One of the things I like about value investing is the way that it naturally gravitates to stocks that are generally already at or near historical low prices. Under normal circumstances, that usually means that the downside risk aspect of buying a stock is minimized simply because the market is usually more likely to push a stock higher out of those extreme lows once investors begin to recognize the value proposition is in place. That typically means an analysis of the stock’s reward: risk profile is easier to skew in my favor, provided the underlying business is healthy.

A secondary factor that I like to consider in my value analysis is the direction of a stock’s trend. An extended, long-term downward trend is pretty typical for stocks trading at bargain prices, which means that in many ways, value investing works in a contrarian fashion to traditional market opinion. Sometimes, however, a stock can start to push higher out of those extreme lows as investors begin to recognize the fundamental strength of the underlying company. That creates a nice intersection of bargain proposition with near-term price strength.

One of the companies that I think offers an interesting case in point right now is Xerox Holdings Corporation (XRX). This is a company whose business is built around digital printing technology and workplace solutions. The last couple of earnings reports for this company have indicated big impacts on their business from the COVID-19 pandemic; those setbacks have been strong enough to prompt the company to suspend forward guidance for revenue and profitability growth for the time being. The stock had held through the spring and summer months in a narrow trading range below $20, but since the beginning of August has begun to pick some bullish momentum. Despite the pandemic’s impact over the last few months, the company’s balance sheet remains strong, which implies that they are well-positioned to ride through the economic turmoil of current conditions and come out ahead in the long run.

Fundamental and Value Profile

Xerox Corporation is a provider of digital print technology and related solutions. The Company has capabilities in imaging and printing, data analytics, and the development of secure and automated solutions to help customers improve productivity. The Company’s primary offerings span three main areas: Managed Document Services, Workplace Solutions and Graphic Communications. Its Managed Document Services offerings help customers, ranging from small businesses to global enterprises, optimize their printing and related document workflow and business processes. Managed Document Services includes the document outsourcing business, as well as a set of communication and marketing solutions. The Company’s Workplace Solutions and Graphic Communications products and solutions support the work processes of its customers by providing them with printing and communications infrastructure. XRX’s current market cap is about $4.3 billion.

Earnings and Sales Growth: Over the last twelve months, earnings declined nearly -85%, while sales decreased by -36%. In the last quarter, the decline in earnings accelerated to -28.57% while revenues were -21.24% lower. XRX’s operating profile before the pandemic set in was very healthy; over the last twelve months, Net Income was a little over 13% of Revenues; however in the last quarter, this metric narrowed significantly to 1.84%. It’s worth noting that in the quarter prior, quarterly Net Income was -0.11% – which means that the new quarterly number marks an improvement that could signal the company has managed to absorb the worst and is already turning the corner. Even so, this measurement remains a red flag that bears monitoring in the quarters ahead.

Free Cash Flow: XRX’s free cash flow is healthy, at about $775 million over the last twelve month. That number did drop from a little more than $1.2 billion in the quarter prior; but given the severity of the impact the pandemic has had, the turn isn’t surprising. The current Free Cash Flow number still translates to an attractive Free Cash Flow Yield of more than 18.45%. It is also worth noting that XRX’s Free Cash Flow was $0 in June of 2018, with the company showing consistent improvement in this critical metric from that point. That acts as an interesting counterpoint to the company’s Net Income story, however it also bears watching in quarters ahead to determine if Free Cash Flow deteriorates further, or follows the Net Income pattern to start moving back higher.

Debt to Equity: XRX has a debt/equity ratio of .40. That’s generally a conservative number that reflects management’s approach to debt management. Since the beginning of 2018, the company’s long-term debt has decreased from a little more than $5.2 billion to its current level of $2.1 billion. Their balance sheet also shows more than $2.27 billion in cash and liquid assets, which means that servicing their debt isn’t a problem, and provides an important buffer, even if Net Income and Free Cash Flow remain challenged. It should also be noted that in the last quarter, long-term debt dropped from $3.2 billion – meaning that even as the company grappled with the complications of pandemic-induced slowdowns, it managed to pay down almost $1 billion of long-term debt.

