If the market’s recovery since the beginning of the year is legitimate, it becomes more and more tempting to start thinking about expanding our view of the stocks we pay attention to, so we can consider more useful investing opportunities. The temptation for a value-oriented investor is just as real, because when the market experiences the kind of drop we saw at the end of 2018, an ever-increasing number of stocks throughout the various sectors of the market start to trade at attractive valuation multiples. That reality can make it harder to stay disciplined and selective about the actual opportunities you decide to work with.

The problem with that temptation isn’t really all that different from staying fully invested at the top of an extended bull market; nobody really knows if or when a reversal is going to come, and so the risk that you’re going to be wrong – in either direction – is incrementally higher at those extremes. It’s one thing to recognize that a stock might look like it carries a good value proposition, but quite another to be able to work with a reasonable expectation that the stock should be worth more in the long-term than it is today. Remember, sometimes a cheap stock is just a cheap stock, which means that sometimes the market is actually telling you all you need to know about the company when you see its stock trading at deep discounts.

Another temptation that is pretty easy to give into is to work with smaller companies, because they usually trade at somewhat lower prices than their bigger brethren, and when they pop, they often pop in a pretty big way. In and of itself, that isn’t bad, and I don’t mind admitting that when I find a small-cap stock with a good combination of fundamental strength and nice value, I don’t hesitate to find a way to work with it. The caveat, however for me is that both of those elements have to be working together. If they don’t both point in the same direction, I’ll usually put the stock aside and look for something else.

At the beginning of this week an interesting stock came across my desk via the different screening tools I like to use. Matson Inc. (MATX) is very likely not a stock you’re familiar with, because the company’s operations in the United States are limited to Guam, Hawaii, and Alaska, while the rest of their business comes from island economies throughout the South Pacific and Micronesia. This is a small-cap transportation company with a very specific niche, but that is down nearly 25% from its November 2018 high. Sounds tempting, right? Add to that the fact that the bargain case for MATX is very attractive, and you have exactly the kind of temptation that I’ve learned to approach very carefully. Should this stock be something for you to pay attention to? I’ll let you decide.

Fundamental and Value Profile

Matson, Inc. (Matson) is a holding company. The Company provides ocean transportation and logistics services. The Company operates through two segments: Ocean Transportation and Logistics. Its Ocean Transportation business is conducted through its subsidiary, Matson Navigation Company, Inc. (MatNav). MatNav is an asset-based business that provides ocean freight transportation services to the domestic economies of Hawaii, Alaska and Guam, and to other island economies in Micronesia and in the South Pacific. Matson’s fleet consists of approximately 20 owned and over three chartered vessels, including containerships, combination container/roll-on/roll-off ships, roll-on/roll-off barge and barges equipped with cranes. Matson’s Logistics business is conducted through Matson Logistics, Inc. (Matson Logistics or Logistics), a subsidiary of MatNav. Matson Logistics is an asset-light business that provides multimodal transportation services. MATX’s current market cap is $1.4 billion.

Earnings and Sales Growth: Over the last twelve months, earnings and sales both grew, with earnings increasing nearly 23%, and sales growing a little more than 8%. Growing earnings faster than sales is hard to do, and generally isn’t sustainable in the long term; but it can also be a positive mark of management’s ability to maximize their business operations. In the last quarter, earnings increased almost 28%, while sales improved by 5.8%. The company’s margin profile over the last twelve months is healthy, as Net Income was 11.7% of Revenues over the past year; however it did contract in the last quarter to about 7.05%. The quarterly number appears to be adequate for now, but it could also be a sign that costs are increasing, which could be a stumbling block in the quarters ahead.

Free Cash Flow: MATX’s free cash flow is negative, at -$46.5 million. That translates to a Free Cash Flow Yield of -3.39%. I take negative free cash flow as a big warning sign that the company could have liquidity problems that will inhibit its ability to invest in its own business or take advantage of growth opportunities, via acquisition or otherwise.

Debt to Equity: MATX has a debt/equity ratio of 1.16. High leverage isn’t unusual in a lot of industries, and it isn’t categorically bad; however, when I consider small-cap stocks, high debt loads are another red flag. Considering the company’s free cash flow issues, it isn’t that surprising to see that in the last quarter, the company reported $72.1 million in cash and liquid assets, versus a little over $866 million in long-term debt. For now, it looks like they have the margin profile to service their debt, however shrinking Net Income should make you wonder whether that will continue to be true.

Price/Book Ratio: there are a lot of ways to measure how much a stock should be worth; but one of the simplest methods that I like uses the stock’s Book Value, which for MATX is $32.51 and translates to a Price/Book ratio of 1.86. Their average Price/Book Value ratio is 3.18, which means the stock is significantly undervalued, by about 41%. By contrast, however, the stock is trading nearly at par with its historical Price/Cash Flow average. The two averages together offer a long-term target price somewhere between $32 and $55 per share. That’s a wide range between the two values, and since the lower end is below the stock’s current price, it doesn’t translate to a range that makes the value proposition compelling in my book.

Technical Profile

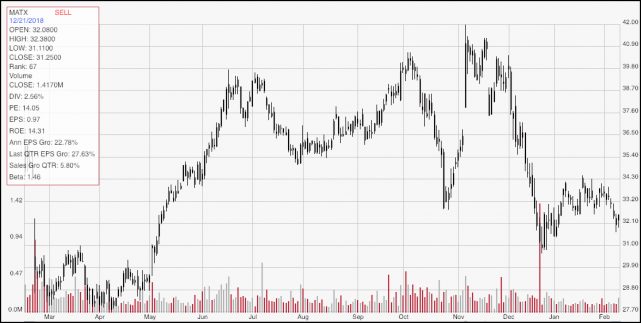

Here’s a look at the stock’s latest technical chart.

Current Price Action/Trends and Pivots: The chart above shows the last year’s worth of price movement for MATX. The stock is about $1 above its late December low, but has dropped back a little over $2 from the pivot high it formed in mid-January. It looks like the stock is setting up a consolidation range, implying that for the time being, the stock is likely to maintain a pretty narrow trading range between about $34 on the high side and $31 on the low side. In order to reverse the downward trend begun by the stock’s decline from November to December, the stock would have to break above $34 as a starting point. A break down below $31 would mark a continuation of that downward trend that should see the stock test its 52-week lows around $27.50.

Near-term Keys: There could be some useful, short-term, momentum-based opportunities in the stock, provided it breaks out – on either side – of the consolidation range I just mentioned. If the stock breaks above $34, consider buying the stock outright, or working with call options with a short-term target in the $38 to $39 range. A drop below $31 might yield an interesting opportunity to short the stock or to buy put options with an eye on the stock’s 52-week low around $27.50. This is not a stock I would consider for any kind of long-term position, however unless I see the stock’s fundamentals improve; in particular, I would look for growth in its Free Cash Flow and a decrease in long-term debt, along with increased cash and liquid assets, before I would take any kind of value-oriented position seriously.