I know – it’s cheesy to use Valentine’s Day as a tagline today. And it’s also more than a little odd to use it with a tech stock. Even so, NVIDIA Corporation (NVDA) is set to make its latest quarterly earnings report after the market closes today, and the fact is that this is a company that has emerged over the last few years as one of the most interesting stocks in the Semiconductor space. As the U.S. and China continue to talk in attempts to avert an escalation of tariffs and ongoing trade conflict, companies like NVDA stand to win – or lose – big, so it’s no surprise to see the market is going to be paying close attention to NVDA’s report this afternoon.

It doesn’t seem all that long ago that NVDA wasn’t much more than a nice, little tech company with a very profitable, but very specific area of expertise – gaming and PC graphics. Their graphics processing units (GPUs) and graphics cards have been required hardware in any kind of respectable computer or home gaming system for years. While that core specialization remains, the company has found ways to extend that expertise in ways that the average person probably wouldn’t expect. The emerging popularity of cryptocurrencies and bitcoin mining added another important revenue stream and helped the stock rally from below $20 per share only four years ago to surge even higher. From there, the company has expanded aggressively into artificial intelligence (AI), datacenters and cloud computing. The company’s moves expanded their profile and presence among Semiconductor stocks to stand now on comparable footing with the biggest names in the world; it also pushed the stock to all-time high around $290 per share.

The broad market’s drop throughout the last quarter of 2018, fueled in no small part by trade tensions, pushed practically every stock in the tech sector well into bear market territory, and NVDA was no exception. By the end of the December, the stock had plunged more than 57% from its October high. It’s up about 15% so far this year, but with today’s earnings call looming, the big question right now, naturally is whether or not it’s going to be able to build on its mostly positive momentum. Besides concerns tied to trade questions and slowing demand in China, bitcoin mining has also slowed down appreciably, and while PC and gaming graphics remain a core strength, it is also an increasingly mature and competitive market as well. Those are among the factors that have combined to work against the stock over the last few months.

Offsetting those concerns are some other elements that really point not only to fundamental strength right now, but also to continued, and even increasing opportunity down the road. The company’s push into AI includes expected growth markets like autonomous driving. The latest release of their flagship Tegra processor, which is essentially an entire computer system on a single chip has seen disappointing results so far, but many analysts seem to think that could simply be a case of the company being so far ahead of the curve the market will eventually have to catch up. Does that mean the stock’s decline is making it a bargain now?

Fundamental and Value Profile

Nvidia Corporation focuses on personal computer (PC) graphics, graphics processing unit (GPU) and also on artificial intelligence (AI). It operates through two segments: GPU and Tegra Processor. Its GPU product brands are aimed at specialized markets, including GeForce for gamers; Quadro for designers; Tesla and DGX for AI data scientists and big data researchers; and GRID for cloud-based visual computing users. Its Tegra brand integrates an entire computer onto a single chip, and incorporates GPUs and multi-core central processing units (CPUs) to drive supercomputing for mobile gaming and entertainment devices, as well as autonomous robots, drones and cars. The Company’s processor has created platforms that address four markets: Gaming, Professional Visualization, Datacenter, and Automotive. Its offerings include NVIDIA DGX AI supercomputer, the NVIDIA DRIVE AI car computing platform and the GeForce NOW cloud gaming service. NVDA’s current market cap is $93.5 billion.

Earnings and Sales Growth: Over the last twelve months, earnings and sales both grew, with earnings increasing 25.5%, and sales growing almost 21%. Growing earnings faster than sales is hard to do, and generally isn’t sustainable in the long term; but it can also be a positive mark of management’s ability to maximize their business operations. The company operates with a margin profile that is among the largest in the Semiconductor industry; over the last twelve months, Net Income was 37.7% of Revenues over the past year, and increased in the last quarter to about 38.6%.

Free Cash Flow: NVDA’s free cash flow is a concern. The total number is about $3.4 billion, which looks pretty good by itself, but that translates to a very modest 3.63%. That number is a bit surprising given the large Net Income/Revenue ratio I just mentioned.

