The Bond Yield Curve: A Review

The yield curve is simply the yields on bonds of varying maturities, typically from three months to 30 years, plotted on a graph. The yield curve illustrates what is called “the term structure of interest rates,” or the idea that a bond´s maturity and yield are connected.

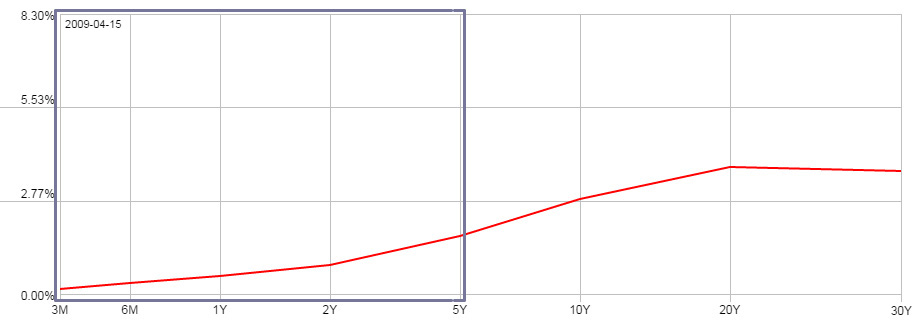

Typically, but not always, short-term bonds offer lower yields, while longer-term bonds pay higher yields. As a result, the typical shape of the yield curve is a curve that begins on the lower left and moves to the upper right, as illustrated in the accompanying image referred to as a “normal” yield curve.

Economically speaking generally, slower growth, low inflation, and depressed risk appetites will help the performance of longer-term bonds, causing yields to fall. Faster growth, higher inflation, and elevated risk appetites will hurt performance, cause yields to rise.

All of these factors push and pull simultaneously to influence the direction of longer-term bonds.The “yield curve” is simply the yield of each bond along the maturity spectrum plotted on a graph, as shown above. The yield curve typically slopes upward, since investors need to be compensated with higher yields for assuming the added risk of investing in longer-term bonds.

The direction of the yield curve is typically measured by comparing the yields on the two- and 10-year issues, although the difference the federal funds rate and the 10-year note can also be used. We use 3M to 30Yr.

What is a Flattening Bond Yield Curve?

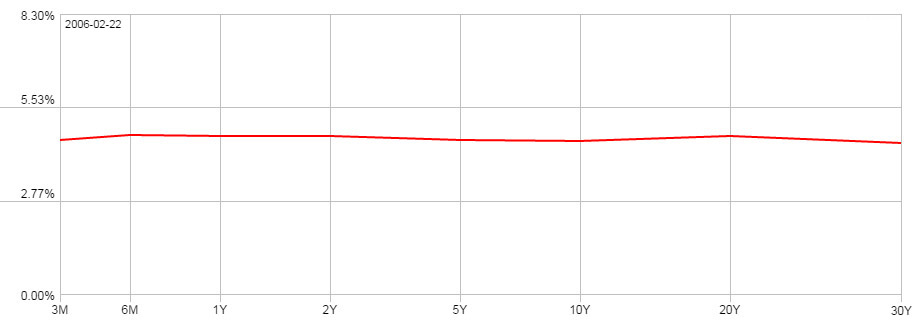

The term “flattening yield curve” means that the gap between the yields on short-term bonds and long-term bonds decreases, making the curve appear less steep.

The narrowing of the gap indicates that yields on long-term U.S. Treasury bonds are falling faster than yields on short-term Treasury bonds or, occasionally, that short-term bond yields are rising even as longer-term yields are falling.

Why Does a Yield Curve Flatten?

A flattening yield curve can indicate that expectations for future inflation are falling. Inflation reduces the future value of an investment, investors demand higher long-term rates to make up for the lost value.

When inflation is less of a concern, this premium shrinks. A flattening also can occur in anticipation of slower economic growth. And sometimes, the curve flattens when short-term rates rise on the expectation that the Federal Reserve will raise interest rates.

What is an Inverted Yield Curve?

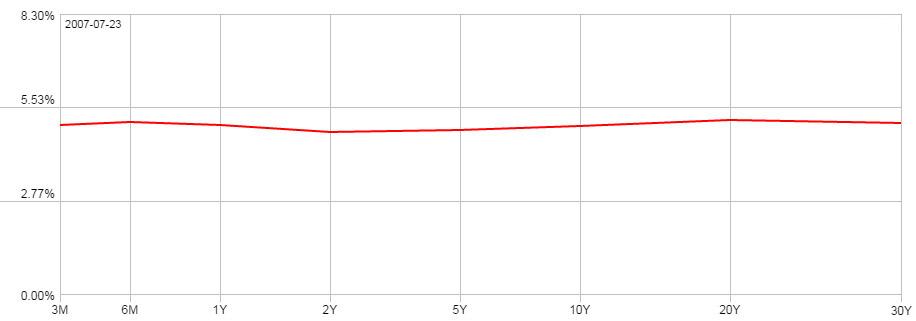

On occasions when a yield curve flattens to the point that short-term rates are higher than long-term rates, the curve is said to be “inverted.”

Typically, an inverted curve has preceded a period of recession. The reason for this is that investors will tolerate low rates now if they believe rates are going to fall even lower later on.

Inverted yield curves are very unusual, having occurred on only eight occasions since 1958. More than two-thirds of the time, the economy has slipped into a recession within a short time after the onset of an inverted yield curve.

What is a Steepening Yield Curve?

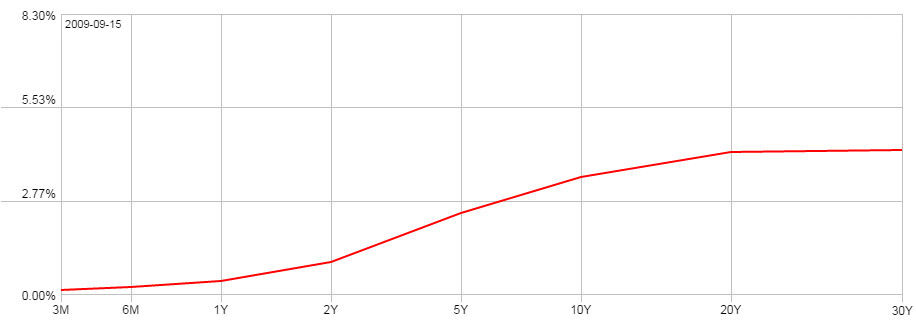

When the yield curve steepens, the gap between the yields on short-term bonds and long-term bonds increases, making the curve appear “steeper”.

The increase in this gap indicates that yields on long-term bonds are rising faster than yields on short-term bonds or, occasionally, that short-term bond yields are falling even as longer-term yields are rising.

Why does a Yield Curve Steepen?

A steepening yield curve typically indicates investor expectations for 1) rising inflation 2) stronger economic growth, since improving growth causes the demand for longer-term capital to increase even as the Fed maintains a low-rate policy.