It also could be a bad omen. Here’s why.

The latest Bank of America Merrill Lynch (NYSE: BAC) monthly survey of global fund managers was released this week and it came with a surprise.

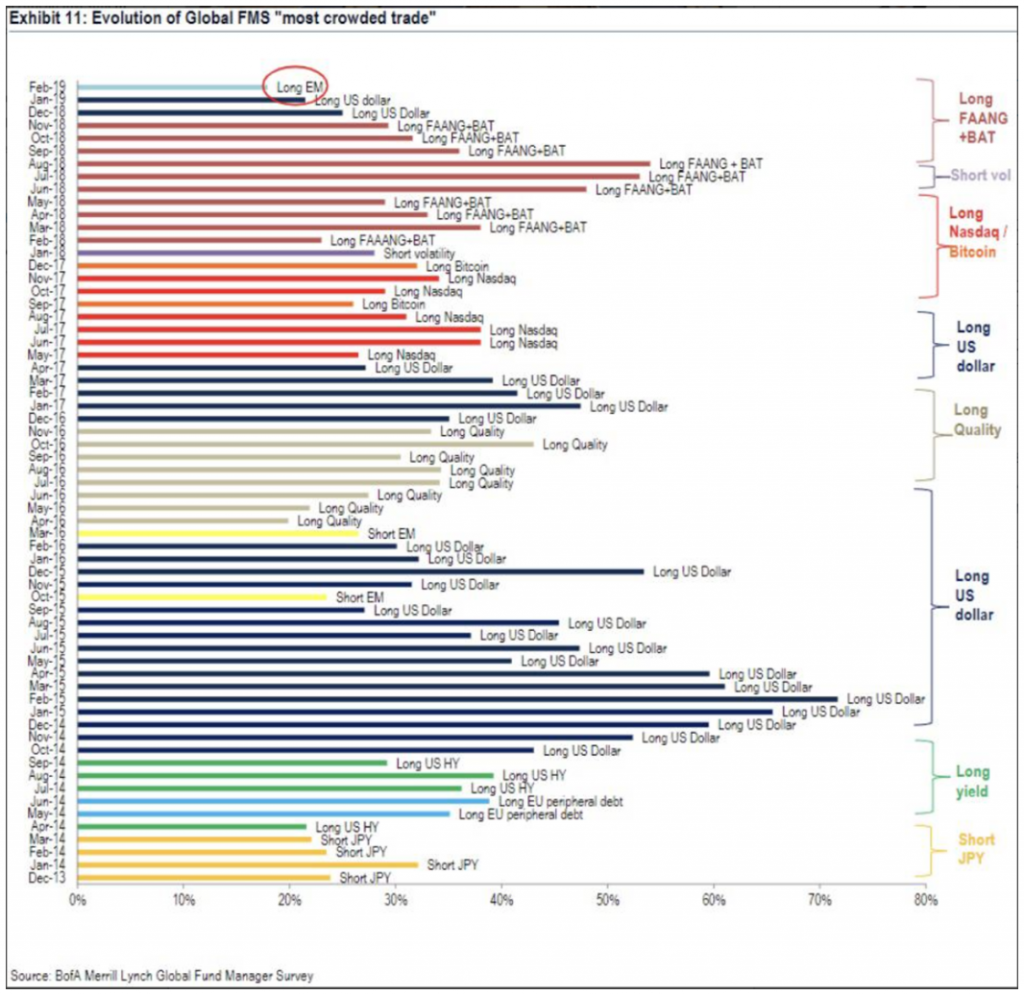

For the first time since the survey included the question, the international fund management community identified being long emerging markets as the most crowded trade in global financial markets.

However, conviction isn’t running high. Just 18% of investors agreed that EMs are overbought, which is the smallest plurality garnered by a “most crowded trade” designee in the survey’s history, according to BoAML’s chief investment strategist, Michael Hartnett.

By contrast, “short EM” was the third most crowded trade identified by respondents in just last month’s survey, which shows just how fast the mood can shift in an uncertain market.

But the distinction of “most crowded trade” could prove to be a bad omen for emerging markets.

As shown in the image above, an asset’s popularity often peaks just before a fall in price. Previous “most crowded” trades have included bitcoin, short volatility, and the FAANG and BAT stocks.

At the end of 2017, bitcoin was surging. It first appeared as the “most crowded trade” in September of that year, and then reappeared in December. Bitcoin peaked that December just below $20,000 and then quickly declined from there. The cryptocurrency is now down roughly 80% from its high.

2017 was also a very calm year for markets, and “synchronized global growth” was echoed among fund managers lulling them into what in hindsight was a false sense of security. Short volatility was the “most crowded trade” of January 2018 before the “Volmageddon” of February 2018 when the CBOE Volatility Index jumped by a record 20 points, decisively ending what was then one of the most popular trades.

After “Volmageddon,” the U.S. FAANG stocks—Facebook (NASDAQ: FB), Amazon (NASDAQ: AMZN), Apple (NASDAQ: AAPL), Netflix (NASDAQ: NFLX), and Google parent Alphabet (NASDAQ: GOOGL, GOOG)—and China’s Baidu (NASDAQ: BIDU), Alibaba (NYSE: BABA), and Tencent (OTC: TCEHY) dominated the market. The FAANG and BAT stocks became the most crowded stock in February of last year and held that spot for 10 months, even after those stocks began to sink in the latter half of the year.

2018 was a difficult year for emerging market assets as countries like Turkey and Argentina faced crises alongside a strong dollar and rising U.S. yields that pushed up borrowing costs.

But the Fed took a dovish turn at the beginning of 2019, and indicated that it would hold on raising interest rates – a move that sparked fresh enthusiasm among investors.

So far this year, emerging market stocks are up nearly 8%, and flow data from last Friday showed that investors have pumped record amounts of money into emerging stocks and bonds. Earlier this month, the Institute of International Finance (IIF) predicted that a “wall of money” would flood emerging markets after the Fed eased its language about future rate hikes, and major investment banks like JPMorgan and Citi have ramped up their exposure to emerging markets in the last few weeks.

But there are already signs that momentum may be slowing down. According to Citi, analyzing flows from their own clients showed that they had already turned cautious on emerging market assets over the last week, with both real money and leveraged investors pulling out of funds after four weeks of inflows.

Apart from the most crowded trade, the BoAML survey showed that investors’ main concern for the market is the possibility of a global trade war. The trade war has been the top concern for the last nine months, and was followed by concerns over a slowdown in China, and a corporate credit crunch.

BoAML’s February survey—which was conducted between the first and seventh of this month with 218 respondents who manage a combined $625 billion—also showed that investor sentiment hasn’t improved much this month, and global equity allocations have fallen to their lowest level since September 2016.

“Despite the recent rally, investor sentiment remains bearish,” Hartnett said.