Sometimes natural phenomena imposes its will on the world with force. Hurricanes in the South or along the Eastern seaboard, tornadoes in the Midwest and massive snowfalls in the North during the winter months are all examples of times when Mother Nature demands attention from the world – even the stock market. At the beginning of this week, the National Weather Service issued severe cold warnings to major portions of the Midwest and extending all the way to many of the north eastern states. The cold settled in forcefully mid-week, and as of yesterday had resulted in an estimated 13 deaths.

The cause? An expansion of the “polar vortex” – a pocket of extremely cold temperatures that normally hovers directly above the North and South Poles. According to weather maps, that expansion actually looks a little like a portion of the vortex broke off of the source and began migrating south. The vortex refers to the fact that it is a low-pressure, counter-clockwise flow of air that drives temperatures well below zero degrees Fahrenheit. They aren’t actually all that uncommon during the winter, but according to meteorologists, this one is the most severe in a generation, sending temperatures in states like Minnesota, Wisconsin, Michigan and other parts of the Midwest 30 to 50 degrees below zero.

The winter months can often be a time when it makes sense to pay a little more attention to utility companies that provide gas and electric services throughout the country. Cold temperatures usually mean that we pay more to heat our homes, while mild winters such as the one we saw last year are sometimes cited as a contributor to disappointing results from publicly traded utilities. Does that mean that this polar vortex could present an opportunity for a savvy investor to work with a stock like DTE Energy (DTE), which provides gas and electric utilities specifically in Michigan? I’ll let you decide.

Fundamental and Value Profile

DTE Energy Company is an energy company. Its segments include Electric, which consists of DTE Electric Company, which is engaged in the generation, purchase, distribution and sale of electricity to residential, commercial and industrial customers in southeastern Michigan; Gas, which consists of DTE Gas Company, which is engaged in the purchase, storage, transportation, distribution and sale of natural gas to residential, commercial and industrial customers throughout Michigan; Gas Storage and Pipelines, which consists of natural gas pipeline, gathering and storage businesses; Power and Industrial Projects, which consists of projects that deliver energy and utility-type products and services to industrial, commercial and institutional customers, and sell electricity from renewable energy projects; Energy Trading, which consists of energy marketing and trading operations, and Corporate and Other, which includes various holding company activities and holds certain non-utility debt. DTE has a current market cap of about $21.4 billion.

Earnings and Sales Growth: Over the last twelve months, earnings grew by nearly 44%, while revenue increased about 9.4%. In the last quarter, earnings increased by almost 57% wile sales increased a little over 12%. Growing earnings faster than sales is difficult to do, and is generally not sustainable in the long-term; but it is also a positive mark of management’s ability to maximize its business operations effectively. The company operates with a pretty healthy operating margin; over the last twelve months, Net Income was about 8.8% of Revenues. This number increased in the last quarter to a little above 9.4%.

Free Cash Flow: DTE’s free cash flow is negligible, at only about $157 million. That translates to a very unimpressive Free Cash Flow Yield of less than 1%.

Dividend: DTE’s annual divided is $3.78 per share, which translates to a yield of about 3.3% at the stock’s current price.

Price/Book Ratio: there are a lot of ways to measure how much a stock should be worth; but one of the simplest methods that I like uses the stock’s Book Value, which for DTE is $58.76 and translates to a Price/Book ratio of 2.0 at the stock’s current price. The stock’s historical average Price/Book ratio is 1,9, meaning that the stock is slightly overvalued. This is supported by the fact the stock is also trading about 15% above its historical Price/Cash Flow ratio. That isn’t too surprising, given that the broad market’s volatility since the end of 2018 prompted many investors to start looking towards defensive industries like utilities as “safe haven” alternatives; but it should give you pause in terms of thinking about the stock as any kind of long-term value play.

Technical Profile

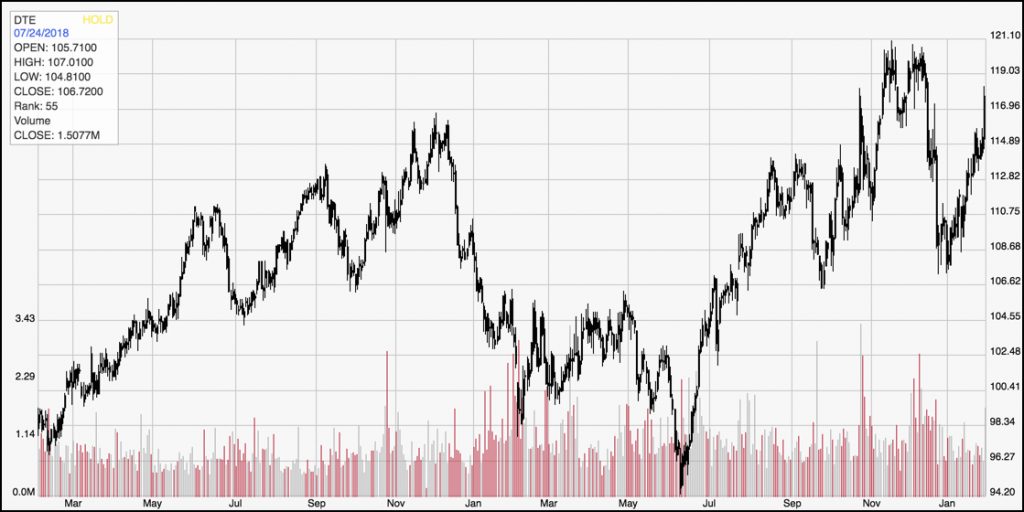

Here’s a look at the stock’s latest technical chart.

Current Price Action/Trends and Pivots: The stock has been following a pretty solid upward trend since June of 2018, but saw that trend threatened late in the year as even utility stocks gave way to the market sell off into the end of the year. That pushed the stock off of its high around $121 to a low around $107, but since the beginning of the year the stock has rebounded nicely to drive just a few dollars away from its historical high. Major support is around $107, while resistance is at that high. From a reward: risk standpoint, that does mean that if you intend to use the stock as a defensive play, you would need to accept the reality that the stock has about $10 of near-term downward risk compared to just a little over $3 of any kind of realistic upside potential.

Near-term Keys: Utility stocks can be pretty tough to try to work with for any kind of short-term trades, no matter whether you’re talking about buying the stock or using call options for a bullish play, or you think the stock downside risk makes a shorting or put buying opportunity attractive. The stock’s current upside momentum does suggest that it is likely to test that all-time high fairly soon; but a break below immediate support, to around $112 would likely prompt a steeper decline to test that major support around $107. I think utilities in general make the most sense as long-term positions, but only if what you’re looking for is relative stability based on lower general volatility than you typically see in the rest of the market. There really isn’t a value-based case to make for DTE as a place where you will be likely to see a major increase in price from its current level.