Debt to Equity: NVDA has a debt/equity ratio of .21. This is a low number that generally suggests debt management shouldn’t be a problem. NVDA’s balance sheet is a significant source of additional strength, since cash and liquid assets are more than $7.6 billion versus long-term debt of just $1.9 billion.

Price/Book Ratio: there are a lot of ways to measure how much a stock should be worth; but one of the simplest methods that I like uses the stock’s Book Value, which for NVDA is $15.53 per share, and which translates to a Price/Book ratio of 9.98. That seems high, but it is also important to contrast that number against the stock’s historical average to see how Mr. Market has historically treated the stock in this respect. Their average Price/Book Value ratio is 12.63, which means the stock is actually quite undervalued, and offers about 26.5% upside potential at its current price. That notion is supported by the fact the stock is also trading about 23% below its historical Price/Cash Flow average. Together, those figures offer a long-term target price in the $183 to $196 range.

Technical Profile

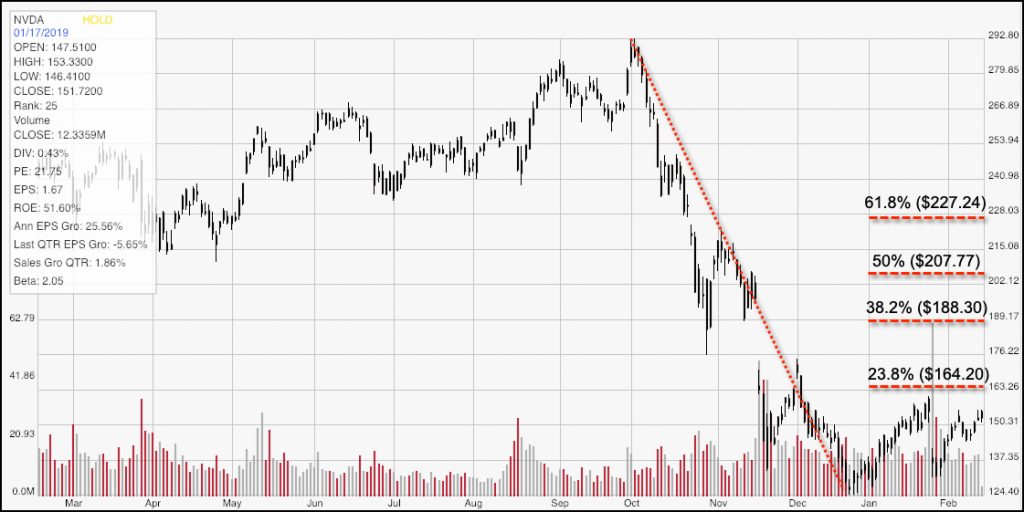

Here’s a look at the stock’s latest technical chart.

Current Price Action/Trends and Pivots: The dotted red diagonal line traces the stock’s downward trend from early October to the end of December 2018. It also informs the Fibonacci retracement lines shown on the right side of the chart. Despite the stock’s increase from the trend low around $125, the stock isn’t actually in a short-term upward trend; instead it seems to be building a consolidation base, with resistance a little below the 23.6% retracement line shown around $164 per share. Major support for that base appears to be in the $137 to $138 range. The stock would have to break above $164, to at least $165 before any kind of upward trend could be identified; however since that would also mark a break out of a consolidation range at the bottom of a downward trend, if it happens, it should be take as a strong indication the stock could rally strongly and begin to recover much of the ground it gave up at the end of last year. If resistance at $164 holds, the consolidation range could hold for for the foreseeable future, offering neither a bullish nor a bearish technical outlook for the stock.

Near-term Keys: If the stock breaks above $165, the signal should be clear: buy the stock, or start using call options to take advantage of a rally that could easily hit $188 per share in short order. There could be an interesting bearish short-term trade to make if the stock reverses lower off of resistance again, however, since the stock’s most likely support is more than $17 away from its current price, and more than $25 away from the $164 resistance level. That is a very workable range for a bearish trade, either by shorting the stock or working with put options. What about a long-term, value-based opportunity? The stock has an intriguing value proposition right now, with a fundamental profile that is largely positive, although not overwhelmingly so. That could change significantly with this afternoon’s after-market report, so it will be worth watching.