Starboard has a reputation for bringing struggling restaurants back from the brink, and it’s got the right recipe for Papa John’s.

Papa John’s (NASDAQ: PZZA) moved higher this week after the struggling pizza chain announced Monday that it had received a $200 million investment from activist firm Starboard Value LP and would be getting three new directors to its board, including Starboard CEO Jeffrey C. Smith who has been appointed chairman.

This comes on the heels of a very difficult 2018 for the chain as it was caught up in its founder’s controversies as well as declining North American same-store sales. The company announced that preliminary results for last year revealed an 8.1% decline in same-store sales in the territory, as well as a decline of 7.3% in sales for the full year.

“These results are disappointing to all of us, but we have a strong foundation built on quality and are confident in the great growth potential for the brand, particularly with the support of our new partners,” said Papa John’s CEO Steve Ritchie.

“Our agreement with Starboard concludes a comprehensive strategic review conducted over the past five months to better position Papa John’s for growth, improve the company’s financial performance and serve the best interests of our shareholders,” said Olivia Kirtley, a member of the committee that initiated the project. The review began in September, just a few months after founder John Schnatter resigned as chairman of the board following reports that he had used a racial slur in a conference call to discuss PR strategy.

In recent months, there had been a flurry of speculation about a buyout or private-equity takeover of the nation’s third-largest pizza company. But last week, Reuters reported that Papa John’s had abandoned efforts for an outright sale and was opting instead to look for an investor.

And the deal Papa John’s ended up with is about as good an outcome as it could have asked for. Not just because a private equity buyout would likely have left the company saddled with a significant debt burden, but also because Starboard’s recent track record with Olive Garden-parent Darden Restaurants (NYSE: DRI) was a big success story.

Starboard issued a searing criticism of Olive Garden back in 2014 for being too generous with the breadsticks and not salting its pasta water in a very detailed 300-slide presentation. It then tossed Darden’s entire board of directors.

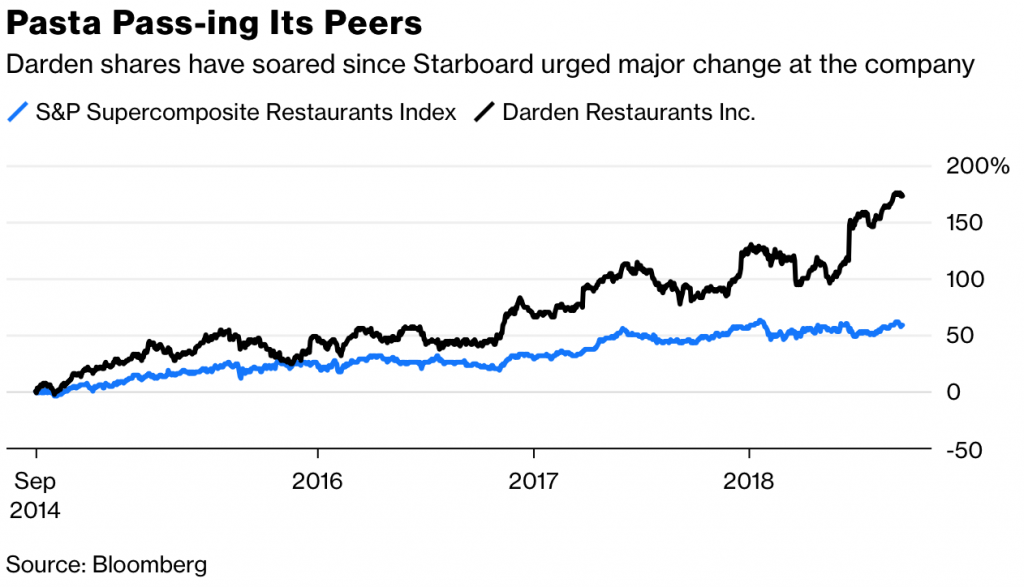

But since then, Olive Garden has delivered 17 consecutive quarters of comparable sales growth and Darden’s stock has exploded higher – peaking in September 2018 with a gain of 185% since Starboard took over Darden’s board in October 2014.

This is particularly impressive considering how tightly squeezed the restaurant industry has been in the last several years as it has grappled with over saturation, changing consumer tastes, as well as the proliferation of fast-casual restaurants such as Panera Bread and Chipotle Mexican Grill (NYSE: CMG).

With Starboard’s win with Darden, it’s likely the activist firm will be a force for good at Papa John’s. Starboard’s arrival hasn’t come with as much of a jolt as there was with Darden as just three new board members have been appointed as part of this investment, rather than an aggressive overhaul of the entire board.

But it should be enough fresh blood to help the struggling pizza chain emerge from this dark chapter. Papa John’s marketing and menu are both in need of a refresh, which Starboard is well-equipped to help with. And while the damage to the brand Schnatter did last year will be difficult to overcome, new board members demonstrate that the company is committed to real change.

“Securing this investment from Starboard is Papa John’s biggest step yet away from the Schnatter era,” wrote Bloomberg’s Sarah Halzack. “Investors are right to reward the company for moving on.”