Dividend: XRX pays a dividend of $1.00 per share, which translates to an annual yield of 5.07% at the stock’s current price. As things stand now, the dividend appears stable; it could also provide signals of fundamental weakness or strength, depending on whether management chooses to leave it as is, or as some companies have already started doing, decides to reduce or even eliminate it to save cash.

Price/Book Ratio: there are a lot of ways to measure how much a stock should be worth; but I like to worth with a combination of Price/Book and Price/Cash Flow analysis. Together, these measurements provide a long-term target at about $24.50 per share. That suggests that eve with the recent move upward, the stock still carries a nice value proposition, with about more than 22% upside right now.

Technical Profile

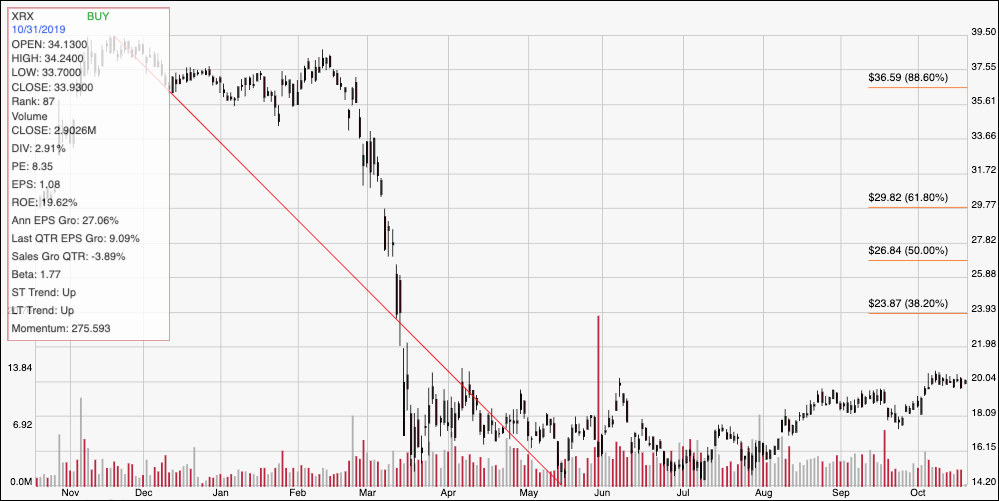

Here’s a look at the stock’s latest technical chart.

Current Price Action/Trends and Pivots: The diagonal red line traces the stock’s downward plunge from its high at around $39.50 in November to the stock’s low point, reached in mid-May at around $15. It also provides the baseline for the Fibonacci retracement lines shown on the right side of the chart. The greatest portion of that drop came in one month, from February to March, with the broad market’s nosedive into bear market territory. While the broad market indices, and the largest tech stock have rebounded since then, the stock languished until a couple of months ago, hovering in a narrowing range between support at $15 and resistance at around $18. Since the end of July, the stock started picking up bullish momentum, breaking above $18 in early August. The stock hovered again between a little under $20 and $18 in September before rising to a new high at around $21 earlier this month. That means that current support is now at around $20, with the nearest expected next resistance somewhere between $24 and $29, based loosely on the brief pauses the stock saw in its February to March decline. A drop below support at $20 should find new support somewhere between $19 and $20.

Near-term Keys: Even with the stock recent, gradual increase XRX has a very attractive value proposition, and some intriguing fundamental strengths as reflected by its current balance sheet that I think make it a useful stock for value investors. It’s next earnings report is coming up in a week, which means that the information I’ve just outlined could get even better, or force the stock back toward its lows of the year. That said, as things stand, an improvement in Net Income on a quarterly basis, with continued stability in Free Cash Flow, cash, and long-term debt levels would be a good sign that the most recent quarter’s challenges were just one-time anomalies at a unique moment in time for a company with an overall solid fundamental profile. If you prefer to work with short-term trading strategies, the stock’s recent rally could offer some interesting opportunities. Take a break above $21 as a signal to buy the stock or work with call options, with a near-term price target at around $24 and around $28 if bullish momentum keeps building. If the stock drops below $20, you can consider shorting the stock or buying put options, using $18 as a quick-hit profit target on a bearish trade.