When it comes to measuring the salaciousness of different types of investments, commodities – particularly silver – measure fairly low on that scale. After all, silver is cheap and has always taken a backseat to its more expensive sibling gold, which costs around $1,318 an ounce compared to silver’s measly $15.81 an ounce as of this writing.

But silver’s inexpensive nature relative to its consistently growing demand makes it a strong asset to hold in any form. Whether investors own it through an ETF, trust, stock, or plain old-fashioned bullion, the metal’s use across a broad range of sectors ensures demand will always rise in the long term, despite short-term fluctuations in market prices.

Here’s why the white metal is more attractive than investors give it credit for – and why owning it can insulate any portfolio from the market’s short-term pressures…

The Numbers

While silver won’t offer the explosive short-term gains typical of regular stocks, the metal has historically outperformed many of the major U.S. indexes by a decent margin, which lends to its credibility as a healthy long-term investment.

Over the last 20 years, the spot price of silver has nearly tripled in value, climbing 181% from roughly $5.63 an ounce in February 1999 to $15.81 today. That demolishes the Dow Jones’s 10.5% gain over the same period, while also handily beating the S&P 500’s 118% return.

Additionally, silver is one of the few assets that typically rises in value during times of broader market volatility. This lends to its reputation as a “safe haven,” a term used to define any investible asset that serves as a hedge against a decline in stock prices. Other safe havens include gold, bonds, and other risk-averse investments that market participants often flock to when the Dow or S&P take a nosedive.

The most vivid proof of silver’s reliability during a market crisis can be gleaned from the most recent recession that began in 2007. Back then, the Dow Jones plummeted an abysmal 53% from the October 2007 peak to the March 2009 trough amid what some economists considered the worst financial crisis in modern history. Even bonds, considered a more common safe-haven investment than silver, saw yields plunge, with the 10-Year Treasury yield dropping from 4.65% to 2.13% over the same period.

Meanwhile, as the stock market was stuck in a burning room, silver prices soon experienced one of their largest bull rallies in history as investors saw the metal’s incredible value as a hedge. Over the two-year period between the crisis midpoint in October 2008 to October 2010, silver more than doubled in value as prices skyrocketed an enormous 152%.

Despite silver’s meager 0.1% gain so far this year due to China’s slowing economy – one of the world’s largest silver importers due to the country’s massive solar energy initiatives – global demand for the metal is expected to keep rising. Silver’s industrial use in semiconductors, solar panels, alloys, and other tools essential to modern society ensure that the metal’s demand always remains strong, but 2019 is expected to be a particularly incredible year for silver demand.

While China’s solar industry drags its feet due to broader economic struggles, other growing solar markets in India and Australia, among other nations, are expected to pick up the slack. According to the Silver Institute, additional capacity for photovoltaic (PV) cells – the primary ingredient of solar panels that’s made of nearly 90% silver – will be above 100 GW per year through 2022. This, the institute says, should translate into a 7% rise in the U.S. silver price to $16.75 this year as market volatility pushes “investors to look for alternative options such as precious metals, which will boost silver investment.

The Different Ways to Invest in Silver

For the beginner investor, it may be difficult to decide where to start when entering the silver market. However, there are three primary types of silver investments that offer all of the same benefits: inexpensive buying prices, safe-haven appeal, and long-term value.

The first and most obvious type of silver investment is physical silver bullion. While silver bars may be the first image that comes to mind when thinking of physical silver, they can often to be expensive to store in a way that maintains their luster and value. For investors looking for less cumbersome bullion, consider American Silver Eagle coins, which are guaranteed by the U.S. Mint and can be easily stored in coin capsules.

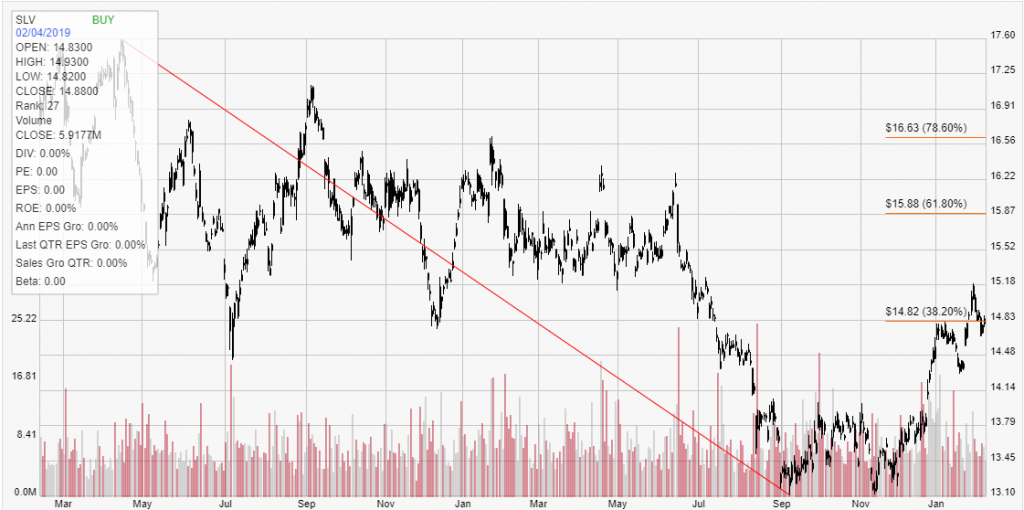

Another type of silver investment that allows broad access to the silver market without the hassle of storing bullion are exchange-traded funds (ETFs). These are investment vehicles that provide exposure to either commodity prices or a broad basket of stocks. The most popular silver ETF that tracks the price of silver is the iShares Silver Trust (SLV), which backs itself with about $6 billion worth of silver bullion safely stored in London and New York vaults. Due to broader recognition among market participants as a listed equity on the New York Stock Exchange, SLV has been known to often outperform the spot price of silver. So far this year, SLV is up 2.1%, crushing silver prices by 20 to 1.

The third most commonly used type of silver investment are silver stocks, typically companies that mine, produce, and sell the silver. However, the safest and most reliable silver stocks are silver streaming companies, which make deals with silver mining companies to buy their production at a fixed price. That kind of agreement can give streaming companies the upper hand because they can buy silver at a discount if the price of silver suddenly jumps before they receive the miner’s supply. One prominent example is Wheaton Precious Metals Corp. (WPM), a Vancouver-based streamer that has outperformed both spot prices and SLV by climbing 9.4% this year.

The Bottom Line

While it may not be as appealing as a tech behemoth or Dow component, silver has proven to be an exceptionally reliable investment time and time again. It’s important to consider the different ways in which diversifying a portfolio ensures the long-term strength of your money, and investors would be hard-pressed to find a better way to diversify than investing in silver bullion, ETFs, or stocks. The metal’s ability to withstand enormous pressure in the broader market ensures that investors will have at least one green spot in their portfolio if the Dow or S&P ever heads south for an extended period.

| Buy Target $14.82 | Short Term Target $15.88 |

| Intermediate Target $16.63 |