currently has a little over $1.85 billion in cash and liquid assets against $1.7 billion in long-term debt. The company’s balance sheet indicates their operating profits are sufficient to service the debt they have, with very strong liquidity that is more than adequate to make up for any potential operating shortfall.

Dividend: JNPR’s annual divided is $.80 per share, and has increased from $.76 in 2019; that translates to a yield of 3.56% at the stock’s current price.

Price/Book Ratio: there are a lot of ways to measure how much a stock should be worth; but I like to worth with a combination of Price/Book and Price/Cash Flow analysis. Together, these measurements provide a long-term target at about $23.50 per share. That suggests the stock is a bit overvalued at its current price, by about -6%. JNPR’s bargain price sits at around $19.

Technical Profile

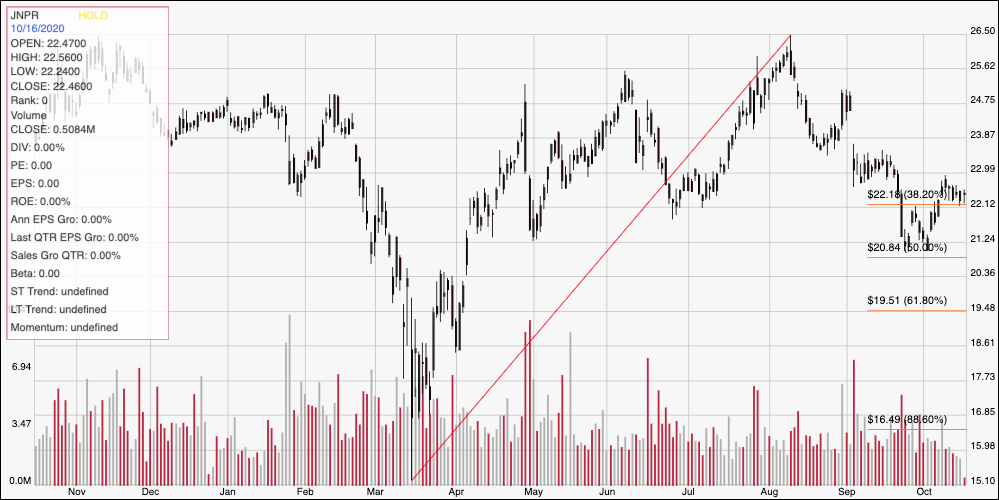

Here’s a look at the stock’s latest technical chart.

Current Price Action/Trends and Pivots: The red diagonal line traces the stock’s upward trend from March to its August peak at around $26.50; it also provides the baseline for the Fibonacci retracement lines shown on the right side of the chart. The stock’s bullish rally from a bear market low around $15 is impressive, marking an improvement of 77% over that period; but after hitting the stock’s pre-pandemic high at around $26.50, the stock dropped back to find a new intermediate low at around $21, where the 50% retracement line sits. The stock then rallied above the 38.2% retracement like at $22 and appears to be holding new support at that level. Immediate resistance is around $23.50 based on pivots in September and August in that range; a push to $24 should give the stock momentum to test the 52-week high range between $25.50 and $26.50. A drop below $22 should find next support around $21, but additional rom to fall to the 61.8% retracement line around $19.50 if bearish momentum accelerates.

Near-term Keys: The stock’s overall trend right now is clearly bearish, making any kind of short-term bullish trade very aggressive right now; but if the stock does push to $24, that could an interesting signal that the trend is about to reverse to the upside. That could provide an opportunity to buy the stock or work with call options, using a range between $25.50 to $26.50 as a near-term exit point. A drop below $22 doesn’t show a ton of opportunity on the bearish side, with next support only about $1 away, so I don’t think there is a good opportunity to short the stock or work with put options unless and until the stock drops below $21 per share. In that case, you could consider a bearish trade with a near-term target at around $19.50. As for JNPR’s value proposition, the fact is that the stock is more overvalued now than it was just a couple of months ago – despite the fact that the stock has been dropping. If the company’s fundamentals can improve in the next couple of quarters, that may change, but otherwise I wouldn’t begin to take JNPR seriously as a value opportunity unless the stock drops below $20 per share.